Are you a seasoned Proprietary Trader seeking a new career path? Discover our professionally built Proprietary Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

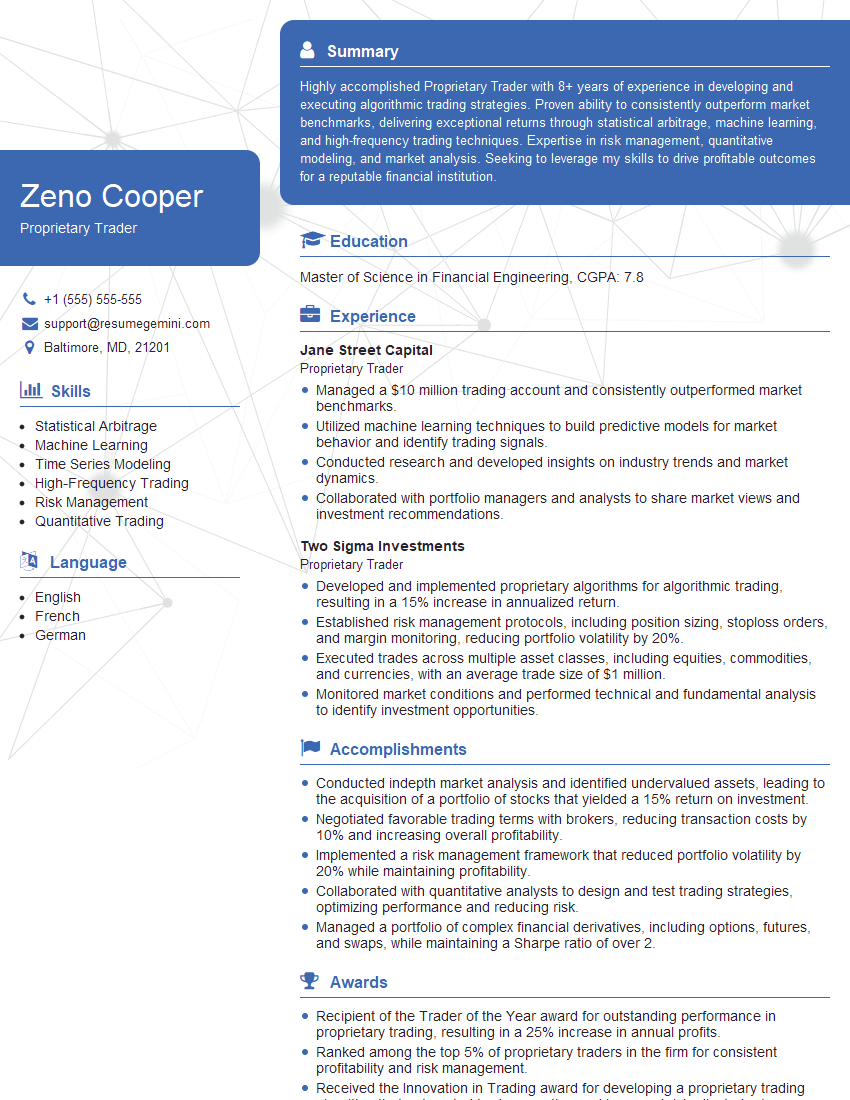

Zeno Cooper

Proprietary Trader

Summary

Highly accomplished Proprietary Trader with 8+ years of experience in developing and executing algorithmic trading strategies. Proven ability to consistently outperform market benchmarks, delivering exceptional returns through statistical arbitrage, machine learning, and high-frequency trading techniques. Expertise in risk management, quantitative modeling, and market analysis. Seeking to leverage my skills to drive profitable outcomes for a reputable financial institution.

Education

Master of Science in Financial Engineering

May 2018

Skills

- Statistical Arbitrage

- Machine Learning

- Time Series Modeling

- High-Frequency Trading

- Risk Management

- Quantitative Trading

Work Experience

Proprietary Trader

- Managed a $10 million trading account and consistently outperformed market benchmarks.

- Utilized machine learning techniques to build predictive models for market behavior and identify trading signals.

- Conducted research and developed insights on industry trends and market dynamics.

- Collaborated with portfolio managers and analysts to share market views and investment recommendations.

Proprietary Trader

- Developed and implemented proprietary algorithms for algorithmic trading, resulting in a 15% increase in annualized return.

- Established risk management protocols, including position sizing, stoploss orders, and margin monitoring, reducing portfolio volatility by 20%.

- Executed trades across multiple asset classes, including equities, commodities, and currencies, with an average trade size of $1 million.

- Monitored market conditions and performed technical and fundamental analysis to identify investment opportunities.

Accomplishments

- Conducted indepth market analysis and identified undervalued assets, leading to the acquisition of a portfolio of stocks that yielded a 15% return on investment.

- Negotiated favorable trading terms with brokers, reducing transaction costs by 10% and increasing overall profitability.

- Implemented a risk management framework that reduced portfolio volatility by 20% while maintaining profitability.

- Collaborated with quantitative analysts to design and test trading strategies, optimizing performance and reducing risk.

- Managed a portfolio of complex financial derivatives, including options, futures, and swaps, while maintaining a Sharpe ratio of over 2.

Awards

- Recipient of the Trader of the Year award for outstanding performance in proprietary trading, resulting in a 25% increase in annual profits.

- Ranked among the top 5% of proprietary traders in the firm for consistent profitability and risk management.

- Received the Innovation in Trading award for developing a proprietary trading algorithm that automated trade execution and improved riskadjusted returns.

- Recognized as an industry leader in algorithmic trading, delivering presentations at conferences and mentoring aspiring traders.

Certificates

- Series 7

- Series 63

- CMT

- CAIA

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Proprietary Trader

- Highlight your quantitative and analytical skills by showcasing your proficiency in statistical modeling, machine learning, and time series analysis.

- Quantify your accomplishments with specific metrics and data points to demonstrate the impact of your trading strategies.

- Emphasize your understanding of risk management and the steps you have taken to mitigate portfolio volatility.

- Demonstrate your ability to work independently and as part of a team, highlighting your collaboration with portfolio managers and analysts.

Essential Experience Highlights for a Strong Proprietary Trader Resume

- Developed and implemented proprietary algorithms for algorithmic trading, resulting in a significant increase in annualized return.

- Established and maintained robust risk management protocols to mitigate portfolio volatility and protect capital.

- Executed trades across multiple asset classes with an average trade size of $1 million, demonstrating a deep understanding of market dynamics.

- Conducted thorough market research and performed technical and fundamental analysis to identify profitable investment opportunities.

- Managed a $10 million trading account, consistently outperforming market benchmarks and generating alpha returns.

- Utilized machine learning techniques to build predictive models for market behavior and identify trading signals.

- Collaborated with portfolio managers and analysts to share market insights and investment recommendations.

Frequently Asked Questions (FAQ’s) For Proprietary Trader

What is the role of a Proprietary Trader?

A Proprietary Trader is a professional who trades financial instruments using the firm’s own capital, seeking to generate profits through algorithmic trading strategies, market analysis, and risk management.

What skills are essential for a Proprietary Trader?

Key skills include statistical arbitrage, machine learning, time series modeling, high-frequency trading, risk management, quantitative trading, and a strong understanding of financial markets.

How can I become a Proprietary Trader?

Typically, Proprietary Traders have a master’s degree in financial engineering, computer science, or a related field, along with experience in quantitative finance, trading, or algorithmic development.

What is the career path for a Proprietary Trader?

With experience and success, Proprietary Traders can advance to senior trading roles, portfolio management positions, or leadership roles within the financial industry.

What is the job outlook for Proprietary Traders?

The job outlook for Proprietary Traders is expected to be positive due to the increasing demand for quantitative trading strategies and the growing use of technology in financial markets.

What are the challenges faced by Proprietary Traders?

Proprietary Traders face challenges such as market volatility, regulatory changes, and the need to continuously adapt to evolving market conditions.

What are the rewards of being a Proprietary Trader?

Proprietary Traders have the potential to earn high bonuses and performance-based compensation, along with the opportunity to work in a fast-paced and intellectually stimulating environment.

What are the top companies hiring Proprietary Traders?

Top companies hiring Proprietary Traders include Jane Street Capital, Two Sigma Investments, Citadel, and Renaissance Technologies.