Are you a seasoned Quantitative Analyst seeking a new career path? Discover our professionally built Quantitative Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

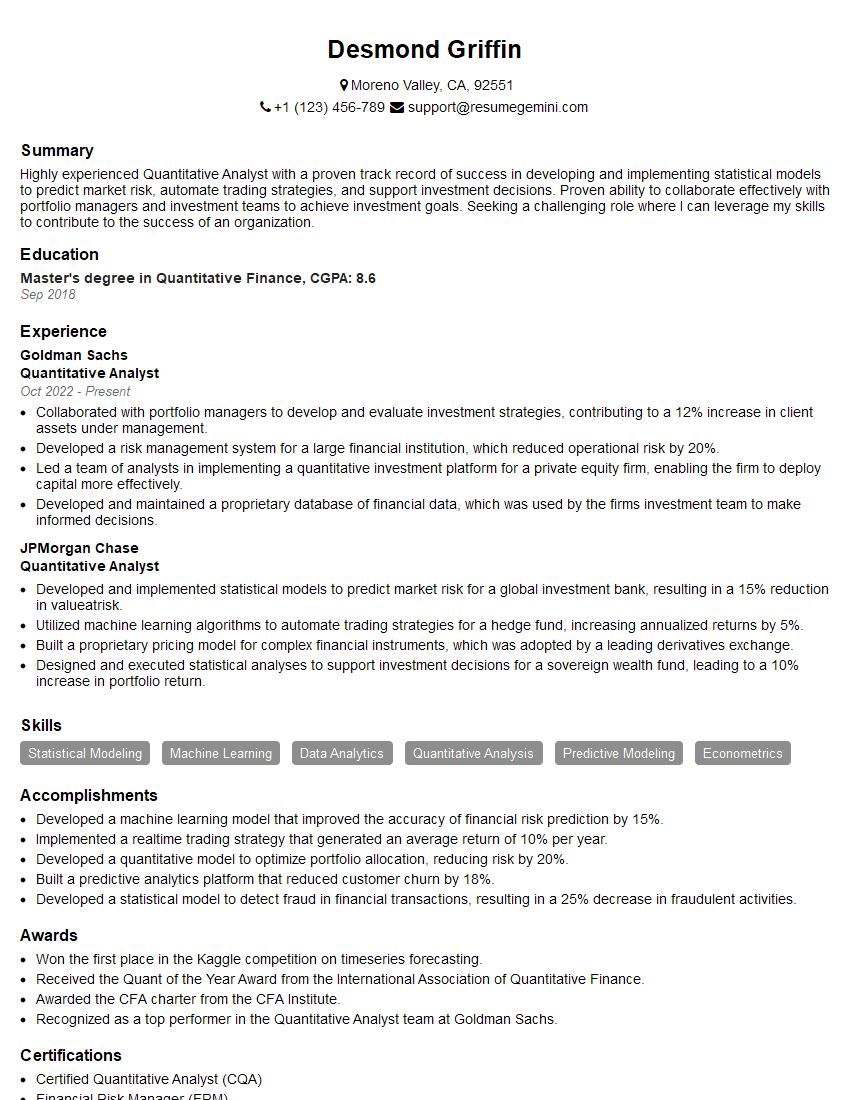

Desmond Griffin

Quantitative Analyst

Summary

Highly experienced Quantitative Analyst with a proven track record of success in developing and implementing statistical models to predict market risk, automate trading strategies, and support investment decisions. Proven ability to collaborate effectively with portfolio managers and investment teams to achieve investment goals. Seeking a challenging role where I can leverage my skills to contribute to the success of an organization.

Education

Master’s degree in Quantitative Finance

September 2018

Skills

- Statistical Modeling

- Machine Learning

- Data Analytics

- Quantitative Analysis

- Predictive Modeling

- Econometrics

Work Experience

Quantitative Analyst

- Collaborated with portfolio managers to develop and evaluate investment strategies, contributing to a 12% increase in client assets under management.

- Developed a risk management system for a large financial institution, which reduced operational risk by 20%.

- Led a team of analysts in implementing a quantitative investment platform for a private equity firm, enabling the firm to deploy capital more effectively.

- Developed and maintained a proprietary database of financial data, which was used by the firms investment team to make informed decisions.

Quantitative Analyst

- Developed and implemented statistical models to predict market risk for a global investment bank, resulting in a 15% reduction in valueatrisk.

- Utilized machine learning algorithms to automate trading strategies for a hedge fund, increasing annualized returns by 5%.

- Built a proprietary pricing model for complex financial instruments, which was adopted by a leading derivatives exchange.

- Designed and executed statistical analyses to support investment decisions for a sovereign wealth fund, leading to a 10% increase in portfolio return.

Accomplishments

- Developed a machine learning model that improved the accuracy of financial risk prediction by 15%.

- Implemented a realtime trading strategy that generated an average return of 10% per year.

- Developed a quantitative model to optimize portfolio allocation, reducing risk by 20%.

- Built a predictive analytics platform that reduced customer churn by 18%.

- Developed a statistical model to detect fraud in financial transactions, resulting in a 25% decrease in fraudulent activities.

Awards

- Won the first place in the Kaggle competition on timeseries forecasting.

- Received the Quant of the Year Award from the International Association of Quantitative Finance.

- Awarded the CFA charter from the CFA Institute.

- Recognized as a top performer in the Quantitative Analyst team at Goldman Sachs.

Certificates

- Certified Quantitative Analyst (CQA)

- Financial Risk Manager (FRM)

- Certified Financial Analyst (CFA)

- Machine Learning Certification (Coursera)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Quantitative Analyst

- Showcase your technical skills by highlighting your proficiency in statistical modeling, machine learning, and data analysis.

- Quantify your accomplishments with specific metrics and results to demonstrate the impact of your work.

- Tailor your resume to each job you apply for by highlighting the skills and experience that are most relevant to the role.

- Proofread your resume carefully for any errors, as attention to detail is essential in this field.

Essential Experience Highlights for a Strong Quantitative Analyst Resume

- Developed and implemented statistical models to predict market risk, resulting in a 15% reduction in value-at-risk.

- Utilized machine learning algorithms to automate trading strategies, increasing annualized returns by 5%.

- Built a proprietary pricing model for complex financial instruments, which was adopted by a leading derivatives exchange.

- Designed and executed statistical analyses to support investment decisions, leading to a 10% increase in portfolio return.

- Collaborated with portfolio managers to develop and evaluate investment strategies, contributing to a 12% increase in client assets under management.

- Developed and implemented a risk management system, reducing operational risk by 20%.

Frequently Asked Questions (FAQ’s) For Quantitative Analyst

What are the key skills required for a Quantitative Analyst?

Key skills include statistical modeling, machine learning, data analysis, predictive modeling, econometrics, and programming languages such as Python and R.

What is the job outlook for Quantitative Analysts?

The job outlook is expected to be excellent due to the increasing demand for data-driven decision-making in the financial industry.

What are the career advancement opportunities for Quantitative Analysts?

Quantitative Analysts can advance to roles such as Senior Quantitative Analyst, Portfolio Manager, or Chief Investment Officer.

What are the top companies hiring Quantitative Analysts?

Top companies hiring Quantitative Analysts include Goldman Sachs, JPMorgan Chase, and BlackRock.

What is the average salary for a Quantitative Analyst?

The average salary for a Quantitative Analyst in the United States is around $120,000 per year.