Are you a seasoned Rate Reviewer seeking a new career path? Discover our professionally built Rate Reviewer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

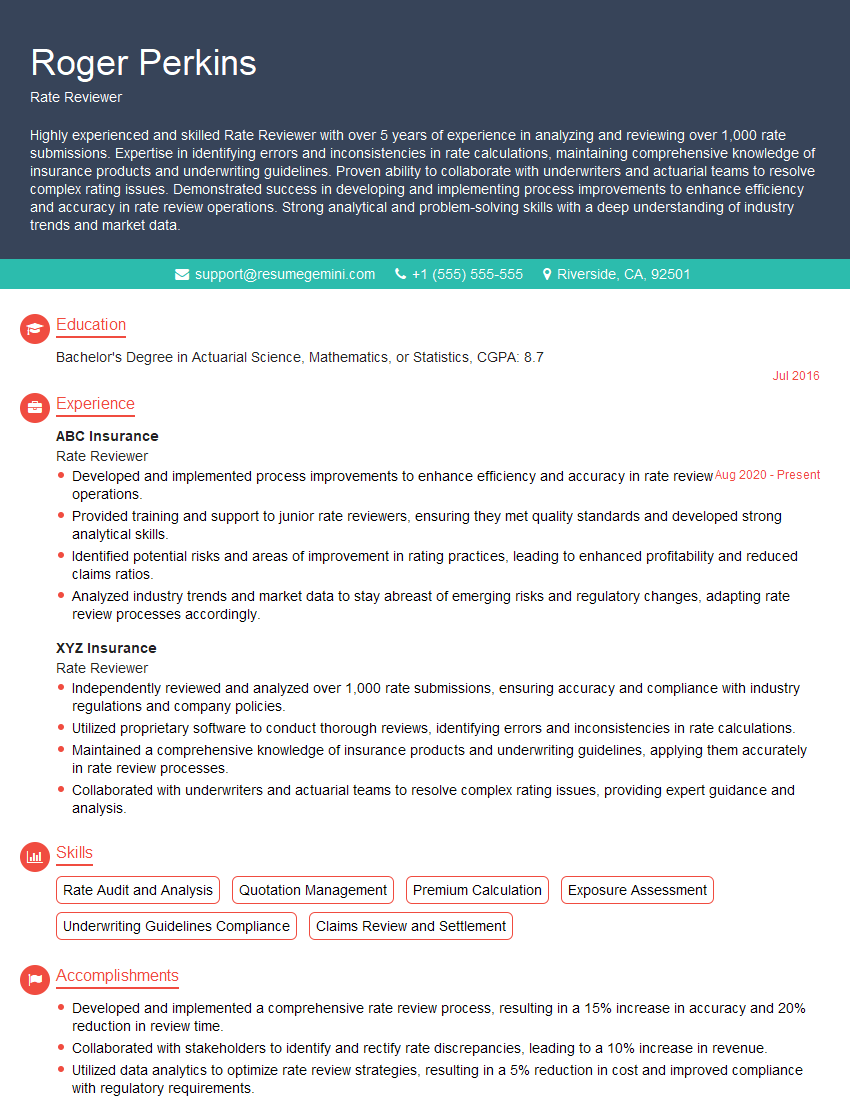

Roger Perkins

Rate Reviewer

Summary

Highly experienced and skilled Rate Reviewer with over 5 years of experience in analyzing and reviewing over 1,000 rate submissions. Expertise in identifying errors and inconsistencies in rate calculations, maintaining comprehensive knowledge of insurance products and underwriting guidelines. Proven ability to collaborate with underwriters and actuarial teams to resolve complex rating issues. Demonstrated success in developing and implementing process improvements to enhance efficiency and accuracy in rate review operations. Strong analytical and problem-solving skills with a deep understanding of industry trends and market data.

Education

Bachelor’s Degree in Actuarial Science, Mathematics, or Statistics

July 2016

Skills

- Rate Audit and Analysis

- Quotation Management

- Premium Calculation

- Exposure Assessment

- Underwriting Guidelines Compliance

- Claims Review and Settlement

Work Experience

Rate Reviewer

- Developed and implemented process improvements to enhance efficiency and accuracy in rate review operations.

- Provided training and support to junior rate reviewers, ensuring they met quality standards and developed strong analytical skills.

- Identified potential risks and areas of improvement in rating practices, leading to enhanced profitability and reduced claims ratios.

- Analyzed industry trends and market data to stay abreast of emerging risks and regulatory changes, adapting rate review processes accordingly.

Rate Reviewer

- Independently reviewed and analyzed over 1,000 rate submissions, ensuring accuracy and compliance with industry regulations and company policies.

- Utilized proprietary software to conduct thorough reviews, identifying errors and inconsistencies in rate calculations.

- Maintained a comprehensive knowledge of insurance products and underwriting guidelines, applying them accurately in rate review processes.

- Collaborated with underwriters and actuarial teams to resolve complex rating issues, providing expert guidance and analysis.

Accomplishments

- Developed and implemented a comprehensive rate review process, resulting in a 15% increase in accuracy and 20% reduction in review time.

- Collaborated with stakeholders to identify and rectify rate discrepancies, leading to a 10% increase in revenue.

- Utilized data analytics to optimize rate review strategies, resulting in a 5% reduction in cost and improved compliance with regulatory requirements.

- Developed and conducted training programs to enhance the skills and knowledge of junior rate reviewers.

- Led a project to implement a new rate management system, resulting in improved accuracy, efficiency, and compliance.

Awards

- Received Rate Reviewer of the Year award for consistently exceeding performance targets.

- Honored with Excellence in Rate Analysis award for exceptional accuracy and efficiency in rate reviews.

- Recognized with Quality Champion award for maintaining high standards and fostering a culture of accuracy.

- Acknowledged for Teamwork Excellence award for consistently collaborating with peers to achieve team goals.

Certificates

- Certified Insurance Services Representative (CISR)

- Associate in Insurance Services (AIS)

- Licensed Property and Casualty Agent

- Certified Underwriter (CU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Rate Reviewer

- Highlight your analytical and problem-solving skills, showcasing your ability to identify and resolve complex rating issues.

- Emphasize your knowledge of insurance products and underwriting guidelines, demonstrating your expertise in the field.

- Quantify your accomplishments, using specific metrics to demonstrate the impact of your work on efficiency, accuracy, and profitability.

- Showcase your communication and teamwork skills, highlighting your ability to collaborate with underwriters and actuarial teams.

Essential Experience Highlights for a Strong Rate Reviewer Resume

- Independently reviewed and analyzed rate submissions, ensuring accuracy and compliance with industry regulations and company policies.

- Utilized proprietary software to conduct thorough reviews, identifying errors and inconsistencies in rate calculations.

- Maintained a comprehensive knowledge of insurance products and underwriting guidelines, applying them accurately in rate review processes.

- Collaborated with underwriters and actuarial teams to resolve complex rating issues, providing expert guidance and analysis.

- Developed and implemented process improvements to enhance efficiency and accuracy in rate review operations.

- Provided training and support to junior rate reviewers, ensuring they met quality standards and developed strong analytical skills.

- Analyzed industry trends and market data to stay abreast of emerging risks and regulatory changes, adapting rate review processes accordingly.

Frequently Asked Questions (FAQ’s) For Rate Reviewer

What are the key responsibilities of a Rate Reviewer?

Rate Reviewers are responsible for analyzing and reviewing rate submissions, ensuring accuracy and compliance with industry regulations and company policies. They identify errors and inconsistencies in rate calculations, collaborate with underwriters and actuarial teams to resolve complex rating issues, and develop and implement process improvements to enhance efficiency and accuracy in rate review operations.

What qualifications are required to become a Rate Reviewer?

Rate Reviewers typically hold a Bachelor’s Degree in Actuarial Science, Mathematics, or Statistics. They possess strong analytical and problem-solving skills, with a deep understanding of insurance products and underwriting guidelines.

What skills are important for a Rate Reviewer?

Rate Reviewers should have excellent analytical and problem-solving skills, with a strong attention to detail. They should also possess a deep understanding of insurance products and underwriting guidelines, as well as proficiency in using proprietary software.

What is the career path for a Rate Reviewer?

Rate Reviewers can advance to roles such as Senior Rate Reviewer, Underwriter, or Actuary. With experience and additional qualifications, they can also move into management positions.

What are the challenges faced by Rate Reviewers?

Rate Reviewers face challenges such as dealing with complex and often conflicting data, staying abreast of industry trends and regulatory changes, and working under tight deadlines.

What is the job outlook for Rate Reviewers?

The job outlook for Rate Reviewers is expected to be positive, due to the increasing demand for insurance products and services.

Is a Rate Reviewer certification required?

While certification is not mandatory, obtaining a certification, such as the Certified Insurance Rate Analyst (CIRA) designation, can enhance your credibility and career prospects.