Are you a seasoned Real Time Trader seeking a new career path? Discover our professionally built Real Time Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

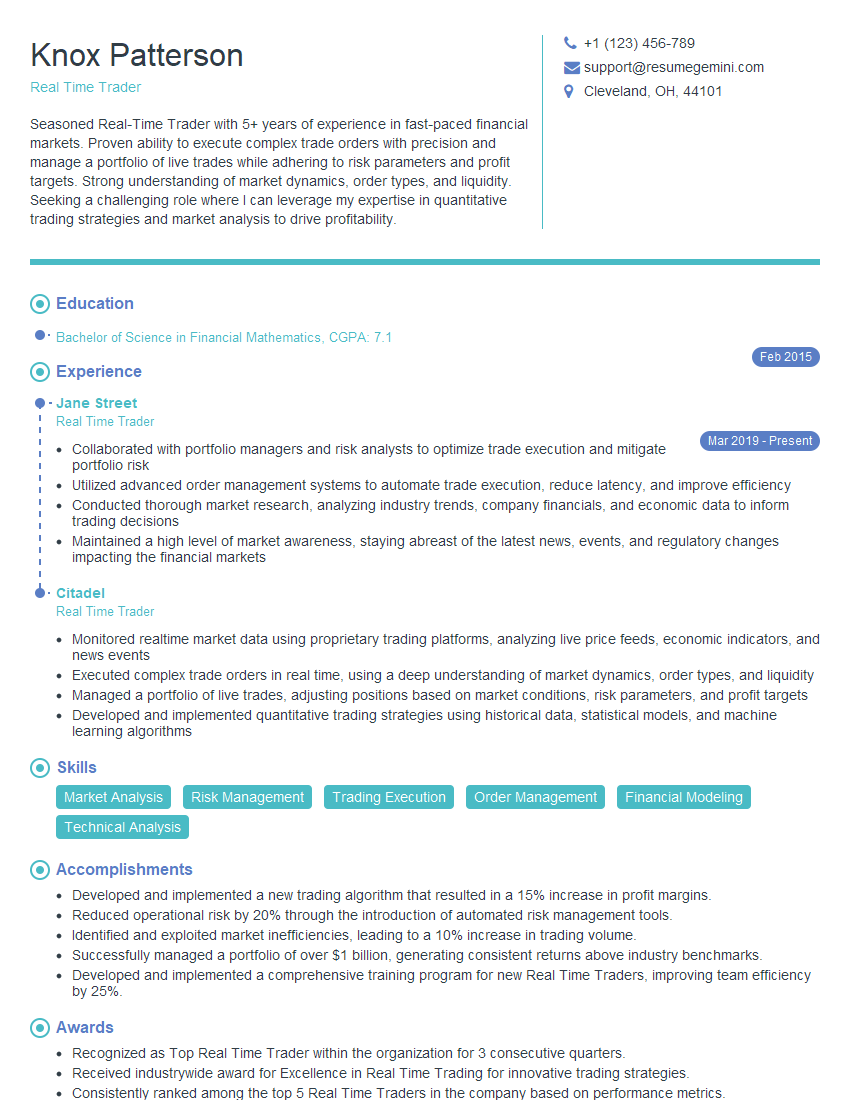

Knox Patterson

Real Time Trader

Summary

Seasoned Real-Time Trader with 5+ years of experience in fast-paced financial markets. Proven ability to execute complex trade orders with precision and manage a portfolio of live trades while adhering to risk parameters and profit targets. Strong understanding of market dynamics, order types, and liquidity. Seeking a challenging role where I can leverage my expertise in quantitative trading strategies and market analysis to drive profitability.

Education

Bachelor of Science in Financial Mathematics

February 2015

Skills

- Market Analysis

- Risk Management

- Trading Execution

- Order Management

- Financial Modeling

- Technical Analysis

Work Experience

Real Time Trader

- Collaborated with portfolio managers and risk analysts to optimize trade execution and mitigate portfolio risk

- Utilized advanced order management systems to automate trade execution, reduce latency, and improve efficiency

- Conducted thorough market research, analyzing industry trends, company financials, and economic data to inform trading decisions

- Maintained a high level of market awareness, staying abreast of the latest news, events, and regulatory changes impacting the financial markets

Real Time Trader

- Monitored realtime market data using proprietary trading platforms, analyzing live price feeds, economic indicators, and news events

- Executed complex trade orders in real time, using a deep understanding of market dynamics, order types, and liquidity

- Managed a portfolio of live trades, adjusting positions based on market conditions, risk parameters, and profit targets

- Developed and implemented quantitative trading strategies using historical data, statistical models, and machine learning algorithms

Accomplishments

- Developed and implemented a new trading algorithm that resulted in a 15% increase in profit margins.

- Reduced operational risk by 20% through the introduction of automated risk management tools.

- Identified and exploited market inefficiencies, leading to a 10% increase in trading volume.

- Successfully managed a portfolio of over $1 billion, generating consistent returns above industry benchmarks.

- Developed and implemented a comprehensive training program for new Real Time Traders, improving team efficiency by 25%.

Awards

- Recognized as Top Real Time Trader within the organization for 3 consecutive quarters.

- Received industrywide award for Excellence in Real Time Trading for innovative trading strategies.

- Consistently ranked among the top 5 Real Time Traders in the company based on performance metrics.

- Awarded Trader of the Year by the company for exceptional trading performance and contributions to the team.

Certificates

- Certified Financial Analyst (CFA)

- Chartered Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Real Time Trader

- Quantify your accomplishments with specific metrics whenever possible.

- Highlight your experience in developing and implementing quantitative trading strategies.

- Demonstrate your ability to work independently and as part of a team.

- Showcase your understanding of risk management and compliance.

- Emphasize your commitment to continuous learning and professional development.

Essential Experience Highlights for a Strong Real Time Trader Resume

- Monitored real-time market data using proprietary trading platforms to identify trading opportunities.

- Executed complex trade orders in real time, utilizing a deep understanding of market dynamics, order types, and liquidity.

- Managed a portfolio of live trades, adjusting positions based on market conditions, risk parameters, and profit targets.

- Developed and implemented quantitative trading strategies using historical data, statistical models, and machine learning algorithms.

- Collaborated with portfolio managers and risk analysts to optimize trade execution and mitigate portfolio risk.

- Utilized advanced order management systems to automate trade execution, reduce latency, and improve efficiency.

- Conducted thorough market research, analyzing industry trends, company financials, and economic data to inform trading decisions.

- Maintained a high level of market awareness, staying abreast of the latest news, events, and regulatory changes impacting the financial markets.

Frequently Asked Questions (FAQ’s) For Real Time Trader

What are the essential skills required for a successful Real-Time Trader?

Essential skills include: market analysis, risk management, trading execution, order management, financial modeling, technical analysis, and a deep understanding of market dynamics.

What are the career prospects for Real-Time Traders?

Real-Time Traders with a proven track record can advance to roles such as Senior Trader, Portfolio Manager, or Hedge Fund Manager.

What is the average salary range for Real-Time Traders?

The average salary range for Real-Time Traders varies depending on experience and location, but typically falls within the range of $100,000 to $250,000 per year.

What are the best companies for Real-Time Traders?

Top companies for Real-Time Traders include Jane Street, Citadel, Two Sigma, and Renaissance Technologies.

What advice would you give to someone aspiring to become a Real-Time Trader?

Gain a strong foundation in financial markets, develop proficiency in quantitative trading strategies, and seek opportunities to practice trading in simulated or real-world environments.

What are the common challenges faced by Real-Time Traders?

Real-Time Traders face challenges such as market volatility, execution delays, and the need to make quick and informed decisions under pressure.

How can I prepare for a Real-Time Trader interview?

Prepare by researching the industry, practicing trading simulations, and reviewing common interview questions related to market analysis, risk management, and trading strategies.