Are you a seasoned Reconcilement Clerk seeking a new career path? Discover our professionally built Reconcilement Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

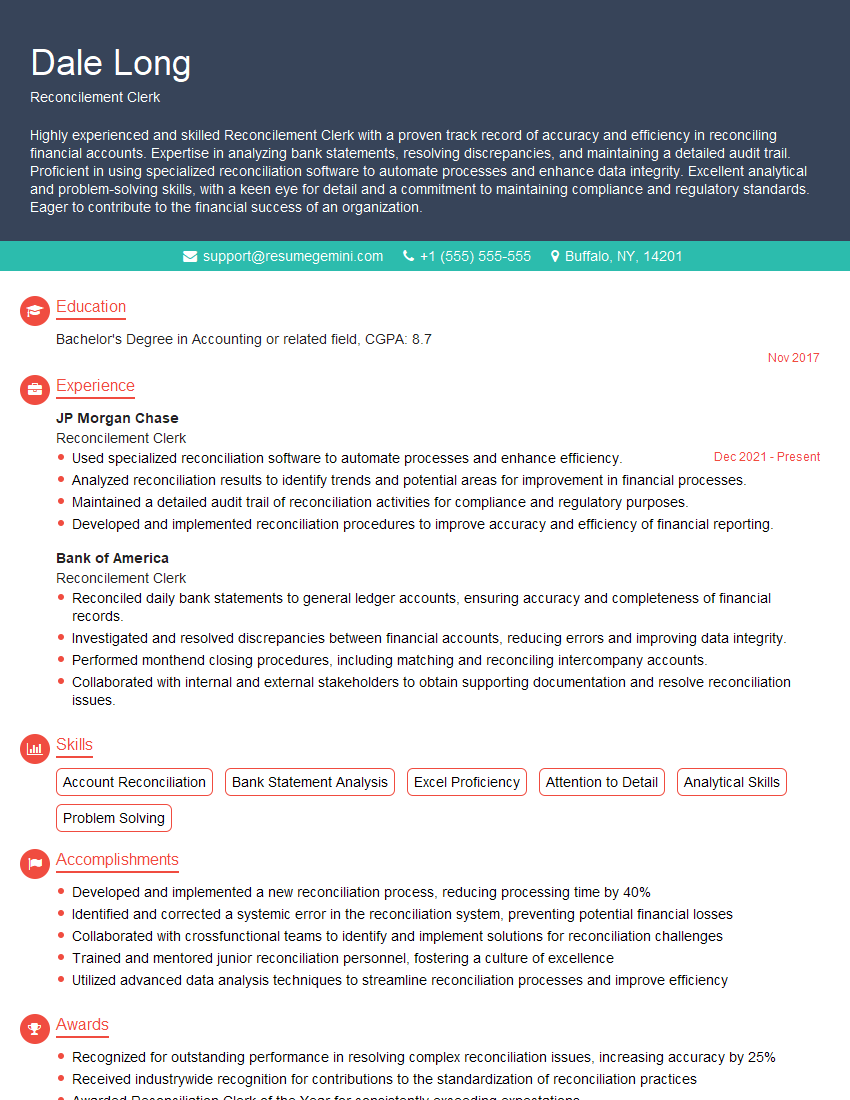

Dale Long

Reconcilement Clerk

Summary

Highly experienced and skilled Reconcilement Clerk with a proven track record of accuracy and efficiency in reconciling financial accounts. Expertise in analyzing bank statements, resolving discrepancies, and maintaining a detailed audit trail. Proficient in using specialized reconciliation software to automate processes and enhance data integrity. Excellent analytical and problem-solving skills, with a keen eye for detail and a commitment to maintaining compliance and regulatory standards. Eager to contribute to the financial success of an organization.

Education

Bachelor’s Degree in Accounting or related field

November 2017

Skills

- Account Reconciliation

- Bank Statement Analysis

- Excel Proficiency

- Attention to Detail

- Analytical Skills

- Problem Solving

Work Experience

Reconcilement Clerk

- Used specialized reconciliation software to automate processes and enhance efficiency.

- Analyzed reconciliation results to identify trends and potential areas for improvement in financial processes.

- Maintained a detailed audit trail of reconciliation activities for compliance and regulatory purposes.

- Developed and implemented reconciliation procedures to improve accuracy and efficiency of financial reporting.

Reconcilement Clerk

- Reconciled daily bank statements to general ledger accounts, ensuring accuracy and completeness of financial records.

- Investigated and resolved discrepancies between financial accounts, reducing errors and improving data integrity.

- Performed monthend closing procedures, including matching and reconciling intercompany accounts.

- Collaborated with internal and external stakeholders to obtain supporting documentation and resolve reconciliation issues.

Accomplishments

- Developed and implemented a new reconciliation process, reducing processing time by 40%

- Identified and corrected a systemic error in the reconciliation system, preventing potential financial losses

- Collaborated with crossfunctional teams to identify and implement solutions for reconciliation challenges

- Trained and mentored junior reconciliation personnel, fostering a culture of excellence

- Utilized advanced data analysis techniques to streamline reconciliation processes and improve efficiency

Awards

- Recognized for outstanding performance in resolving complex reconciliation issues, increasing accuracy by 25%

- Received industrywide recognition for contributions to the standardization of reconciliation practices

- Awarded Reconciliation Clerk of the Year for consistently exceeding expectations

- Recognized by peers for exceptional problemsolving skills in handling complex reconciliations

Certificates

- Certified Public Accountant (CPA)

- Certified Fraud Examiner (CFE)

- Certified Internal Auditor (CIA)

- Certified Management Accountant (CMA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Reconcilement Clerk

Highlight your technical skills

- Use keywords from the job description in your resume, such as ‘bank statement analysis’, ‘Excel proficiency’, and ‘attention to detail’.

- Quantify your accomplishments whenever possible. For example, instead of saying ‘reconciled accounts’, say ‘reconciled over 500 accounts per month, resulting in a 99% accuracy rate’.

- Proofread your resume carefully before submitting it. A well-written resume will make you stand out from the competition.

Essential Experience Highlights for a Strong Reconcilement Clerk Resume

- Reconcile daily bank statements to general ledger accounts to ensure accuracy and completeness of financial records.

- Investigate and resolve discrepancies between financial accounts to reduce errors and improve data integrity.

- Perform month-end closing procedures, including matching and reconciling intercompany accounts.

- Collaborate with internal and external stakeholders to obtain supporting documentation and resolve reconciliation issues.

- Use specialized reconciliation software to automate processes and enhance efficiency.

- Analyze reconciliation results to identify trends and potential areas for improvement in financial processes.

- Develop and implement reconciliation procedures to improve accuracy and efficiency of financial reporting.

Frequently Asked Questions (FAQ’s) For Reconcilement Clerk

What is the primary role of a Reconcilement Clerk?

The primary role of a Reconcilement Clerk is to ensure the accuracy and completeness of financial records by reconciling bank statements to general ledger accounts and investigating and resolving any discrepancies.

What are the key skills required for a Reconcilement Clerk?

The key skills required for a Reconcilement Clerk include attention to detail, analytical skills, problem-solving skills, and proficiency in Microsoft Excel and specialized reconciliation software.

What are the career prospects for a Reconcilement Clerk?

Reconciliation Clerks can advance to more senior roles in accounting, such as Accountant, Financial Analyst, or Controller. With additional experience and qualifications, they may also pursue roles in auditing or financial management.

What are the common challenges faced by Reconciliation Clerks?

Reconciliation Clerks often face challenges such as dealing with large volumes of data, tight deadlines, and the need to maintain accuracy and compliance with financial regulations.

What are the key trends in the field of Reconciliation?

Key trends in the field of Reconciliation include the increasing use of automation and data analytics to improve efficiency and accuracy, as well as the adoption of new technologies such as blockchain to enhance security and transparency.

How can I improve my skills as a Reconciliation Clerk?

To improve your skills as a Reconciliation Clerk, you can focus on developing your attention to detail, analytical skills, problem-solving skills, and proficiency in Microsoft Excel and specialized reconciliation software. Additionally, you can seek out opportunities to learn about new trends in the field of Reconciliation, such as automation and data analytics.