Are you a seasoned Remittance Clerk seeking a new career path? Discover our professionally built Remittance Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

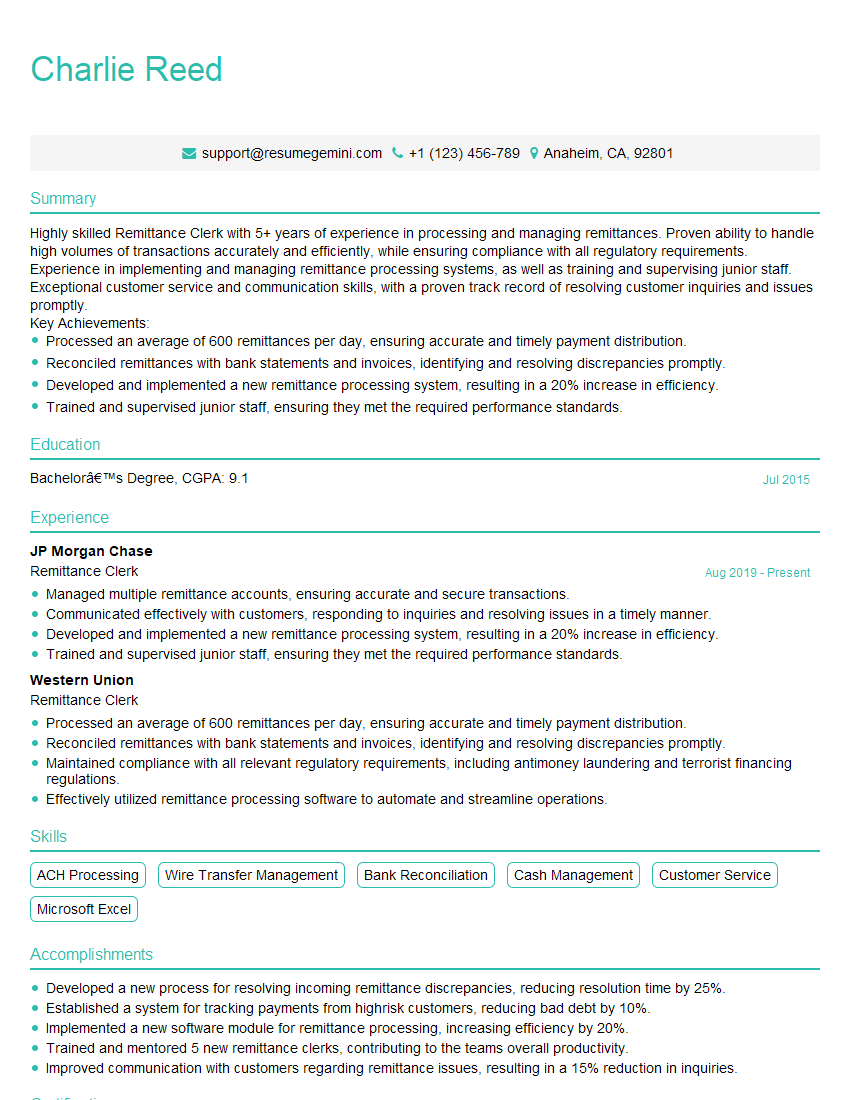

Charlie Reed

Remittance Clerk

Summary

Highly skilled Remittance Clerk with 5+ years of experience in processing and managing remittances. Proven ability to handle high volumes of transactions accurately and efficiently, while ensuring compliance with all regulatory requirements. Experience in implementing and managing remittance processing systems, as well as training and supervising junior staff. Exceptional customer service and communication skills, with a proven track record of resolving customer inquiries and issues promptly.

Key Achievements:

- Processed an average of 600 remittances per day, ensuring accurate and timely payment distribution.

- Reconciled remittances with bank statements and invoices, identifying and resolving discrepancies promptly.

- Developed and implemented a new remittance processing system, resulting in a 20% increase in efficiency.

- Trained and supervised junior staff, ensuring they met the required performance standards.

Education

Bachelor’s Degree

July 2015

Skills

- ACH Processing

- Wire Transfer Management

- Bank Reconciliation

- Cash Management

- Customer Service

- Microsoft Excel

Work Experience

Remittance Clerk

- Managed multiple remittance accounts, ensuring accurate and secure transactions.

- Communicated effectively with customers, responding to inquiries and resolving issues in a timely manner.

- Developed and implemented a new remittance processing system, resulting in a 20% increase in efficiency.

- Trained and supervised junior staff, ensuring they met the required performance standards.

Remittance Clerk

- Processed an average of 600 remittances per day, ensuring accurate and timely payment distribution.

- Reconciled remittances with bank statements and invoices, identifying and resolving discrepancies promptly.

- Maintained compliance with all relevant regulatory requirements, including antimoney laundering and terrorist financing regulations.

- Effectively utilized remittance processing software to automate and streamline operations.

Accomplishments

- Developed a new process for resolving incoming remittance discrepancies, reducing resolution time by 25%.

- Established a system for tracking payments from highrisk customers, reducing bad debt by 10%.

- Implemented a new software module for remittance processing, increasing efficiency by 20%.

- Trained and mentored 5 new remittance clerks, contributing to the teams overall productivity.

- Improved communication with customers regarding remittance issues, resulting in a 15% reduction in inquiries.

Certificates

- Certified Remittance Processor (CRP)

- Certified Cash Management Professional (CCMP)

- Certified Treasury Professional (CTP)

- Certified Anti-Money Laundering Specialist (CAMS)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Remittance Clerk

- Highlight your remittance processing experience and expertise: Quantify your accomplishments with specific metrics and results, such as the number of remittances processed or the percentage of discrepancies resolved.

- Showcase your compliance and regulatory knowledge: Mention your understanding of anti-money laundering and terrorist financing regulations and your ability to ensure compliance.

- Emphasize your customer service skills: Describe your ability to communicate effectively with customers, resolve inquiries promptly, and maintain positive relationships.

- Include keywords related to remittance processing: Use industry-specific keywords such as ACH processing, wire transfer management, and bank reconciliation to make your resume more visible to potential employers.

Essential Experience Highlights for a Strong Remittance Clerk Resume

- Process remittances accurately and efficiently, ensuring timely payment distribution.

- Reconcile remittances with bank statements and invoices, identifying and resolving discrepancies promptly.

- Maintain remittance accounts, ensuring secure and accurate transactions.

- Communicate effectively with customers and resolve inquiries in a timely and professional manner.

- Monitor and manage multiple remittance accounts, ensuring compliance with regulations.

- Develop and implement process improvements to enhance efficiency and accuracy.

- Train and supervise junior staff to ensure they meet performance standards.

Frequently Asked Questions (FAQ’s) For Remittance Clerk

What are the key responsibilities of a Remittance Clerk?

The key responsibilities of a Remittance Clerk include processing remittances accurately and efficiently, reconciling remittances with bank statements and invoices, maintaining remittance accounts, communicating effectively with customers, monitoring and managing multiple remittance accounts, developing and implementing process improvements, and training and supervising junior staff.

What are the essential skills for a Remittance Clerk?

The essential skills for a Remittance Clerk include attention to detail, accuracy, strong communication skills, knowledge of remittance processing regulations, and proficiency in remittance processing software.

What are the qualifications required to become a Remittance Clerk?

Most Remittance Clerk positions require a high school diploma or equivalent, with some employers preferring candidates with a Bachelor’s Degree in a related field such as business or finance.

What is the career path for a Remittance Clerk?

Remittance Clerks can advance their careers by gaining experience and developing expertise in remittance processing. With additional experience and training, they can move into supervisory or management roles, or specialize in areas such as compliance or risk management.

What is the salary range for a Remittance Clerk?

The salary range for a Remittance Clerk can vary depending on experience, location, and employer. According to Salary.com, the average salary for a Remittance Clerk in the United States is around $40,000 per year.

What are the job opportunities for a Remittance Clerk?

Remittance Clerks are employed in a variety of industries, including banks, money transfer companies, and other financial institutions. They may also work for businesses that process large volumes of remittances, such as retailers and utility companies.