Are you a seasoned Retail Mortgage Processor seeking a new career path? Discover our professionally built Retail Mortgage Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

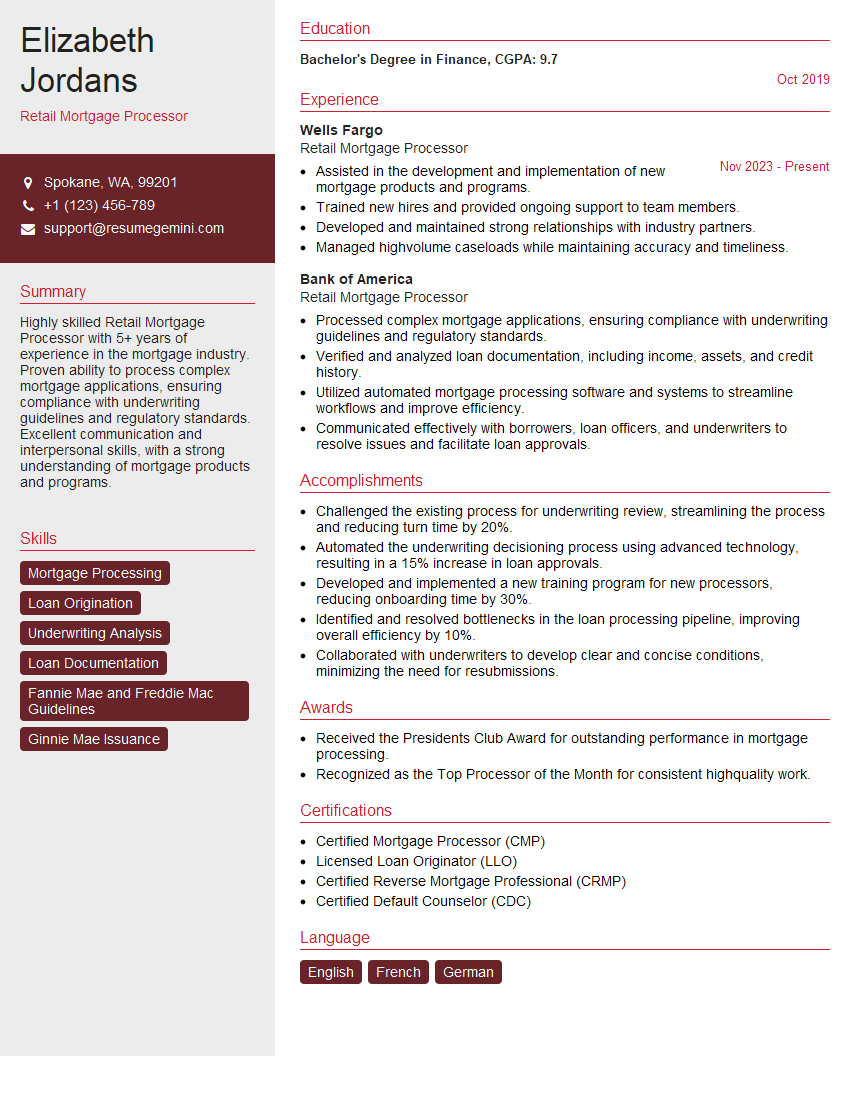

Elizabeth Jordans

Retail Mortgage Processor

Summary

Highly skilled Retail Mortgage Processor with 5+ years of experience in the mortgage industry. Proven ability to process complex mortgage applications, ensuring compliance with underwriting guidelines and regulatory standards. Excellent communication and interpersonal skills, with a strong understanding of mortgage products and programs.

Education

Bachelor’s Degree in Finance

October 2019

Skills

- Mortgage Processing

- Loan Origination

- Underwriting Analysis

- Loan Documentation

- Fannie Mae and Freddie Mac Guidelines

- Ginnie Mae Issuance

Work Experience

Retail Mortgage Processor

- Assisted in the development and implementation of new mortgage products and programs.

- Trained new hires and provided ongoing support to team members.

- Developed and maintained strong relationships with industry partners.

- Managed highvolume caseloads while maintaining accuracy and timeliness.

Retail Mortgage Processor

- Processed complex mortgage applications, ensuring compliance with underwriting guidelines and regulatory standards.

- Verified and analyzed loan documentation, including income, assets, and credit history.

- Utilized automated mortgage processing software and systems to streamline workflows and improve efficiency.

- Communicated effectively with borrowers, loan officers, and underwriters to resolve issues and facilitate loan approvals.

Accomplishments

- Challenged the existing process for underwriting review, streamlining the process and reducing turn time by 20%.

- Automated the underwriting decisioning process using advanced technology, resulting in a 15% increase in loan approvals.

- Developed and implemented a new training program for new processors, reducing onboarding time by 30%.

- Identified and resolved bottlenecks in the loan processing pipeline, improving overall efficiency by 10%.

- Collaborated with underwriters to develop clear and concise conditions, minimizing the need for resubmissions.

Awards

- Received the Presidents Club Award for outstanding performance in mortgage processing.

- Recognized as the Top Processor of the Month for consistent highquality work.

Certificates

- Certified Mortgage Processor (CMP)

- Licensed Loan Originator (LLO)

- Certified Reverse Mortgage Professional (CRMP)

- Certified Default Counselor (CDC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Retail Mortgage Processor

- Start by highlighting your experience in processing retail mortgage applications.

- Quantify your accomplishments with specific metrics whenever possible.

- Use action verbs and strong language to describe your skills and responsibilities.

- Proofread carefully before submitting your resume.

- Use keywords relevant to the job you’re applying for, such as ‘mortgage processing,’ ‘loan origination,’ and ‘underwriting analysis.’

Essential Experience Highlights for a Strong Retail Mortgage Processor Resume

- Processed complex mortgage applications, ensuring compliance with underwriting guidelines and regulatory standards.

- Verified and analyzed loan documentation, including income, assets, and credit history.

- Utilized automated mortgage processing software and systems to streamline workflows and improve efficiency.

- Communicated effectively with borrowers, loan officers, and underwriters to resolve issues and facilitate loan approvals.

- Assisted in the development and implementation of new mortgage products and programs.

- Trained new hires and provided ongoing support to team members.

- Managed high-volume caseloads while maintaining accuracy and timeliness.

Frequently Asked Questions (FAQ’s) For Retail Mortgage Processor

What is the primary role of a Retail Mortgage Processor?

The primary role of a Retail Mortgage Processor is to handle the processing of mortgage applications from customers. This involves ensuring compliance with underwriting guidelines, verifying and analyzing loan documentation, communicating with borrowers, and managing the loan process through to completion.

What skills are essential for a successful Retail Mortgage Processor?

Essential skills for a Retail Mortgage Processor include knowledge of mortgage products and programs, understanding of underwriting guidelines, proficiency in mortgage processing software, excellent communication skills, and a strong attention to detail.

What are the career advancement opportunities for Retail Mortgage Processors?

Retail Mortgage Processors can advance their careers by moving into roles such as Loan Officer, Underwriter, or Mortgage Manager. With additional experience and training, they can also specialize in areas such as jumbo loans or reverse mortgages.

What is the job outlook for Retail Mortgage Processors?

The job outlook for Retail Mortgage Processors is expected to be positive over the next several years due to the increasing demand for mortgage loans and the need for qualified professionals to process these applications.

What are some of the key challenges faced by Retail Mortgage Processors?

Some of the key challenges faced by Retail Mortgage Processors include managing high-volume caseloads, meeting tight deadlines, and staying up-to-date with changing regulations and industry best practices.

What is the average salary for a Retail Mortgage Processor?

The average salary for a Retail Mortgage Processor in the United States is around $60,000 per year, according to the Bureau of Labor Statistics.

What advice would you give to someone who wants to become a Retail Mortgage Processor?

To become a Retail Mortgage Processor, it is recommended to obtain a bachelor’s degree in finance or a related field, gain experience in customer service or a related industry, and obtain the necessary certifications and licenses.