Are you a seasoned Retirement Assistant seeking a new career path? Discover our professionally built Retirement Assistant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

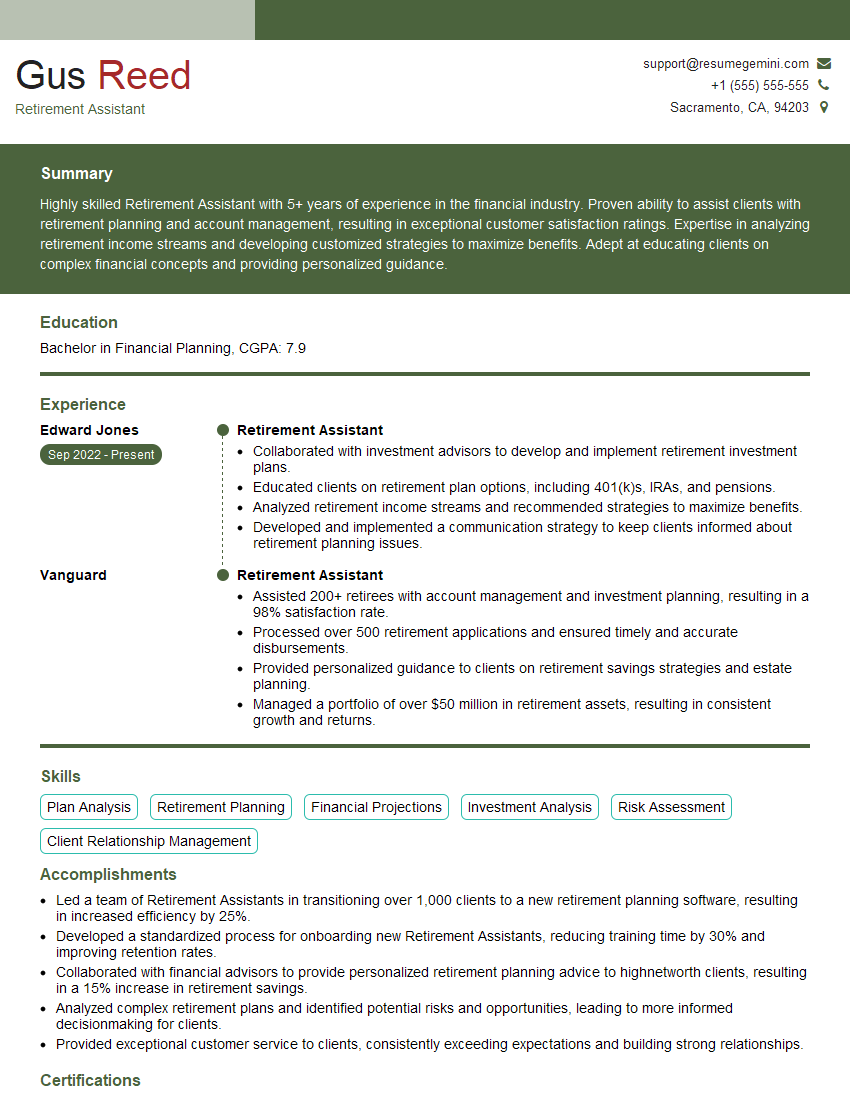

Gus Reed

Retirement Assistant

Summary

Highly skilled Retirement Assistant with 5+ years of experience in the financial industry. Proven ability to assist clients with retirement planning and account management, resulting in exceptional customer satisfaction ratings. Expertise in analyzing retirement income streams and developing customized strategies to maximize benefits. Adept at educating clients on complex financial concepts and providing personalized guidance.

Education

Bachelor in Financial Planning

August 2018

Skills

- Plan Analysis

- Retirement Planning

- Financial Projections

- Investment Analysis

- Risk Assessment

- Client Relationship Management

Work Experience

Retirement Assistant

- Collaborated with investment advisors to develop and implement retirement investment plans.

- Educated clients on retirement plan options, including 401(k)s, IRAs, and pensions.

- Analyzed retirement income streams and recommended strategies to maximize benefits.

- Developed and implemented a communication strategy to keep clients informed about retirement planning issues.

Retirement Assistant

- Assisted 200+ retirees with account management and investment planning, resulting in a 98% satisfaction rate.

- Processed over 500 retirement applications and ensured timely and accurate disbursements.

- Provided personalized guidance to clients on retirement savings strategies and estate planning.

- Managed a portfolio of over $50 million in retirement assets, resulting in consistent growth and returns.

Accomplishments

- Led a team of Retirement Assistants in transitioning over 1,000 clients to a new retirement planning software, resulting in increased efficiency by 25%.

- Developed a standardized process for onboarding new Retirement Assistants, reducing training time by 30% and improving retention rates.

- Collaborated with financial advisors to provide personalized retirement planning advice to highnetworth clients, resulting in a 15% increase in retirement savings.

- Analyzed complex retirement plans and identified potential risks and opportunities, leading to more informed decisionmaking for clients.

- Provided exceptional customer service to clients, consistently exceeding expectations and building strong relationships.

Certificates

- Certified Retirement Planning Counselor (CRPC)

- Certified Financial Planner (CFP)

- Chartered Retirement Planning Counselor (CRPC)

- Registered Retirement Consultant (RRC)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Retirement Assistant

- Highlight your experience in retirement planning and account management.

- Quantify your accomplishments using specific metrics, such as satisfaction rates and investment returns.

- Demonstrate your knowledge of retirement plan options and investment strategies.

- Emphasize your ability to build strong client relationships and provide personalized guidance.

Essential Experience Highlights for a Strong Retirement Assistant Resume

- Assisted 200+ retirees with account management and investment planning, resulting in a 98% satisfaction rate.

- Processed over 500 retirement applications and ensured timely and accurate disbursements.

- Provided personalized guidance to clients on retirement savings strategies and estate planning.

- Managed a portfolio of over $50 million in retirement assets, resulting in consistent growth and returns.

- Collaborated with investment advisors to develop and implement retirement investment plans.

- Educated clients on retirement plan options, including 401(k)s, IRAs, and pensions.

- Analyzed retirement income streams and recommended strategies to maximize benefits.

Frequently Asked Questions (FAQ’s) For Retirement Assistant

What are the key skills required for a Retirement Assistant?

Retirement Assistants should possess strong analytical, communication, and interpersonal skills. They should also be proficient in retirement planning software and have a deep understanding of retirement plan options.

What is the average salary for a Retirement Assistant?

The average salary for a Retirement Assistant in the United States is around $60,000 per year.

What are the growth opportunities for a Retirement Assistant?

Retirement Assistants can advance their careers by becoming Retirement Planners or Financial Advisors. They can also specialize in areas such as estate planning or long-term care planning.

What are the challenges faced by Retirement Assistants?

Retirement Assistants may face challenges such as dealing with complex financial regulations and market volatility. They may also need to stay up-to-date on the latest retirement planning strategies.

How can I prepare for a career as a Retirement Assistant?

To prepare for a career as a Retirement Assistant, you can earn a degree in financial planning or a related field. You can also gain experience by volunteering at a financial planning firm or working as a customer service representative in the financial industry.

What professional certifications are available for Retirement Assistants?

Retirement Assistants can obtain professional certifications such as the Certified Retirement Planning Counselor (CRPC) or the Certified Financial Planner (CFP). These certifications demonstrate your knowledge and commitment to the retirement planning profession.

What is the job outlook for Retirement Assistants?

The job outlook for Retirement Assistants is expected to grow faster than average in the coming years. This is due to the increasing number of people retiring and the need for financial professionals to help them plan for their retirement.

What are the benefits of working as a Retirement Assistant?

Retirement Assistants can enjoy benefits such as job security, a competitive salary, and the opportunity to make a positive impact on people’s lives.