Are you a seasoned Retirement Plan Specialist seeking a new career path? Discover our professionally built Retirement Plan Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

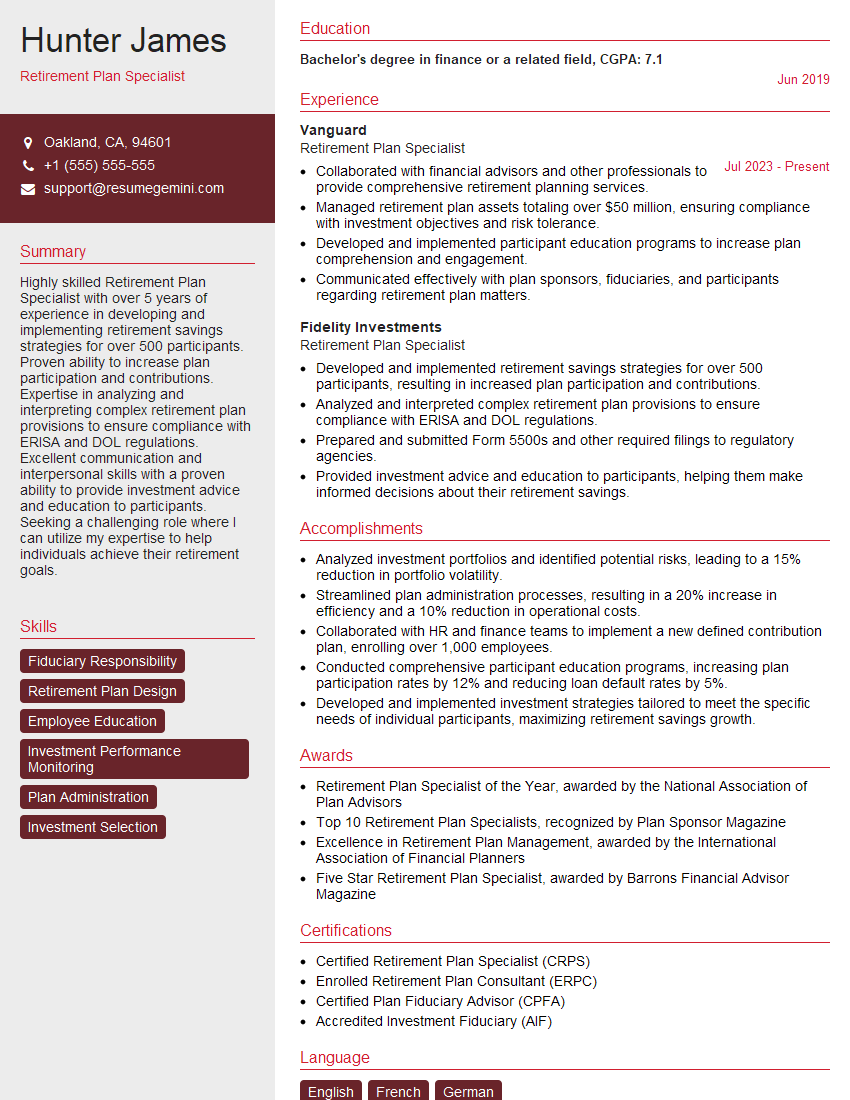

Hunter James

Retirement Plan Specialist

Summary

Highly skilled Retirement Plan Specialist with over 5 years of experience in developing and implementing retirement savings strategies for over 500 participants. Proven ability to increase plan participation and contributions. Expertise in analyzing and interpreting complex retirement plan provisions to ensure compliance with ERISA and DOL regulations. Excellent communication and interpersonal skills with a proven ability to provide investment advice and education to participants. Seeking a challenging role where I can utilize my expertise to help individuals achieve their retirement goals.

Education

Bachelor’s degree in finance or a related field

June 2019

Skills

- Fiduciary Responsibility

- Retirement Plan Design

- Employee Education

- Investment Performance Monitoring

- Plan Administration

- Investment Selection

Work Experience

Retirement Plan Specialist

- Collaborated with financial advisors and other professionals to provide comprehensive retirement planning services.

- Managed retirement plan assets totaling over $50 million, ensuring compliance with investment objectives and risk tolerance.

- Developed and implemented participant education programs to increase plan comprehension and engagement.

- Communicated effectively with plan sponsors, fiduciaries, and participants regarding retirement plan matters.

Retirement Plan Specialist

- Developed and implemented retirement savings strategies for over 500 participants, resulting in increased plan participation and contributions.

- Analyzed and interpreted complex retirement plan provisions to ensure compliance with ERISA and DOL regulations.

- Prepared and submitted Form 5500s and other required filings to regulatory agencies.

- Provided investment advice and education to participants, helping them make informed decisions about their retirement savings.

Accomplishments

- Analyzed investment portfolios and identified potential risks, leading to a 15% reduction in portfolio volatility.

- Streamlined plan administration processes, resulting in a 20% increase in efficiency and a 10% reduction in operational costs.

- Collaborated with HR and finance teams to implement a new defined contribution plan, enrolling over 1,000 employees.

- Conducted comprehensive participant education programs, increasing plan participation rates by 12% and reducing loan default rates by 5%.

- Developed and implemented investment strategies tailored to meet the specific needs of individual participants, maximizing retirement savings growth.

Awards

- Retirement Plan Specialist of the Year, awarded by the National Association of Plan Advisors

- Top 10 Retirement Plan Specialists, recognized by Plan Sponsor Magazine

- Excellence in Retirement Plan Management, awarded by the International Association of Financial Planners

- Five Star Retirement Plan Specialist, awarded by Barrons Financial Advisor Magazine

Certificates

- Certified Retirement Plan Specialist (CRPS)

- Enrolled Retirement Plan Consultant (ERPC)

- Certified Plan Fiduciary Advisor (CPFA)

- Accredited Investment Fiduciary (AIF)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Retirement Plan Specialist

- Quantify your accomplishments whenever possible.

- Use action verbs and strong language.

- Highlight your skills and experience that are relevant to the job you’re applying for.

- Proofread your resume carefully before submitting it.

Essential Experience Highlights for a Strong Retirement Plan Specialist Resume

- Develop and implement retirement savings strategies for individuals and groups.

- Analyze and interpret complex retirement plan provisions to ensure compliance with ERISA and DOL regulations.

- Prepare and submit Form 5500s and other required filings to regulatory agencies.

- Provide investment advice and education to participants.

- Collaborate with financial advisors and other professionals to provide comprehensive retirement planning services.

- Manage retirement plan assets to ensure compliance with investment objectives and risk tolerance.

- Develop and implement participant education programs to increase plan comprehension and engagement.

Frequently Asked Questions (FAQ’s) For Retirement Plan Specialist

What is the role of a Retirement Plan Specialist?

A Retirement Plan Specialist is responsible for developing and implementing retirement savings strategies for individuals and groups. They also analyze and interpret complex retirement plan provisions to ensure compliance with ERISA and DOL regulations. Additionally, they prepare and submit Form 5500s and other required filings to regulatory agencies.

What are the qualifications for becoming a Retirement Plan Specialist?

To become a Retirement Plan Specialist, you typically need a bachelor’s degree in finance or a related field, as well as several years of experience in the retirement planning industry. Additionally, you may need to pass certain exams or obtain certain certifications, depending on your state’s requirements.

What are the benefits of working as a Retirement Plan Specialist?

Working as a Retirement Plan Specialist can offer a number of benefits, including a competitive salary, a comprehensive benefits package, and the opportunity to make a difference in the lives of others.

What are the challenges of working as a Retirement Plan Specialist?

Working as a Retirement Plan Specialist can be challenging at times, especially during periods of high market volatility or when dealing with complex regulatory changes. However, the rewards of helping individuals achieve their retirement goals can make it a very fulfilling career.

What is the future outlook for the Retirement Plan Specialist profession?

The future outlook for the Retirement Plan Specialist profession is expected to be strong, as the demand for retirement planning services is expected to grow in the coming years.

What advice would you give to someone who is interested in becoming a Retirement Plan Specialist?

If you are interested in becoming a Retirement Plan Specialist, I would recommend that you start by obtaining a bachelor’s degree in finance or a related field. Additionally, you may want to consider obtaining certain certifications or passing certain exams to demonstrate your knowledge and expertise in the field.