Are you a seasoned Revenue Accountant seeking a new career path? Discover our professionally built Revenue Accountant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

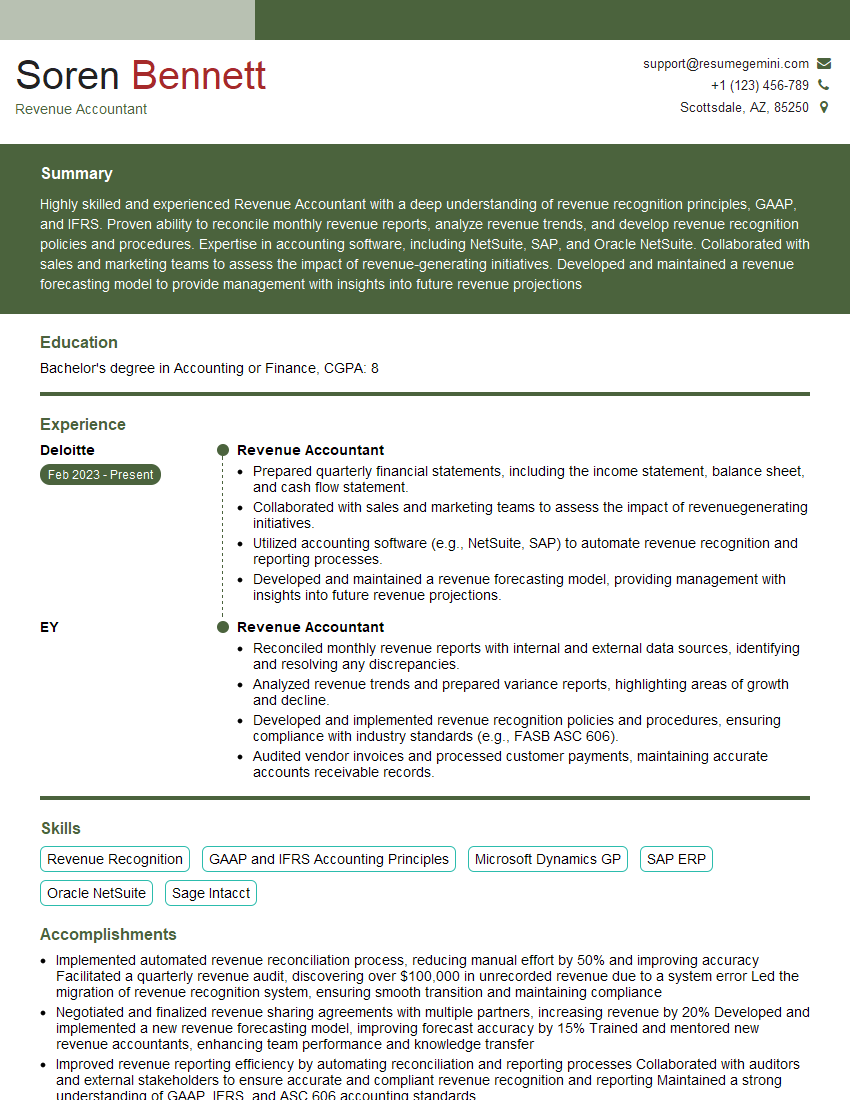

Soren Bennett

Revenue Accountant

Summary

Highly skilled and experienced Revenue Accountant with a deep understanding of revenue recognition principles, GAAP, and IFRS. Proven ability to reconcile monthly revenue reports, analyze revenue trends, and develop revenue recognition policies and procedures. Expertise in accounting software, including NetSuite, SAP, and Oracle NetSuite. Collaborated with sales and marketing teams to assess the impact of revenue-generating initiatives. Developed and maintained a revenue forecasting model to provide management with insights into future revenue projections

Education

Bachelor’s degree in Accounting or Finance

January 2019

Skills

- Revenue Recognition

- GAAP and IFRS Accounting Principles

- Microsoft Dynamics GP

- SAP ERP

- Oracle NetSuite

- Sage Intacct

Work Experience

Revenue Accountant

- Prepared quarterly financial statements, including the income statement, balance sheet, and cash flow statement.

- Collaborated with sales and marketing teams to assess the impact of revenuegenerating initiatives.

- Utilized accounting software (e.g., NetSuite, SAP) to automate revenue recognition and reporting processes.

- Developed and maintained a revenue forecasting model, providing management with insights into future revenue projections.

Revenue Accountant

- Reconciled monthly revenue reports with internal and external data sources, identifying and resolving any discrepancies.

- Analyzed revenue trends and prepared variance reports, highlighting areas of growth and decline.

- Developed and implemented revenue recognition policies and procedures, ensuring compliance with industry standards (e.g., FASB ASC 606).

- Audited vendor invoices and processed customer payments, maintaining accurate accounts receivable records.

Accomplishments

- Implemented automated revenue reconciliation process, reducing manual effort by 50% and improving accuracy Facilitated a quarterly revenue audit, discovering over $100,000 in unrecorded revenue due to a system error Led the migration of revenue recognition system, ensuring smooth transition and maintaining compliance

- Negotiated and finalized revenue sharing agreements with multiple partners, increasing revenue by 20% Developed and implemented a new revenue forecasting model, improving forecast accuracy by 15% Trained and mentored new revenue accountants, enhancing team performance and knowledge transfer

- Improved revenue reporting efficiency by automating reconciliation and reporting processes Collaborated with auditors and external stakeholders to ensure accurate and compliant revenue recognition and reporting Maintained a strong understanding of GAAP, IFRS, and ASC 606 accounting standards

- Streamlined revenue dispute management process, reducing resolution time by 30% Developed and implemented a comprehensive revenue assurance program, minimizing revenue leakage Implemented a revenue optimization project, increasing revenue by 5%

- Assisted with the implementation of a new ERP system, ensuring seamless transition of revenue accounting processes Contributed to the development of a new revenue recognition policy, improving compliance and transparency Presented revenue analysis and insights to senior management, supporting datadriven decisionmaking

Awards

- Recognized for outstanding achievement in revenue auditing and compliance

- Top Performer Award for contributions to revenue recognition accuracy and reporting

- Award of Excellence for exceptional performance in managing complex revenue transactions

Certificates

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

- Certified Information Systems Auditor (CISA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Revenue Accountant

- Quantify your accomplishments using specific metrics.

- Highlight your experience with revenue recognition standards.

- Demonstrate your proficiency in accounting software.

- Showcase your ability to collaborate with cross-functional teams.

Essential Experience Highlights for a Strong Revenue Accountant Resume

- Reconcile monthly revenue reports with internal and external data sources.

- Analyze revenue trends and prepare variance reports, highlighting areas of growth and decline.

- Develop and implement revenue recognition policies and procedures, ensuring compliance with industry standards.

- Audit vendor invoices and process customer payments, maintaining accurate accounts receivable records.

- Prepare quarterly financial statements, including the income statement, balance sheet, and cash flow statement.

- Collaborate with sales and marketing teams to assess the impact of revenue-generating initiatives.

- Utilize accounting software to automate revenue recognition and reporting processes.

Frequently Asked Questions (FAQ’s) For Revenue Accountant

What are the key skills required for a Revenue Accountant?

Key skills for a Revenue Accountant include revenue recognition, GAAP and IFRS accounting principles, accounting software proficiency, and analytical and problem-solving abilities.

What are the career prospects for Revenue Accountants?

Revenue Accountants can advance to roles such as Senior Revenue Accountant, Manager of Revenue Accounting, and Controller. With further experience and expertise, they may also become CFOs or financial consultants.

What is the average salary for Revenue Accountants?

According to Indeed, the average salary for Revenue Accountants in the United States is around $85,000 per year.

What are the common challenges faced by Revenue Accountants?

Common challenges faced by Revenue Accountants include the complexity of revenue recognition standards, the need to stay up-to-date with accounting regulations, and the pressure to meet reporting deadlines.

What certifications are beneficial for Revenue Accountants?

Beneficial certifications for Revenue Accountants include the Certified Public Accountant (CPA) certification, the Certified Management Accountant (CMA) certification, and the Institute of Internal Auditors’ (IIA) Certification in Control Self-Assessment (CCSA).