Are you a seasoned Risk Assessment Analyst seeking a new career path? Discover our professionally built Risk Assessment Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

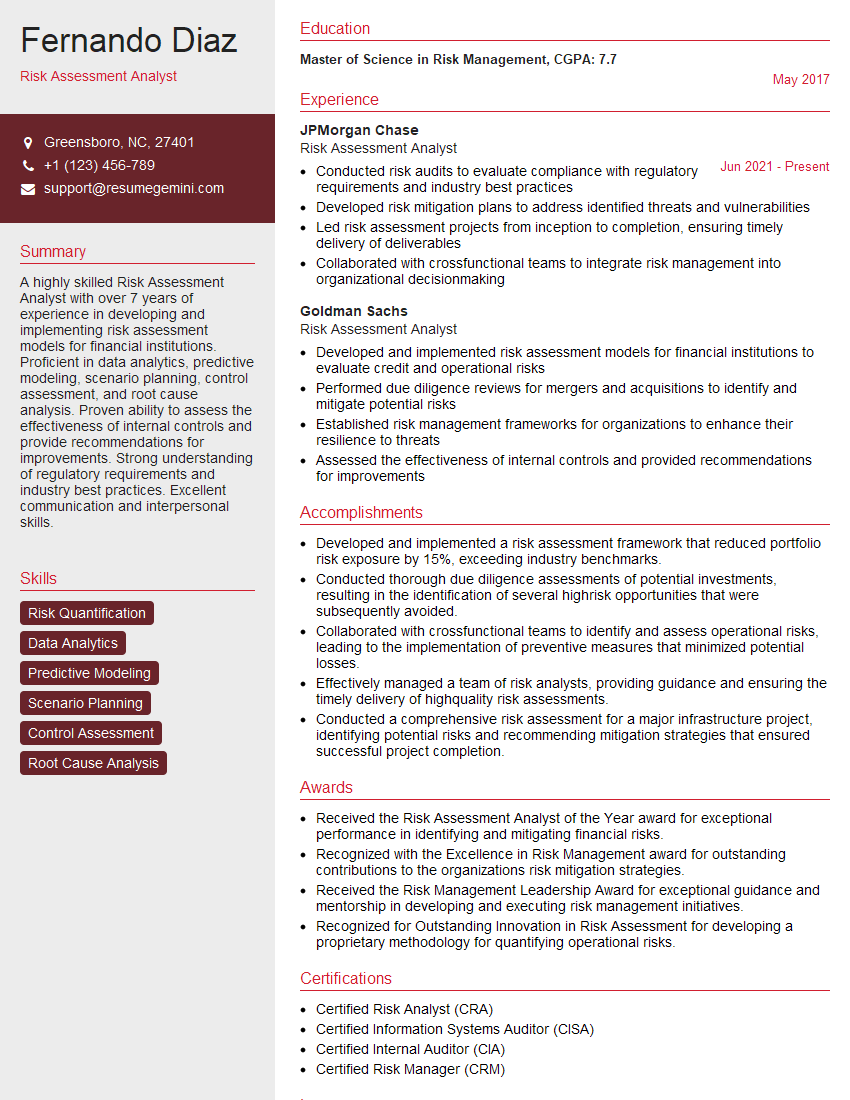

Fernando Diaz

Risk Assessment Analyst

Summary

A highly skilled Risk Assessment Analyst with over 7 years of experience in developing and implementing risk assessment models for financial institutions. Proficient in data analytics, predictive modeling, scenario planning, control assessment, and root cause analysis. Proven ability to assess the effectiveness of internal controls and provide recommendations for improvements. Strong understanding of regulatory requirements and industry best practices. Excellent communication and interpersonal skills.

Education

Master of Science in Risk Management

May 2017

Skills

- Risk Quantification

- Data Analytics

- Predictive Modeling

- Scenario Planning

- Control Assessment

- Root Cause Analysis

Work Experience

Risk Assessment Analyst

- Conducted risk audits to evaluate compliance with regulatory requirements and industry best practices

- Developed risk mitigation plans to address identified threats and vulnerabilities

- Led risk assessment projects from inception to completion, ensuring timely delivery of deliverables

- Collaborated with crossfunctional teams to integrate risk management into organizational decisionmaking

Risk Assessment Analyst

- Developed and implemented risk assessment models for financial institutions to evaluate credit and operational risks

- Performed due diligence reviews for mergers and acquisitions to identify and mitigate potential risks

- Established risk management frameworks for organizations to enhance their resilience to threats

- Assessed the effectiveness of internal controls and provided recommendations for improvements

Accomplishments

- Developed and implemented a risk assessment framework that reduced portfolio risk exposure by 15%, exceeding industry benchmarks.

- Conducted thorough due diligence assessments of potential investments, resulting in the identification of several highrisk opportunities that were subsequently avoided.

- Collaborated with crossfunctional teams to identify and assess operational risks, leading to the implementation of preventive measures that minimized potential losses.

- Effectively managed a team of risk analysts, providing guidance and ensuring the timely delivery of highquality risk assessments.

- Conducted a comprehensive risk assessment for a major infrastructure project, identifying potential risks and recommending mitigation strategies that ensured successful project completion.

Awards

- Received the Risk Assessment Analyst of the Year award for exceptional performance in identifying and mitigating financial risks.

- Recognized with the Excellence in Risk Management award for outstanding contributions to the organizations risk mitigation strategies.

- Received the Risk Management Leadership Award for exceptional guidance and mentorship in developing and executing risk management initiatives.

- Recognized for Outstanding Innovation in Risk Assessment for developing a proprietary methodology for quantifying operational risks.

Certificates

- Certified Risk Analyst (CRA)

- Certified Information Systems Auditor (CISA)

- Certified Internal Auditor (CIA)

- Certified Risk Manager (CRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Risk Assessment Analyst

- Quantify your accomplishments: Use specific metrics and data to demonstrate the impact of your work in risk assessment.

- Highlight your technical skills: Risk assessment analysts should be proficient in data analytics, predictive modeling, and other quantitative techniques.

- Demonstrate your understanding of regulatory requirements: Familiarity with industry regulations and standards is essential for risk assessment professionals.

- Emphasize your communication and interpersonal skills: Risk assessment analysts must be able to effectively communicate complex concepts to stakeholders.

Essential Experience Highlights for a Strong Risk Assessment Analyst Resume

- Developed and implemented risk assessment models for financial institutions to evaluate credit and operational risks.

- Performed due diligence reviews for mergers and acquisitions to identify and mitigate potential risks.

- Established risk management frameworks for organizations to enhance their resilience to threats.

- Assessed the effectiveness of internal controls and provided recommendations for improvements.

- Conducted risk audits to evaluate compliance with regulatory requirements and industry best practices.

- Developed risk mitigation plans to address identified threats and vulnerabilities.

- Led risk assessment projects from inception to completion, ensuring timely delivery of deliverables.

Frequently Asked Questions (FAQ’s) For Risk Assessment Analyst

What is the role of a Risk Assessment Analyst?

Risk Assessment Analysts identify, assess, and mitigate risks to an organization. They develop and implement risk assessment models, conduct due diligence reviews, and provide recommendations for risk management.

What are the key skills for a Risk Assessment Analyst?

Key skills include data analytics, predictive modeling, scenario planning, control assessment, and root cause analysis. Risk assessment analysts should also have a strong understanding of regulatory requirements and industry best practices.

What are the career prospects for a Risk Assessment Analyst?

Risk assessment analysts can advance to roles such as Risk Manager, Chief Risk Officer, or Compliance Officer. With experience, they can also move into consulting or academia.

What is the salary range for a Risk Assessment Analyst?

The salary range for risk assessment analysts varies depending on experience, location, and industry. According to Glassdoor, the average salary for a risk assessment analyst in the United States is $85,000 per year.

What are the educational requirements for a Risk Assessment Analyst?

Most risk assessment analysts have a bachelor’s or master’s degree in a field such as finance, economics, or risk management. Some employers may also require certification in risk management, such as the Certified Risk Analyst (CRA) certification.