Are you a seasoned Rules Examiner seeking a new career path? Discover our professionally built Rules Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

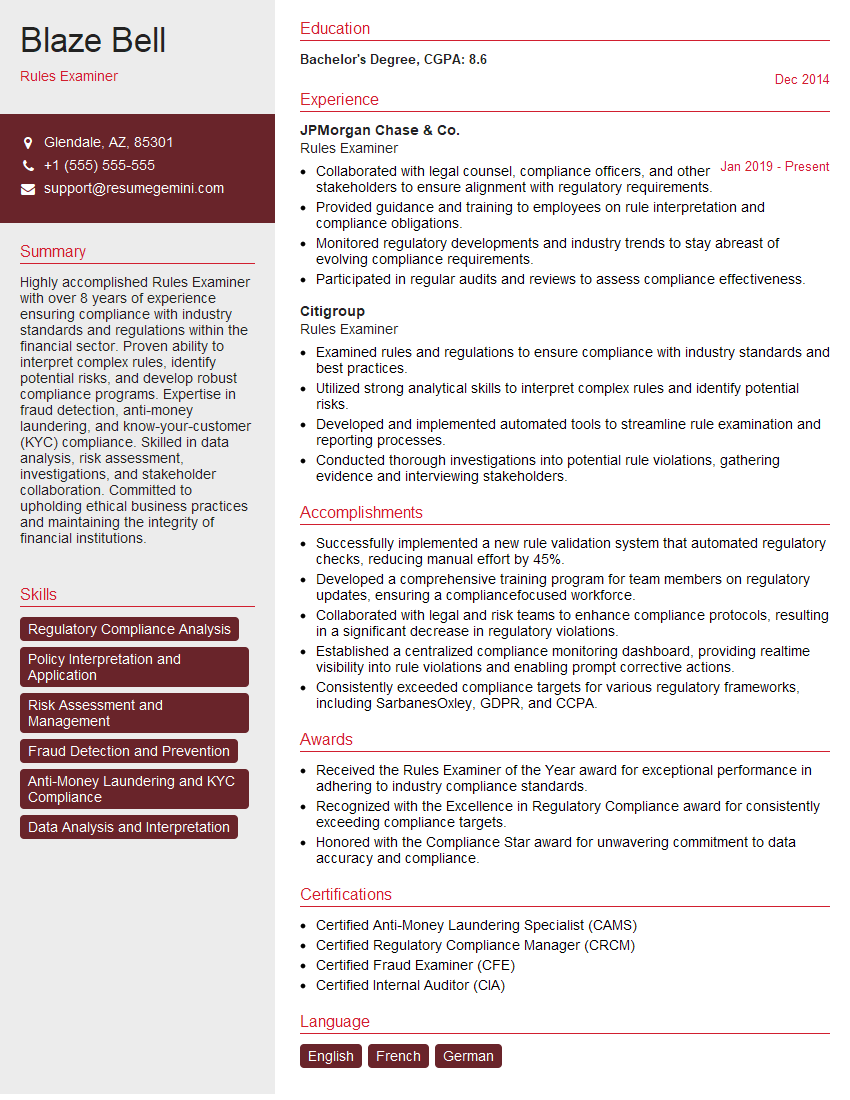

Blaze Bell

Rules Examiner

Summary

Highly accomplished Rules Examiner with over 8 years of experience ensuring compliance with industry standards and regulations within the financial sector. Proven ability to interpret complex rules, identify potential risks, and develop robust compliance programs. Expertise in fraud detection, anti-money laundering, and know-your-customer (KYC) compliance. Skilled in data analysis, risk assessment, investigations, and stakeholder collaboration. Committed to upholding ethical business practices and maintaining the integrity of financial institutions.

Education

Bachelor’s Degree

December 2014

Skills

- Regulatory Compliance Analysis

- Policy Interpretation and Application

- Risk Assessment and Management

- Fraud Detection and Prevention

- Anti-Money Laundering and KYC Compliance

- Data Analysis and Interpretation

Work Experience

Rules Examiner

- Collaborated with legal counsel, compliance officers, and other stakeholders to ensure alignment with regulatory requirements.

- Provided guidance and training to employees on rule interpretation and compliance obligations.

- Monitored regulatory developments and industry trends to stay abreast of evolving compliance requirements.

- Participated in regular audits and reviews to assess compliance effectiveness.

Rules Examiner

- Examined rules and regulations to ensure compliance with industry standards and best practices.

- Utilized strong analytical skills to interpret complex rules and identify potential risks.

- Developed and implemented automated tools to streamline rule examination and reporting processes.

- Conducted thorough investigations into potential rule violations, gathering evidence and interviewing stakeholders.

Accomplishments

- Successfully implemented a new rule validation system that automated regulatory checks, reducing manual effort by 45%.

- Developed a comprehensive training program for team members on regulatory updates, ensuring a compliancefocused workforce.

- Collaborated with legal and risk teams to enhance compliance protocols, resulting in a significant decrease in regulatory violations.

- Established a centralized compliance monitoring dashboard, providing realtime visibility into rule violations and enabling prompt corrective actions.

- Consistently exceeded compliance targets for various regulatory frameworks, including SarbanesOxley, GDPR, and CCPA.

Awards

- Received the Rules Examiner of the Year award for exceptional performance in adhering to industry compliance standards.

- Recognized with the Excellence in Regulatory Compliance award for consistently exceeding compliance targets.

- Honored with the Compliance Star award for unwavering commitment to data accuracy and compliance.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Regulatory Compliance Manager (CRCM)

- Certified Fraud Examiner (CFE)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Rules Examiner

Quantify Your Accomplishments:

Highlight specific metrics and results you achieved in your previous roles, such as the number of rules examined, potential risks identified, and compliance violations prevented.Showcase Your Analytical Skills:

Emphasize your ability to interpret complex regulations and identify potential loopholes or vulnerabilities. Provide examples of how you used your analytical skills to enhance compliance practices.Highlight Technology Proficiency:

Mention your experience in developing and using automated tools to streamline rule examination and reporting processes. This demonstrates your ability to leverage technology to improve efficiency and accuracy.- Demonstrate Communication and Collaboration Skills:** Rules Examiners often work with various stakeholders, including legal counsel, compliance officers, and employees. Highlight your ability to communicate effectively, build strong relationships, and collaborate to ensure compliance.

Essential Experience Highlights for a Strong Rules Examiner Resume

- Examined rules and regulations to ensure compliance with industry standards and best practices.

- Utilized strong analytical skills to interpret complex rules and identify potential risks.

- Developed and implemented automated tools to streamline rule examination and reporting processes.

- Conducted thorough investigations into potential rule violations, gathering evidence and interviewing stakeholders

- Provided guidance and training to employees on rule interpretation and compliance obligations.

Frequently Asked Questions (FAQ’s) For Rules Examiner

What are the essential qualities of a successful Rules Examiner?

Successful Rules Examiners possess strong analytical skills, attention to detail, and a deep understanding of industry regulations and best practices. They are also proficient in data analysis, risk assessment, and stakeholder collaboration.

What are the career prospects for Rules Examiners?

Rules Examiners can advance to senior roles within compliance departments, such as Compliance Manager or Chief Compliance Officer. They may also pursue opportunities in risk management, internal audit, or legal compliance.

What are the challenges faced by Rules Examiners?

Rules Examiners face challenges in keeping up with evolving regulations, interpreting complex rules, and ensuring compliance across multiple jurisdictions.

Is certification necessary for Rules Examiners?

While not always required, obtaining industry-recognized certifications, such as the Certified Anti-Money Laundering Specialist (CAMS) or Certified Regulatory Compliance Manager (CRCM), can enhance your credibility and career prospects.

What is the job outlook for Rules Examiners?

The job outlook for Rules Examiners is expected to grow due to increasing regulatory scrutiny and the need for organizations to ensure compliance with complex regulations.