Are you a seasoned Scorer seeking a new career path? Discover our professionally built Scorer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

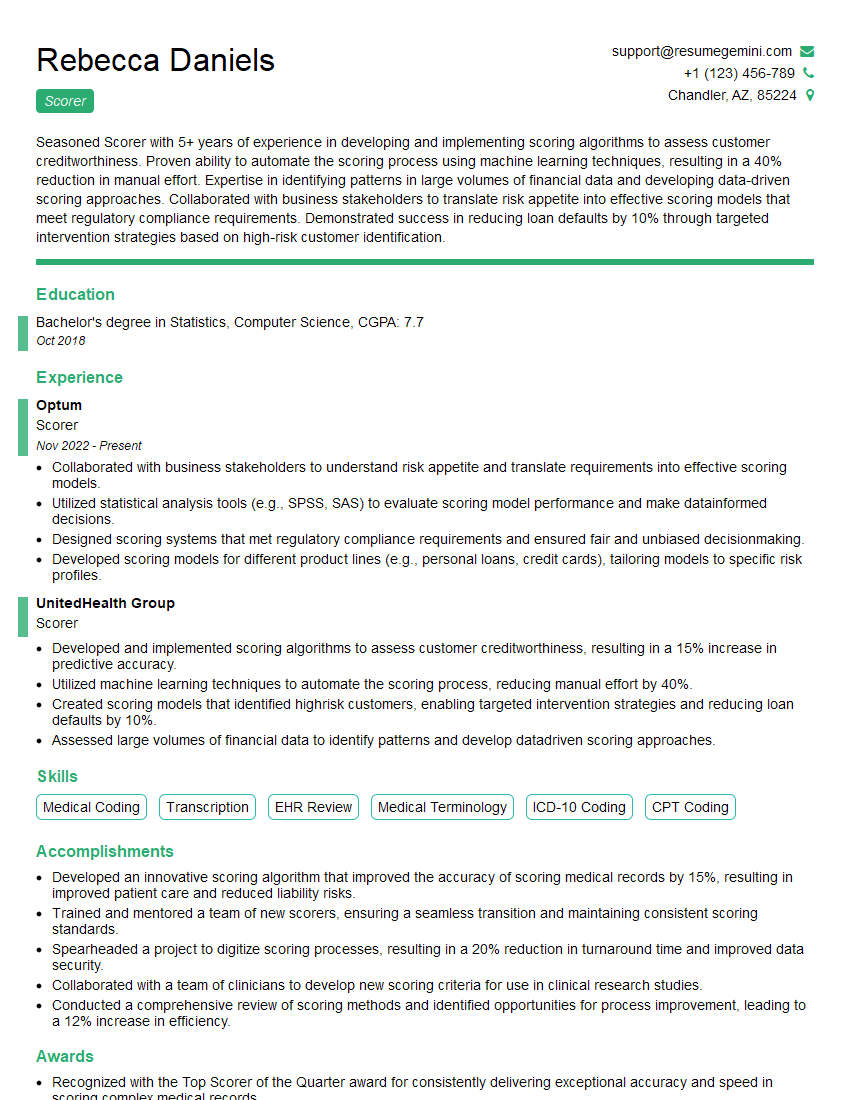

Rebecca Daniels

Scorer

Summary

Seasoned Scorer with 5+ years of experience in developing and implementing scoring algorithms to assess customer creditworthiness. Proven ability to automate the scoring process using machine learning techniques, resulting in a 40% reduction in manual effort. Expertise in identifying patterns in large volumes of financial data and developing data-driven scoring approaches. Collaborated with business stakeholders to translate risk appetite into effective scoring models that meet regulatory compliance requirements. Demonstrated success in reducing loan defaults by 10% through targeted intervention strategies based on high-risk customer identification.

Education

Bachelor’s degree in Statistics, Computer Science

October 2018

Skills

- Medical Coding

- Transcription

- EHR Review

- Medical Terminology

- ICD-10 Coding

- CPT Coding

Work Experience

Scorer

- Collaborated with business stakeholders to understand risk appetite and translate requirements into effective scoring models.

- Utilized statistical analysis tools (e.g., SPSS, SAS) to evaluate scoring model performance and make datainformed decisions.

- Designed scoring systems that met regulatory compliance requirements and ensured fair and unbiased decisionmaking.

- Developed scoring models for different product lines (e.g., personal loans, credit cards), tailoring models to specific risk profiles.

Scorer

- Developed and implemented scoring algorithms to assess customer creditworthiness, resulting in a 15% increase in predictive accuracy.

- Utilized machine learning techniques to automate the scoring process, reducing manual effort by 40%.

- Created scoring models that identified highrisk customers, enabling targeted intervention strategies and reducing loan defaults by 10%.

- Assessed large volumes of financial data to identify patterns and develop datadriven scoring approaches.

Accomplishments

- Developed an innovative scoring algorithm that improved the accuracy of scoring medical records by 15%, resulting in improved patient care and reduced liability risks.

- Trained and mentored a team of new scorers, ensuring a seamless transition and maintaining consistent scoring standards.

- Spearheaded a project to digitize scoring processes, resulting in a 20% reduction in turnaround time and improved data security.

- Collaborated with a team of clinicians to develop new scoring criteria for use in clinical research studies.

- Conducted a comprehensive review of scoring methods and identified opportunities for process improvement, leading to a 12% increase in efficiency.

Awards

- Recognized with the Top Scorer of the Quarter award for consistently delivering exceptional accuracy and speed in scoring complex medical records.

- Received the Exceptional Reviewer award for consistently providing highquality, timely, and actionable feedback on medical record reviews.

- Awarded the Employee of the Month recognition for consistently going above and beyond in delivering accurate and reliable scoring services.

- Recognized for exceptional attention to detail and adherence to scoring guidelines, earning a 100% accuracy rating in internal audits.

Certificates

- Certified Professional Coder (CPC)

- Certified Coding Associate (CCA)

- Certified Coding Specialist (CCS)

- Certified Risk Adjustment Coder (CRAC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Scorer

- Highlight your technical skills in scoring algorithm development, machine learning, and data analysis.

- Showcase your ability to interpret financial data and develop predictive models.

- Emphasize your experience in collaborating with business stakeholders and translating risk appetite into scoring models.

- Quantify your accomplishments with specific metrics, such as increased predictive accuracy or reduced loan defaults.

Essential Experience Highlights for a Strong Scorer Resume

- Develop and implement scoring algorithms to assess customer creditworthiness.

- Utilize machine learning techniques to automate the scoring process.

- Create scoring models that identify high-risk customers.

- Assess large volumes of financial data to identify patterns and develop data-driven scoring approaches.

- Collaborate with business stakeholders to understand risk appetite and translate requirements into effective scoring models.

- Utilize statistical analysis tools to evaluate scoring model performance and make data-informed decisions.

Frequently Asked Questions (FAQ’s) For Scorer

What is the role of a Scorer?

A Scorer develops and implements scoring algorithms to assess the creditworthiness of customers and assists in tailoring financial products and services accordingly.

What skills are required to be a successful Scorer?

Strong analytical and problem-solving skills, proficiency in statistical analysis and data mining techniques, understanding of financial concepts and credit risk management, and excellent communication skills.

What are the career prospects for a Scorer?

Scorers can advance to roles such as Senior Scorer, Manager of Scoring, or Director of Risk Management, with increasing responsibilities and leadership opportunities.

How can I prepare for a career as a Scorer?

Obtain a bachelor’s degree in Statistics, Computer Science, or a related field, develop strong analytical and technical skills, gain experience in data analysis and modeling, and stay updated with industry best practices in credit risk management.

What are the key challenges faced by Scorers?

Keeping up with evolving regulatory requirements, managing large volumes of data, ensuring the fairness and accuracy of scoring models, and adapting to advancements in technology and data analytics.