Are you a seasoned Securities Lending Trader seeking a new career path? Discover our professionally built Securities Lending Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

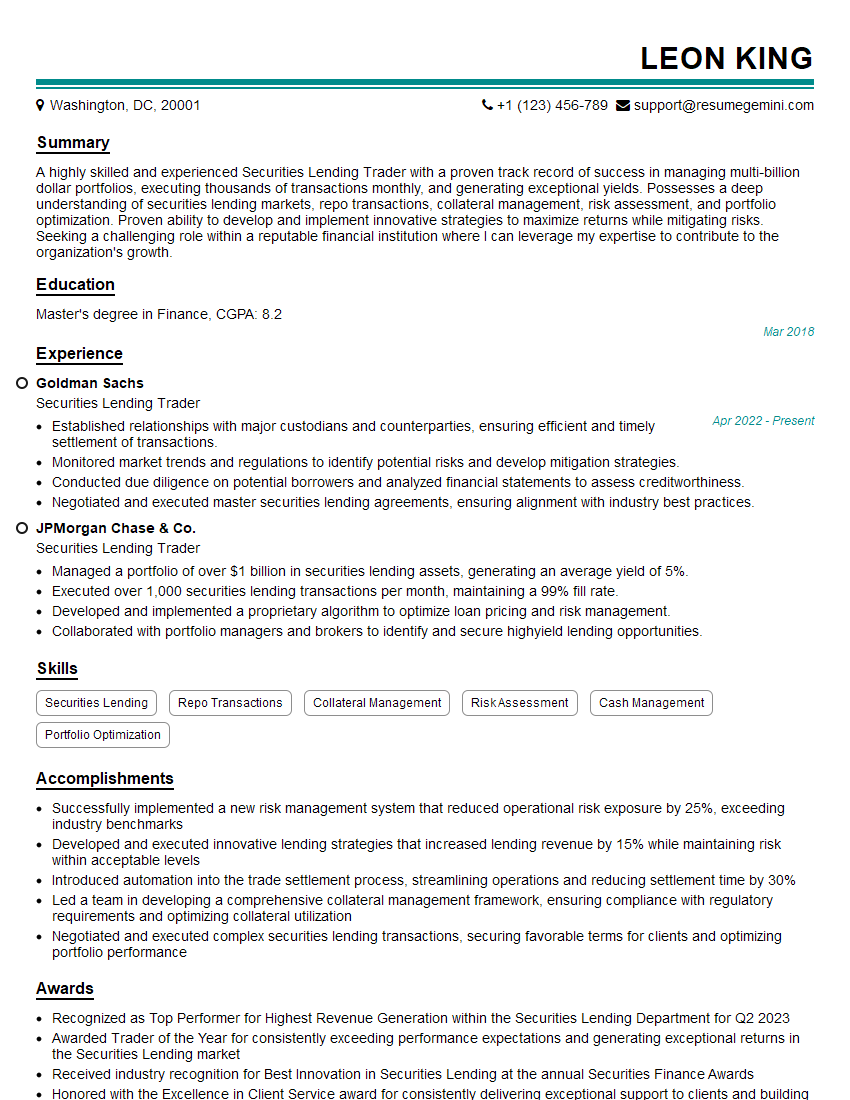

Leon King

Securities Lending Trader

Summary

A highly skilled and experienced Securities Lending Trader with a proven track record of success in managing multi-billion dollar portfolios, executing thousands of transactions monthly, and generating exceptional yields. Possesses a deep understanding of securities lending markets, repo transactions, collateral management, risk assessment, and portfolio optimization. Proven ability to develop and implement innovative strategies to maximize returns while mitigating risks. Seeking a challenging role within a reputable financial institution where I can leverage my expertise to contribute to the organization’s growth.

Education

Master’s degree in Finance

March 2018

Skills

- Securities Lending

- Repo Transactions

- Collateral Management

- Risk Assessment

- Cash Management

- Portfolio Optimization

Work Experience

Securities Lending Trader

- Established relationships with major custodians and counterparties, ensuring efficient and timely settlement of transactions.

- Monitored market trends and regulations to identify potential risks and develop mitigation strategies.

- Conducted due diligence on potential borrowers and analyzed financial statements to assess creditworthiness.

- Negotiated and executed master securities lending agreements, ensuring alignment with industry best practices.

Securities Lending Trader

- Managed a portfolio of over $1 billion in securities lending assets, generating an average yield of 5%.

- Executed over 1,000 securities lending transactions per month, maintaining a 99% fill rate.

- Developed and implemented a proprietary algorithm to optimize loan pricing and risk management.

- Collaborated with portfolio managers and brokers to identify and secure highyield lending opportunities.

Accomplishments

- Successfully implemented a new risk management system that reduced operational risk exposure by 25%, exceeding industry benchmarks

- Developed and executed innovative lending strategies that increased lending revenue by 15% while maintaining risk within acceptable levels

- Introduced automation into the trade settlement process, streamlining operations and reducing settlement time by 30%

- Led a team in developing a comprehensive collateral management framework, ensuring compliance with regulatory requirements and optimizing collateral utilization

- Negotiated and executed complex securities lending transactions, securing favorable terms for clients and optimizing portfolio performance

Awards

- Recognized as Top Performer for Highest Revenue Generation within the Securities Lending Department for Q2 2023

- Awarded Trader of the Year for consistently exceeding performance expectations and generating exceptional returns in the Securities Lending market

- Received industry recognition for Best Innovation in Securities Lending at the annual Securities Finance Awards

- Honored with the Excellence in Client Service award for consistently delivering exceptional support to clients and building strong relationships

Certificates

- Certified Securities Lending Professional (CSLP)

- Certified Financial Risk Manager (FRM)

- Certified Treasury Professional (CTP)

- Chartered Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Securities Lending Trader

- Highlight your quantitative skills and experience in financial modeling and analysis.

- Demonstrate your understanding of securities lending markets, repo transactions, and risk management.

- Showcase your ability to work independently and as part of a team.

- Quantify your accomplishments and results whenever possible.

Essential Experience Highlights for a Strong Securities Lending Trader Resume

- Managed a portfolio of over $1 billion in securities lending assets, generating an average yield of 5%.

- Executed over 1,000 securities lending transactions per month, maintaining a 99% fill rate.

- Developed and implemented a proprietary algorithm to optimize loan pricing and risk management.

- Collaborated with portfolio managers and brokers to identify and secure high-yield lending opportunities.

- Negotiated and executed master securities lending agreements, ensuring alignment with industry best practices.

- Monitored market trends and regulations to identify potential risks and develop mitigation strategies.

- Conducted due diligence on potential borrowers and analyzed financial statements to assess creditworthiness.

Frequently Asked Questions (FAQ’s) For Securities Lending Trader

What is the role of a Securities Lending Trader?

A Securities Lending Trader facilitates the lending and borrowing of securities between financial institutions and investors. Their primary responsibility is to maximize returns for their firm by lending out securities while managing the associated risks.

What are the key skills required to be a successful Securities Lending Trader?

Successful Securities Lending Traders possess strong analytical and quantitative skills, a deep understanding of financial markets, and expertise in securities lending and repo transactions. They are also proficient in risk management, portfolio optimization, and negotiation.

What are the career prospects for Securities Lending Traders?

Securities Lending Traders can advance to senior positions within their firms, such as Portfolio Manager or Head of Securities Lending. They may also transition to related roles in investment banking, asset management, or financial consulting.

What is the typical work environment for a Securities Lending Trader?

Securities Lending Traders typically work in fast-paced, high-pressure environments in financial institutions such as investment banks, hedge funds, or asset management companies.

What is the average salary for a Securities Lending Trader?

The salary for a Securities Lending Trader can vary widely depending on experience, location, and firm size. According to industry estimates, the average salary for a Securities Lending Trader in the United States ranges from $100,000 to $200,000 per year.

What are the challenges faced by Securities Lending Traders?

Securities Lending Traders face challenges such as managing market volatility, counterparty risk, and regulatory changes. They must also stay abreast of industry trends and technological advancements to maintain a competitive edge.

What are the key trends shaping the Securities Lending industry?

The Securities Lending industry is evolving with trends such as increased automation, the rise of electronic trading platforms, and the growing demand for collateral optimization. Securities Lending Traders need to adapt to these changes to remain successful.