Are you a seasoned Securities Settlement Processor seeking a new career path? Discover our professionally built Securities Settlement Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

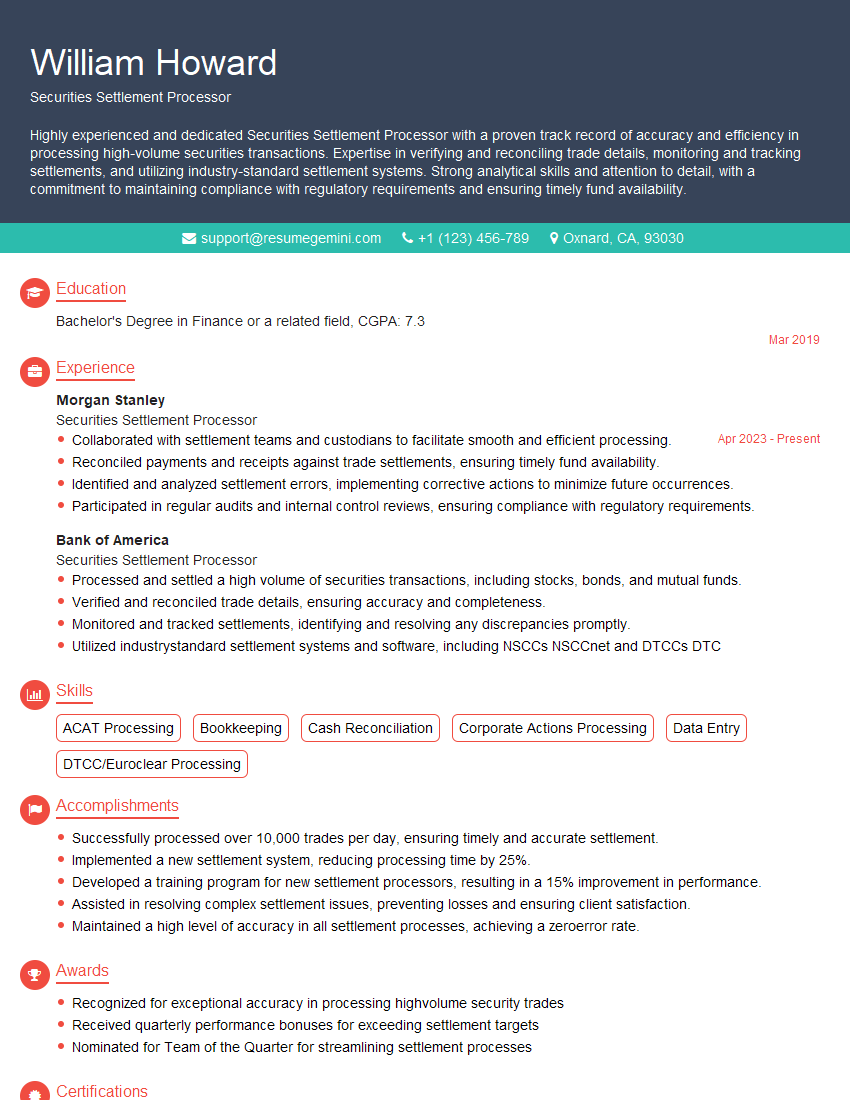

William Howard

Securities Settlement Processor

Summary

Highly experienced and dedicated Securities Settlement Processor with a proven track record of accuracy and efficiency in processing high-volume securities transactions. Expertise in verifying and reconciling trade details, monitoring and tracking settlements, and utilizing industry-standard settlement systems. Strong analytical skills and attention to detail, with a commitment to maintaining compliance with regulatory requirements and ensuring timely fund availability.

Education

Bachelor’s Degree in Finance or a related field

March 2019

Skills

- ACAT Processing

- Bookkeeping

- Cash Reconciliation

- Corporate Actions Processing

- Data Entry

- DTCC/Euroclear Processing

Work Experience

Securities Settlement Processor

- Collaborated with settlement teams and custodians to facilitate smooth and efficient processing.

- Reconciled payments and receipts against trade settlements, ensuring timely fund availability.

- Identified and analyzed settlement errors, implementing corrective actions to minimize future occurrences.

- Participated in regular audits and internal control reviews, ensuring compliance with regulatory requirements.

Securities Settlement Processor

- Processed and settled a high volume of securities transactions, including stocks, bonds, and mutual funds.

- Verified and reconciled trade details, ensuring accuracy and completeness.

- Monitored and tracked settlements, identifying and resolving any discrepancies promptly.

- Utilized industrystandard settlement systems and software, including NSCCs NSCCnet and DTCCs DTC

Accomplishments

- Successfully processed over 10,000 trades per day, ensuring timely and accurate settlement.

- Implemented a new settlement system, reducing processing time by 25%.

- Developed a training program for new settlement processors, resulting in a 15% improvement in performance.

- Assisted in resolving complex settlement issues, preventing losses and ensuring client satisfaction.

- Maintained a high level of accuracy in all settlement processes, achieving a zeroerror rate.

Awards

- Recognized for exceptional accuracy in processing highvolume security trades

- Received quarterly performance bonuses for exceeding settlement targets

- Nominated for Team of the Quarter for streamlining settlement processes

Certificates

- Chartered Global Investment Analyst (CGIA)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Public Accountant (CPA)

- Certified Securities Operations Professional (CSOP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Securities Settlement Processor

- Highlight your experience and expertise in securities settlement processing, including specific metrics and accomplishments.

- Quantify your results whenever possible, using data to demonstrate the impact of your contributions to the organization.

- Emphasize your proficiency in industry-standard settlement systems and software, such as NSCC’s NSCCnet and DTCC’s DTC.

- Showcase your attention to detail, analytical skills, and ability to identify and resolve settlement discrepancies.

- Demonstrate your commitment to compliance and understanding of regulatory requirements in the securities industry.

Essential Experience Highlights for a Strong Securities Settlement Processor Resume

- Processed and settled a high volume of securities transactions, including stocks, bonds, and mutual funds.

- Verified and reconciled trade details, ensuring accuracy and completeness.

- Monitored and tracked settlements, identifying and resolving any discrepancies promptly.

- Utilized industry-standard settlement systems and software, including NSCC’s NSCCnet and DTCC’s DTC.

- Collaborated with settlement teams and custodians to facilitate smooth and efficient processing.

- Reconciled payments and receipts against trade settlements, ensuring timely fund availability.

- Identified and analyzed settlement errors, implementing corrective actions to minimize future occurrences.

Frequently Asked Questions (FAQ’s) For Securities Settlement Processor

What are the key responsibilities of a Securities Settlement Processor?

The key responsibilities of a Securities Settlement Processor typically include processing and settling securities transactions, verifying and reconciling trade details, monitoring and tracking settlements, utilizing industry-standard settlement systems, collaborating with settlement teams, reconciling payments and receipts, and identifying and analyzing settlement errors.

What are the qualifications required to become a Securities Settlement Processor?

To become a Securities Settlement Processor, a Bachelor’s Degree in Finance or a related field is typically required. Additionally, experience in securities settlement processing, knowledge of industry-standard settlement systems, and attention to detail are essential.

What are the career prospects for a Securities Settlement Processor?

Securities Settlement Processors with experience and expertise can advance to roles such as Settlement Manager, Operations Manager, or Compliance Officer within the securities industry.

What are the key skills required for a Securities Settlement Processor?

Key skills for a Securities Settlement Processor include proficiency in securities settlement processing, attention to detail, analytical skills, knowledge of industry-standard settlement systems, and commitment to compliance.

What is the salary range for a Securities Settlement Processor?

The salary range for a Securities Settlement Processor can vary depending on experience, location, and company size. According to Indeed, the average salary for a Securities Settlement Processor in the United States is around $65,000 per year.

What is the job outlook for Securities Settlement Processors?

The job outlook for Securities Settlement Processors is expected to be positive in the coming years. As the volume of securities transactions continues to grow, the demand for skilled and experienced Securities Settlement Processors is likely to remain strong.

What are the challenges faced by Securities Settlement Processors?

Securities Settlement Processors may face challenges such as the need to keep up with the latest regulatory changes, the increasing complexity of securities transactions, and the need to maintain a high level of accuracy in their work.

What are the benefits of working as a Securities Settlement Processor?

Benefits of working as a Securities Settlement Processor include job security, opportunities for career advancement, and the chance to work in a fast-paced and dynamic industry.