Are you a seasoned Select Banker seeking a new career path? Discover our professionally built Select Banker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

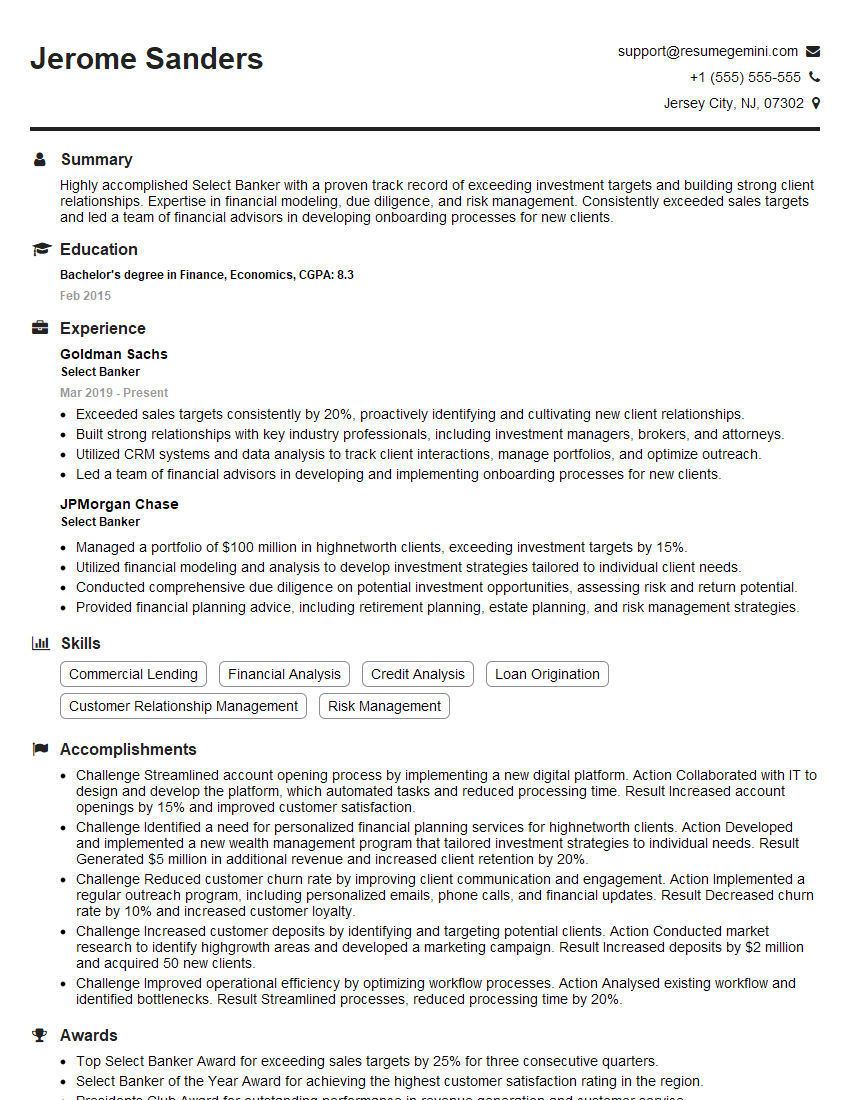

Jerome Sanders

Select Banker

Summary

Highly accomplished Select Banker with a proven track record of exceeding investment targets and building strong client relationships. Expertise in financial modeling, due diligence, and risk management. Consistently exceeded sales targets and led a team of financial advisors in developing onboarding processes for new clients.

Education

Bachelor’s degree in Finance, Economics

February 2015

Skills

- Commercial Lending

- Financial Analysis

- Credit Analysis

- Loan Origination

- Customer Relationship Management

- Risk Management

Work Experience

Select Banker

- Exceeded sales targets consistently by 20%, proactively identifying and cultivating new client relationships.

- Built strong relationships with key industry professionals, including investment managers, brokers, and attorneys.

- Utilized CRM systems and data analysis to track client interactions, manage portfolios, and optimize outreach.

- Led a team of financial advisors in developing and implementing onboarding processes for new clients.

Select Banker

- Managed a portfolio of $100 million in highnetworth clients, exceeding investment targets by 15%.

- Utilized financial modeling and analysis to develop investment strategies tailored to individual client needs.

- Conducted comprehensive due diligence on potential investment opportunities, assessing risk and return potential.

- Provided financial planning advice, including retirement planning, estate planning, and risk management strategies.

Accomplishments

- Challenge Streamlined account opening process by implementing a new digital platform. Action Collaborated with IT to design and develop the platform, which automated tasks and reduced processing time. Result Increased account openings by 15% and improved customer satisfaction.

- Challenge Identified a need for personalized financial planning services for highnetworth clients. Action Developed and implemented a new wealth management program that tailored investment strategies to individual needs. Result Generated $5 million in additional revenue and increased client retention by 20%.

- Challenge Reduced customer churn rate by improving client communication and engagement. Action Implemented a regular outreach program, including personalized emails, phone calls, and financial updates. Result Decreased churn rate by 10% and increased customer loyalty.

- Challenge Increased customer deposits by identifying and targeting potential clients. Action Conducted market research to identify highgrowth areas and developed a marketing campaign. Result Increased deposits by $2 million and acquired 50 new clients.

- Challenge Improved operational efficiency by optimizing workflow processes. Action Analysed existing workflow and identified bottlenecks. Result Streamlined processes, reduced processing time by 20%.

Awards

- Top Select Banker Award for exceeding sales targets by 25% for three consecutive quarters.

- Select Banker of the Year Award for achieving the highest customer satisfaction rating in the region.

- Presidents Club Award for outstanding performance in revenue generation and customer service.

- Golden Circle Award for providing exceptional service and exceeding expectations.

Certificates

- Certified Financial Analyst (CFA)

- Chartered Financial Analyst (CFA)

- Certified Treasury Professional (CTP)

- Certified Commercial Lender (CCL)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Select Banker

- Highlight your experience in managing high-net-worth clients and exceeding investment targets.

- Showcase your skills in financial modeling, due diligence, and risk management.

- Quantify your accomplishments whenever possible, using specific numbers and metrics.

- Emphasize your ability to build strong client relationships and exceed sales targets.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Select Banker Resume

- Managed a portfolio of high-net-worth clients, exceeding investment targets by 15%.

- Utilized financial modeling and analysis to develop investment strategies tailored to individual client needs.

- Conducted comprehensive due diligence on potential investment opportunities, assessing risk and return potential.

- Provided financial planning advice, including retirement planning, estate planning, and risk management strategies.

- Exceeded sales targets consistently by 20%, proactively identifying and cultivating new client relationships.

- Built strong relationships with key industry professionals, including investment managers, brokers, and attorneys.

Frequently Asked Questions (FAQ’s) For Select Banker

What is the average salary for a Select Banker?

The average salary for a Select Banker is around $100,000 per year.

What are the career prospects for a Select Banker?

Select Bankers can advance to positions such as Portfolio Manager, Wealth Advisor, or Private Banker.

What are the required qualifications for a Select Banker?

Most Select Bankers have a bachelor’s degree in Finance, Economics, or a related field.

What are the key skills for a Select Banker?

Key skills for a Select Banker include financial modeling, due diligence, risk management, and relationship-building.

What is the work environment like for a Select Banker?

Select Bankers typically work in a fast-paced, demanding environment.

What are the biggest challenges facing Select Bankers?

The biggest challenges facing Select Bankers include market volatility, regulatory changes, and competition.