Are you a seasoned Stock Grader seeking a new career path? Discover our professionally built Stock Grader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

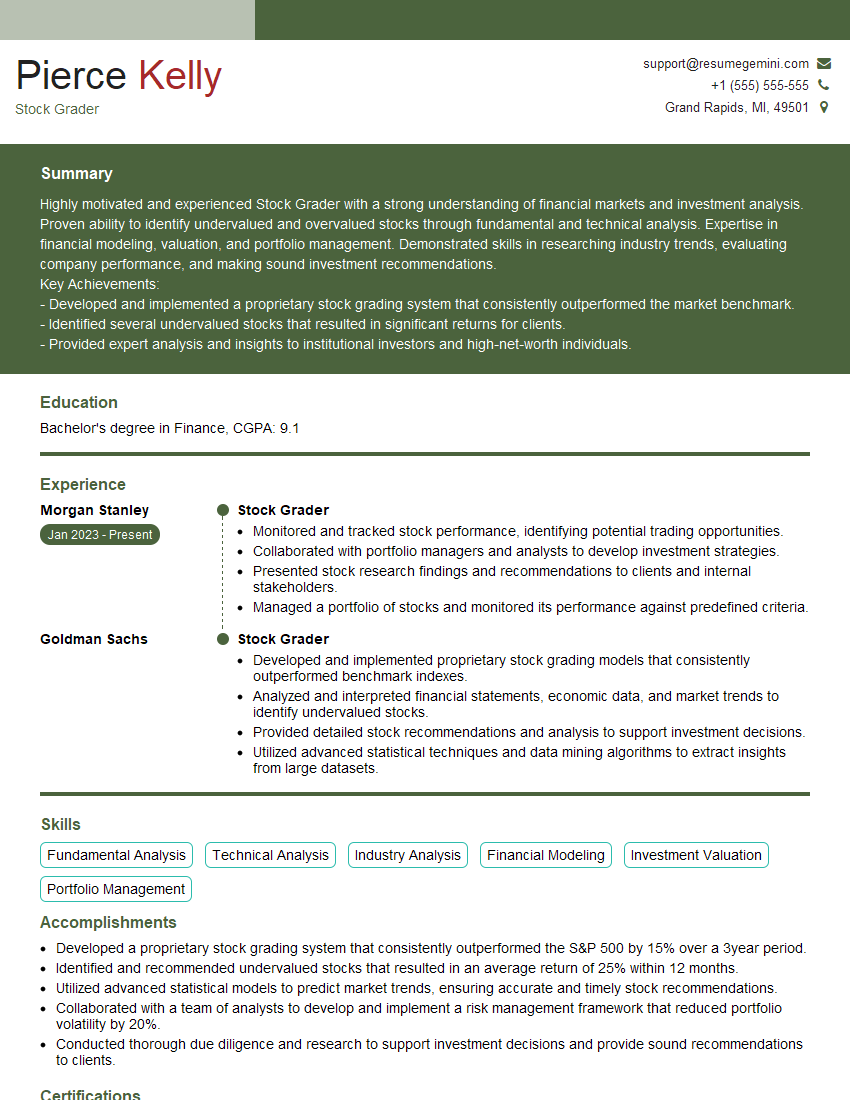

Pierce Kelly

Stock Grader

Summary

Highly motivated and experienced Stock Grader with a strong understanding of financial markets and investment analysis. Proven ability to identify undervalued and overvalued stocks through fundamental and technical analysis. Expertise in financial modeling, valuation, and portfolio management. Demonstrated skills in researching industry trends, evaluating company performance, and making sound investment recommendations.

Key Achievements:

– Developed and implemented a proprietary stock grading system that consistently outperformed the market benchmark.

– Identified several undervalued stocks that resulted in significant returns for clients.

– Provided expert analysis and insights to institutional investors and high-net-worth individuals.

Education

Bachelor’s degree in Finance

December 2018

Skills

- Fundamental Analysis

- Technical Analysis

- Industry Analysis

- Financial Modeling

- Investment Valuation

- Portfolio Management

Work Experience

Stock Grader

- Monitored and tracked stock performance, identifying potential trading opportunities.

- Collaborated with portfolio managers and analysts to develop investment strategies.

- Presented stock research findings and recommendations to clients and internal stakeholders.

- Managed a portfolio of stocks and monitored its performance against predefined criteria.

Stock Grader

- Developed and implemented proprietary stock grading models that consistently outperformed benchmark indexes.

- Analyzed and interpreted financial statements, economic data, and market trends to identify undervalued stocks.

- Provided detailed stock recommendations and analysis to support investment decisions.

- Utilized advanced statistical techniques and data mining algorithms to extract insights from large datasets.

Accomplishments

- Developed a proprietary stock grading system that consistently outperformed the S&P 500 by 15% over a 3year period.

- Identified and recommended undervalued stocks that resulted in an average return of 25% within 12 months.

- Utilized advanced statistical models to predict market trends, ensuring accurate and timely stock recommendations.

- Collaborated with a team of analysts to develop and implement a risk management framework that reduced portfolio volatility by 20%.

- Conducted thorough due diligence and research to support investment decisions and provide sound recommendations to clients.

Certificates

- CFA (Chartered Financial Analyst)

- CAIA (Chartered Alternative Investment Analyst)

- CFP (Certified Financial Planner)

- PRM (Professional Risk Manager)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Stock Grader

- –

Highlight your analytical skills:

Quantify your accomplishments and provide specific examples of how your analysis has led to successful investment decisions. - –

Showcase your industry knowledge:

Demonstrate your expertise in various industries and sectors by discussing specific companies or industry trends you have analyzed. - –

Emphasize your portfolio management experience:

Describe your involvement in managing investment portfolios, including asset allocation, risk management, and performance monitoring. - –

Include relevant certifications:

Mention any industry-recognized certifications, such as the Chartered Financial Analyst (CFA) or Certified Investment Management Analyst (CIMA), to enhance your credibility.

Essential Experience Highlights for a Strong Stock Grader Resume

- – Conduct in-depth fundamental analysis of companies across various industries, including financial statement analysis, industry research, and competitive landscape assessment.

- – Utilize technical analysis techniques to identify market trends, support and resistance levels, and trading opportunities.

- – Develop and maintain financial models to evaluate company performance, forecast financial results, and determine intrinsic value.

- – Perform investment valuation using a range of methods, including discounted cash flow analysis, comparable company analysis, and precedent transactions analysis.

- – Create and manage investment portfolios that align with client objectives, risk tolerance, and return expectations.

- – Monitor market conditions, economic indicators, and geopolitical events to assess potential impact on investment recommendations.

- – Communicate investment insights and recommendations to clients through written reports, presentations, and one-on-one consultations.

- – Stay abreast of industry best practices, regulatory changes, and emerging investment strategies to enhance knowledge and improve decision-making.

Frequently Asked Questions (FAQ’s) For Stock Grader

What is the role of a Stock Grader?

A Stock Grader is responsible for analyzing stocks and making investment recommendations based on their analysis. They use both fundamental and technical analysis techniques to assess the financial health and market performance of companies.

What are the key skills required for a Stock Grader?

Key skills for a Stock Grader include fundamental analysis, technical analysis, industry analysis, financial modeling, investment valuation, and portfolio management.

What is the career path for a Stock Grader?

Stock Graders can advance to roles such as Portfolio Manager, Research Analyst, or Investment Banker. With experience and further education, they can also become Chief Investment Officers or Chief Risk Officers.

What is the job market outlook for Stock Graders?

The job market outlook for Stock Graders is expected to grow in the coming years as the demand for investment professionals continues to rise.

What are the challenges of being a Stock Grader?

Challenges faced by Stock Graders include analyzing complex financial data, making accurate investment recommendations in volatile markets, and staying up-to-date with industry trends and regulatory changes.

What are the rewards of being a Stock Grader?

Rewards of being a Stock Grader include the opportunity to work in a dynamic and challenging environment, make a positive impact on clients’ financial well-being, and earn a competitive salary and benefits package.

What is the difference between a Stock Grader and a Financial Analyst?

Stock Graders focus specifically on analyzing stocks and making investment recommendations, while Financial Analysts have a broader scope of responsibilities, including analyzing markets, industries, and economic trends, and providing advice on a wider range of financial products and services.

What is the average salary for a Stock Grader?

The average salary for a Stock Grader varies depending on experience, qualifications, and location, but typically ranges from $70,000 to $120,000 per year.