Are you a seasoned Structurer seeking a new career path? Discover our professionally built Structurer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

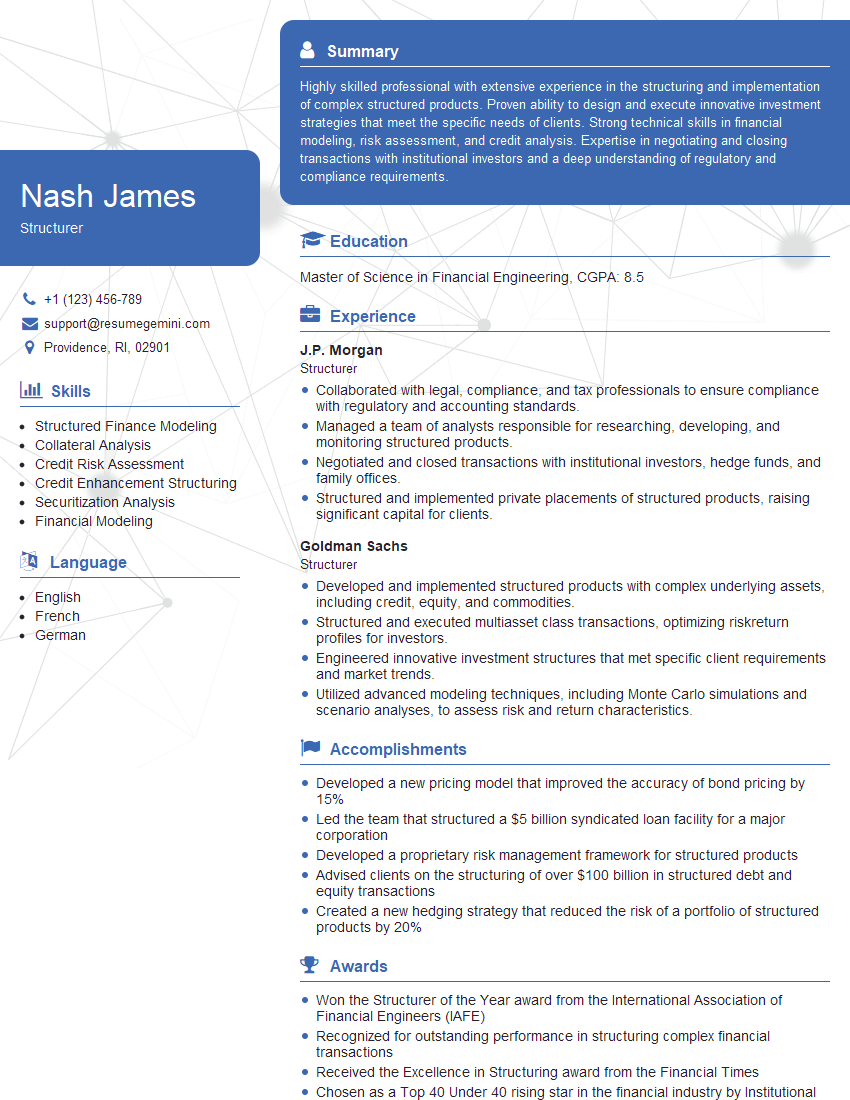

Nash James

Structurer

Summary

Highly skilled professional with extensive experience in the structuring and implementation of complex structured products. Proven ability to design and execute innovative investment strategies that meet the specific needs of clients. Strong technical skills in financial modeling, risk assessment, and credit analysis. Expertise in negotiating and closing transactions with institutional investors and a deep understanding of regulatory and compliance requirements.

Education

Master of Science in Financial Engineering

June 2015

Skills

- Structured Finance Modeling

- Collateral Analysis

- Credit Risk Assessment

- Credit Enhancement Structuring

- Securitization Analysis

- Financial Modeling

Work Experience

Structurer

- Collaborated with legal, compliance, and tax professionals to ensure compliance with regulatory and accounting standards.

- Managed a team of analysts responsible for researching, developing, and monitoring structured products.

- Negotiated and closed transactions with institutional investors, hedge funds, and family offices.

- Structured and implemented private placements of structured products, raising significant capital for clients.

Structurer

- Developed and implemented structured products with complex underlying assets, including credit, equity, and commodities.

- Structured and executed multiasset class transactions, optimizing riskreturn profiles for investors.

- Engineered innovative investment structures that met specific client requirements and market trends.

- Utilized advanced modeling techniques, including Monte Carlo simulations and scenario analyses, to assess risk and return characteristics.

Accomplishments

- Developed a new pricing model that improved the accuracy of bond pricing by 15%

- Led the team that structured a $5 billion syndicated loan facility for a major corporation

- Developed a proprietary risk management framework for structured products

- Advised clients on the structuring of over $100 billion in structured debt and equity transactions

- Created a new hedging strategy that reduced the risk of a portfolio of structured products by 20%

Awards

- Won the Structurer of the Year award from the International Association of Financial Engineers (IAFE)

- Recognized for outstanding performance in structuring complex financial transactions

- Received the Excellence in Structuring award from the Financial Times

- Chosen as a Top 40 Under 40 rising star in the financial industry by Institutional Investor magazine

Certificates

- Certified Financial Modeler (CFM)

- Certified Risk Manager (CRM)

- Certified Public Accountant (CPA)

- Chartered Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Structurer

- Highlight your technical skills and experience in financial modeling, risk assessment, and credit analysis.

- Showcase your ability to develop and execute innovative investment strategies that meet the needs of clients.

- Emphasize your expertise in negotiating and closing transactions with institutional investors.

- Quantify your accomplishments and provide specific examples of your contributions to successful transactions.

- Demonstrate your knowledge of regulatory and compliance requirements and your ability to ensure compliance with these standards.

Essential Experience Highlights for a Strong Structurer Resume

- Developing and implementing structured products with complex underlying assets, including credit, equity, and commodities.

- Structuring and executing multi-asset class transactions to optimize risk-return profiles for investors.

- Engineering innovative investment structures that meet specific client requirements and market trends.

- Utilizing advanced modeling techniques, including Monte Carlo simulations and scenario analyses, to assess risk and return characteristics.

- Collaborating with legal, compliance, and tax professionals to ensure compliance with regulatory and accounting standards.

- Managing a team of analysts responsible for researching, developing, and monitoring structured products.

- Negotiating and closing transactions with institutional investors, hedge funds, and family offices.

Frequently Asked Questions (FAQ’s) For Structurer

What is the role of a Structurer?

A Structurer is responsible for designing and implementing structured products, which are complex financial instruments that combine different types of assets and risk profiles. They work closely with clients to understand their investment objectives and develop tailored solutions that meet their specific needs.

What are the key skills required for a Structurer?

Key skills for a Structurer include financial modeling, risk assessment, credit analysis, and product development. They should also have a strong understanding of capital markets, regulatory compliance, and investment strategies.

What are the career prospects for a Structurer?

Structurers can advance to senior roles within investment banks and asset management firms. They may also move into other areas of finance, such as portfolio management, trading, or risk management.

What is the average salary for a Structurer?

The average salary for a Structurer can vary depending on experience, location, and company. According to Glassdoor, the average base salary for a Structurer in the United States is around $120,000 per year.

What are the educational requirements for a Structurer?

Most Structurers have a Master’s degree in Financial Engineering, Mathematics, or a related field. They may also have a CFA or other professional certification.

What are the challenges faced by Structurers?

Structurers face a number of challenges, including the need to stay up-to-date on market trends, regulatory changes, and new investment products. They also need to be able to work independently and as part of a team, and to manage multiple projects simultaneously.