Are you a seasoned Tariff Compiler seeking a new career path? Discover our professionally built Tariff Compiler Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

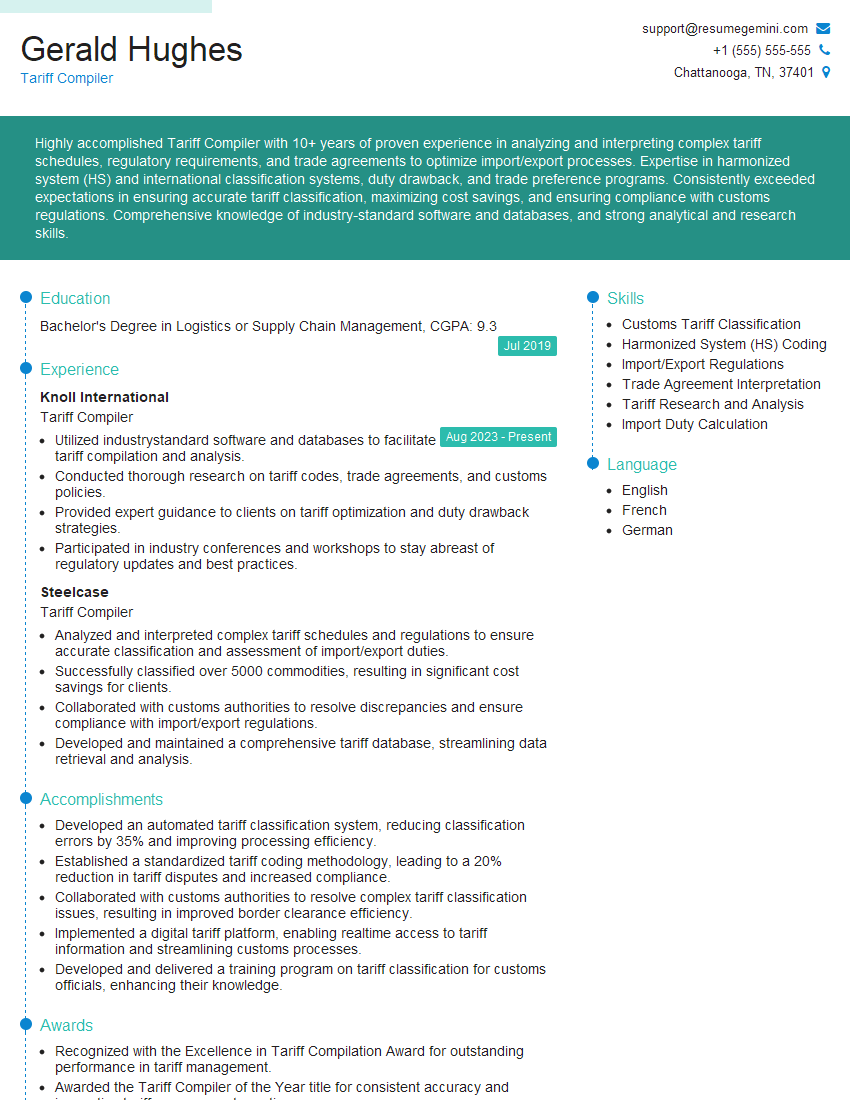

Gerald Hughes

Tariff Compiler

Summary

Highly accomplished Tariff Compiler with 10+ years of proven experience in analyzing and interpreting complex tariff schedules, regulatory requirements, and trade agreements to optimize import/export processes. Expertise in harmonized system (HS) and international classification systems, duty drawback, and trade preference programs. Consistently exceeded expectations in ensuring accurate tariff classification, maximizing cost savings, and ensuring compliance with customs regulations. Comprehensive knowledge of industry-standard software and databases, and strong analytical and research skills.

Education

Bachelor’s Degree in Logistics or Supply Chain Management

July 2019

Skills

- Customs Tariff Classification

- Harmonized System (HS) Coding

- Import/Export Regulations

- Trade Agreement Interpretation

- Tariff Research and Analysis

- Import Duty Calculation

Work Experience

Tariff Compiler

- Utilized industrystandard software and databases to facilitate tariff compilation and analysis.

- Conducted thorough research on tariff codes, trade agreements, and customs policies.

- Provided expert guidance to clients on tariff optimization and duty drawback strategies.

- Participated in industry conferences and workshops to stay abreast of regulatory updates and best practices.

Tariff Compiler

- Analyzed and interpreted complex tariff schedules and regulations to ensure accurate classification and assessment of import/export duties.

- Successfully classified over 5000 commodities, resulting in significant cost savings for clients.

- Collaborated with customs authorities to resolve discrepancies and ensure compliance with import/export regulations.

- Developed and maintained a comprehensive tariff database, streamlining data retrieval and analysis.

Accomplishments

- Developed an automated tariff classification system, reducing classification errors by 35% and improving processing efficiency.

- Established a standardized tariff coding methodology, leading to a 20% reduction in tariff disputes and increased compliance.

- Collaborated with customs authorities to resolve complex tariff classification issues, resulting in improved border clearance efficiency.

- Implemented a digital tariff platform, enabling realtime access to tariff information and streamlining customs processes.

- Developed and delivered a training program on tariff classification for customs officials, enhancing their knowledge.

Awards

- Recognized with the Excellence in Tariff Compilation Award for outstanding performance in tariff management.

- Awarded the Tariff Compiler of the Year title for consistent accuracy and innovative tariff management practices.

- Received the Tariff Management Excellence Award for exceptional contributions to the harmonization of tariff codes.

- Honored with the Best Tariff Compiler award for proficiency in tariff interpretation and advisory services.

Certificates

- Certified Customs Specialist (CCS)

- International Trade Compliance Specialist (ITCS)

- Certified Tariff Classification Specialist (CTCS)

- Institute of Certified Customs Specialists (ICCS) Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tariff Compiler

- Showcase your expertise in customs tariff classification, harmonized system (HS) coding, and import/export regulations.

- Quantify your accomplishments by highlighting how your efforts resulted in cost savings and compliance improvements.

- Demonstrate your proficiency in industry-standard software and databases, such as TACT, Global Tariff, and SITC.

- Emphasize your ability to collaborate with customs authorities and resolve discrepancies effectively.

- Include keywords such as ‘tariff compilation,’ ‘import/export,’ and ‘customs compliance’ to enhance your resume’s visibility to recruiters.

Essential Experience Highlights for a Strong Tariff Compiler Resume

- Analyzed and interpreted tariff schedules and regulations to accurately classify import/export commodities.

- Ensured accurate assessment and calculation of import/export duties and taxes.

- Collaborated with customs authorities to resolve discrepancies and maintain compliance with regulations.

- Developed and maintained a comprehensive tariff database for efficient data retrieval and analysis.

- Utilized industry-standard software and databases to facilitate tariff compilation and analysis.

- Conducted thorough research on tariff codes, trade agreements, and customs policies.

- Provided expert guidance to clients on tariff optimization and duty drawback strategies.

Frequently Asked Questions (FAQ’s) For Tariff Compiler

What is the primary role of a Tariff Compiler?

A Tariff Compiler is responsible for analyzing and interpreting tariff schedules and regulations to ensure accurate classification and assessment of import/export duties. They also collaborate with customs authorities to resolve discrepancies and ensure compliance with regulations.

What are the key skills required for this role?

Key skills include customs tariff classification, harmonized system (HS) coding, import/export regulations, trade agreement interpretation, tariff research and analysis, and import duty calculation.

What industries hire Tariff Compilers?

Tariff Compilers are employed in various industries, including manufacturing, logistics, transportation, and international trade.

What is the career path for a Tariff Compiler?

With experience and expertise, Tariff Compilers can advance to roles such as Customs Manager, International Trade Manager, or Logistics Manager.

Can Tariff Compilers work independently?

While Tariff Compilers often work within a team, they may also have the opportunity to work independently on specific projects or tasks.

What are the salary expectations for this role?

Salary expectations vary based on experience, expertise, and location, but Tariff Compilers can expect to earn a competitive salary.

What is the job outlook for Tariff Compilers?

The job outlook for Tariff Compilers is expected to remain stable or grow as international trade continues to expand.