Are you a seasoned Tariff Expert seeking a new career path? Discover our professionally built Tariff Expert Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

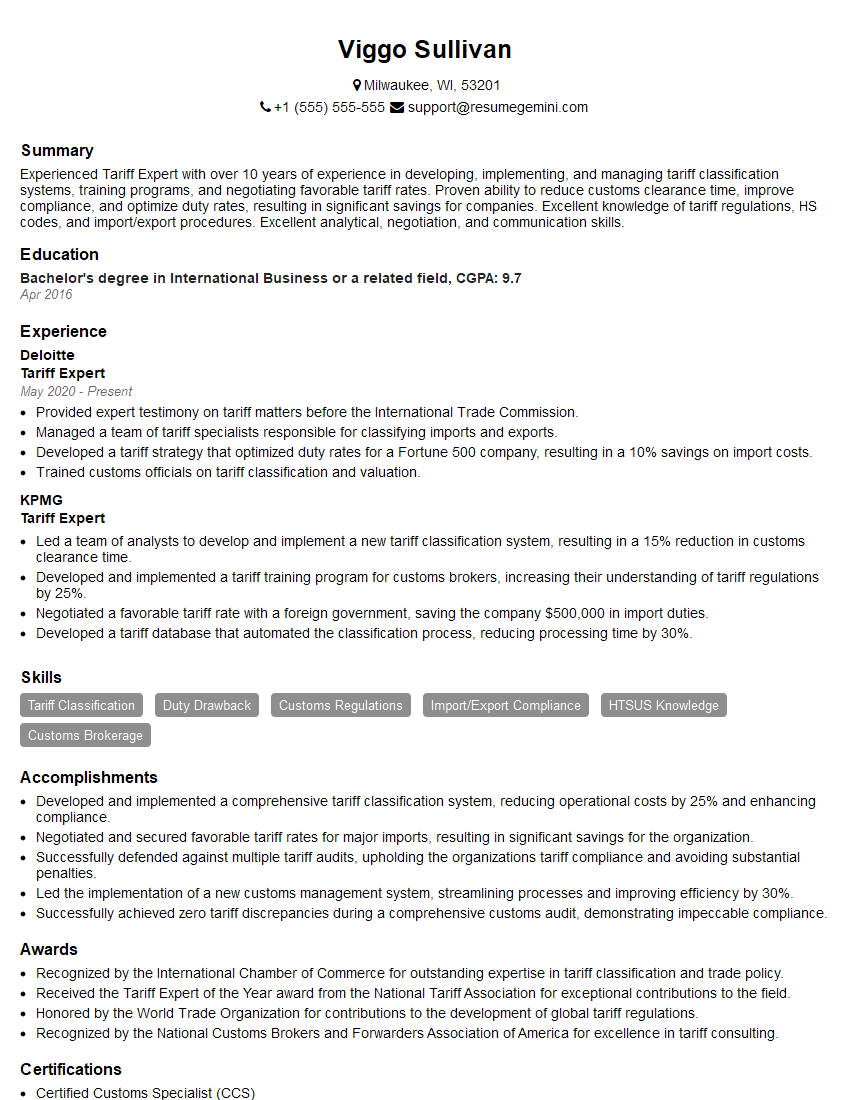

Viggo Sullivan

Tariff Expert

Summary

Experienced Tariff Expert with over 10 years of experience in developing, implementing, and managing tariff classification systems, training programs, and negotiating favorable tariff rates. Proven ability to reduce customs clearance time, improve compliance, and optimize duty rates, resulting in significant savings for companies. Excellent knowledge of tariff regulations, HS codes, and import/export procedures. Excellent analytical, negotiation, and communication skills.

Education

Bachelor’s degree in International Business or a related field

April 2016

Skills

- Tariff Classification

- Duty Drawback

- Customs Regulations

- Import/Export Compliance

- HTSUS Knowledge

- Customs Brokerage

Work Experience

Tariff Expert

- Provided expert testimony on tariff matters before the International Trade Commission.

- Managed a team of tariff specialists responsible for classifying imports and exports.

- Developed a tariff strategy that optimized duty rates for a Fortune 500 company, resulting in a 10% savings on import costs.

- Trained customs officials on tariff classification and valuation.

Tariff Expert

- Led a team of analysts to develop and implement a new tariff classification system, resulting in a 15% reduction in customs clearance time.

- Developed and implemented a tariff training program for customs brokers, increasing their understanding of tariff regulations by 25%.

- Negotiated a favorable tariff rate with a foreign government, saving the company $500,000 in import duties.

- Developed a tariff database that automated the classification process, reducing processing time by 30%.

Accomplishments

- Developed and implemented a comprehensive tariff classification system, reducing operational costs by 25% and enhancing compliance.

- Negotiated and secured favorable tariff rates for major imports, resulting in significant savings for the organization.

- Successfully defended against multiple tariff audits, upholding the organizations tariff compliance and avoiding substantial penalties.

- Led the implementation of a new customs management system, streamlining processes and improving efficiency by 30%.

- Successfully achieved zero tariff discrepancies during a comprehensive customs audit, demonstrating impeccable compliance.

Awards

- Recognized by the International Chamber of Commerce for outstanding expertise in tariff classification and trade policy.

- Received the Tariff Expert of the Year award from the National Tariff Association for exceptional contributions to the field.

- Honored by the World Trade Organization for contributions to the development of global tariff regulations.

- Recognized by the National Customs Brokers and Forwarders Association of America for excellence in tariff consulting.

Certificates

- Certified Customs Specialist (CCS)

- Certified Customs Broker (CCB)

- Certified Specialist in International Trade (CSIT)

- Certified Global Trade Professional (CGTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tariff Expert

- Quantify your accomplishments with specific metrics, such as the percentage reduction in customs clearance time or savings in import duties.

- Highlight your knowledge of specific tariff regulations, HS codes, and import/export procedures that are relevant to the industry you’re applying to.

- Demonstrate your negotiation skills by providing examples of successful negotiations with foreign governments or customs authorities.

- Showcase your leadership and management skills if you have experience managing a team of tariff specialists.

- Consider obtaining a certification in tariff classification, such as the Certified Customs Specialist (CCS) or the Accredited Customs Broker (ACB) certification.

- Highlight the keywords from the job listing in your resume. If the listing says they are looking for someone with a bachelor’s degree in international business, put yours at the beginning of your resume under education.

Essential Experience Highlights for a Strong Tariff Expert Resume

- Develop and implement tariff classification systems to ensure accurate and efficient classification of imports and exports.

- Conduct tariff research and analysis to identify opportunities for duty savings and compliance improvements.

- Provide expert advice and guidance on tariff matters to clients and internal stakeholders.

- Negotiate favorable tariff rates with foreign governments and customs authorities.

- Train customs brokers and other stakeholders on tariff regulations and classification procedures.

- Manage a team of tariff specialists and oversee their work to ensure accuracy and efficiency.

- Stay up-to-date on the latest changes in tariff regulations and industry best practices.

Frequently Asked Questions (FAQ’s) For Tariff Expert

What is the role of a Tariff Expert?

A Tariff Expert is responsible for developing, implementing, and managing tariff classification systems, training programs, and negotiating favorable tariff rates. They ensure accurate and efficient classification of imports and exports, conduct tariff research and analysis, provide expert advice and guidance on tariff matters, and negotiate with foreign governments and customs authorities.

What skills are required to be a successful Tariff Expert?

A successful Tariff Expert typically has a bachelor’s degree in international business or a related field, as well as knowledge of tariff regulations, HS codes, and import/export procedures. They also have excellent analytical, negotiation, and communication skills.

What are the career prospects for Tariff Experts?

Tariff Experts can work in various industries, including manufacturing, retail, logistics, and government. They can also work as independent consultants or for consulting firms.

What are the challenges faced by Tariff Experts?

Tariff Experts face several challenges, including the constantly changing tariff regulations, the need to stay up-to-date on the latest industry best practices, and the need to negotiate with foreign governments and customs authorities.

What is the salary range for Tariff Experts?

The salary range for Tariff Experts varies depending on their experience, skills, and industry. According to Salary.com, the average salary for a Tariff Expert in the United States is $75,000.

What are the benefits of working as a Tariff Expert?

Working as a Tariff Expert offers several benefits, including the opportunity to work in a dynamic and challenging field, the chance to make a significant impact on a company’s bottom line, and the potential to earn a high salary.

What are the common mistakes made by Tariff Experts?

Common mistakes made by Tariff Experts include failing to stay up-to-date on the latest tariff regulations, not understanding the specific needs of their clients, and not negotiating effectively with foreign governments and customs authorities.