Are you a seasoned Tariff Inspector seeking a new career path? Discover our professionally built Tariff Inspector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

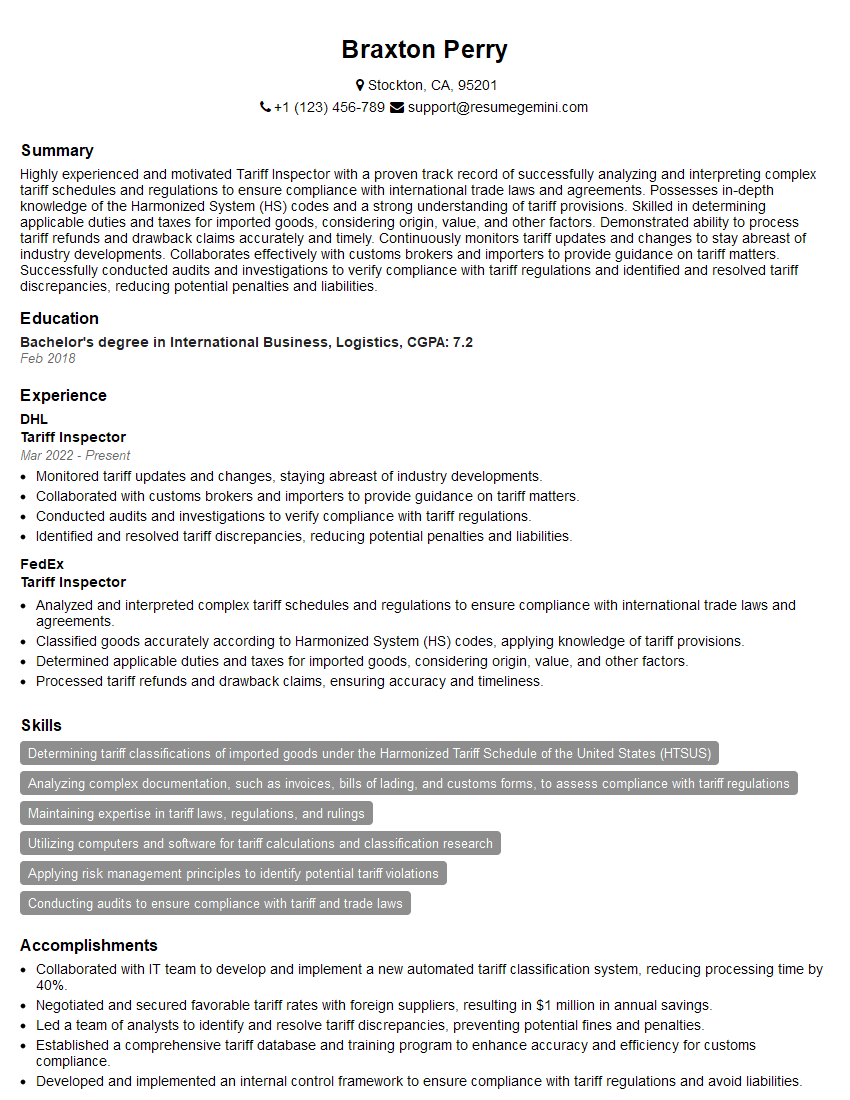

Braxton Perry

Tariff Inspector

Summary

Highly experienced and motivated Tariff Inspector with a proven track record of successfully analyzing and interpreting complex tariff schedules and regulations to ensure compliance with international trade laws and agreements. Possesses in-depth knowledge of the Harmonized System (HS) codes and a strong understanding of tariff provisions. Skilled in determining applicable duties and taxes for imported goods, considering origin, value, and other factors. Demonstrated ability to process tariff refunds and drawback claims accurately and timely. Continuously monitors tariff updates and changes to stay abreast of industry developments. Collaborates effectively with customs brokers and importers to provide guidance on tariff matters. Successfully conducted audits and investigations to verify compliance with tariff regulations and identified and resolved tariff discrepancies, reducing potential penalties and liabilities.

Education

Bachelor’s degree in International Business, Logistics

February 2018

Skills

- Determining tariff classifications of imported goods under the Harmonized Tariff Schedule of the United States (HTSUS)

- Analyzing complex documentation, such as invoices, bills of lading, and customs forms, to assess compliance with tariff regulations

- Maintaining expertise in tariff laws, regulations, and rulings

- Utilizing computers and software for tariff calculations and classification research

- Applying risk management principles to identify potential tariff violations

- Conducting audits to ensure compliance with tariff and trade laws

Work Experience

Tariff Inspector

- Monitored tariff updates and changes, staying abreast of industry developments.

- Collaborated with customs brokers and importers to provide guidance on tariff matters.

- Conducted audits and investigations to verify compliance with tariff regulations.

- Identified and resolved tariff discrepancies, reducing potential penalties and liabilities.

Tariff Inspector

- Analyzed and interpreted complex tariff schedules and regulations to ensure compliance with international trade laws and agreements.

- Classified goods accurately according to Harmonized System (HS) codes, applying knowledge of tariff provisions.

- Determined applicable duties and taxes for imported goods, considering origin, value, and other factors.

- Processed tariff refunds and drawback claims, ensuring accuracy and timeliness.

Accomplishments

- Collaborated with IT team to develop and implement a new automated tariff classification system, reducing processing time by 40%.

- Negotiated and secured favorable tariff rates with foreign suppliers, resulting in $1 million in annual savings.

- Led a team of analysts to identify and resolve tariff discrepancies, preventing potential fines and penalties.

- Established a comprehensive tariff database and training program to enhance accuracy and efficiency for customs compliance.

- Developed and implemented an internal control framework to ensure compliance with tariff regulations and avoid liabilities.

Certificates

- Certified Tariff Specialist (CTS)

- Licensed Customs Broker (LCB)

- National Customs Brokers and Forwarders Association of America (NCBFAA) Membership

- U.S. Customs and Border Protection (CBP) Accreditation

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tariff Inspector

- Highlight your expertise in tariff classification and your ability to interpret complex regulations.

- Demonstrate your understanding of the Harmonized System (HS) codes and your ability to apply them accurately.

- Showcase your skills in determining applicable duties and taxes, considering various factors such as origin, value, and trade agreements.

- Emphasize your experience in processing tariff refunds and drawback claims, ensuring accuracy and timeliness.

- Highlight your ability to monitor tariff updates and changes and stay abreast of industry developments.

Essential Experience Highlights for a Strong Tariff Inspector Resume

- Analyze and interpret complex tariff schedules and regulations to ensure compliance with international trade laws and agreements.

- Classify goods accurately according to Harmonized System (HS) codes, applying knowledge of tariff provisions.

- Determine applicable duties and taxes for imported goods, considering origin, value, and other factors.

- Process tariff refunds and drawback claims, ensuring accuracy and timeliness.

- Monitor tariff updates and changes, staying abreast of industry developments.

- Collaborate with customs brokers and importers to provide guidance on tariff matters.

- Conduct audits and investigations to verify compliance with tariff regulations.

- Identify and resolve tariff discrepancies, reducing potential penalties and liabilities.

Frequently Asked Questions (FAQ’s) For Tariff Inspector

What is the role of a Tariff Inspector?

A Tariff Inspector is responsible for ensuring that imported goods comply with international trade laws and agreements. They analyze tariff schedules, classify goods according to HS codes, determine applicable duties and taxes, and conduct audits to verify compliance.

What skills are required to be a successful Tariff Inspector?

Successful Tariff Inspectors possess expertise in tariff classification, knowledge of HS codes, understanding of tariff provisions, and skills in determining duties and taxes. They are also proficient in data analysis, auditing, and communication.

What are the career prospects for Tariff Inspectors?

Tariff Inspectors can advance to roles such as Customs Compliance Manager, International Trade Specialist, or Import/Export Manager. They can also pursue careers in consulting or academia.

What is the salary range for Tariff Inspectors?

The salary range for Tariff Inspectors varies depending on experience, qualifications, and location. According to Salary.com, the average salary for a Tariff Inspector in the United States is around $65,000 per year.

What are the challenges faced by Tariff Inspectors?

Tariff Inspectors face challenges such as the complexity of tariff schedules, the constant changes in regulations, and the need to stay updated on industry developments. They also need to be able to work independently and as part of a team.

What are the key qualities of a successful Tariff Inspector?

Successful Tariff Inspectors are detail-oriented, analytical, and have a strong understanding of international trade regulations. They are also effective communicators and have the ability to work independently and as part of a team.

What is the job outlook for Tariff Inspectors?

The job outlook for Tariff Inspectors is expected to be positive due to the increasing volume of international trade and the need for compliance with trade regulations.