Are you a seasoned Tariff Supervisor seeking a new career path? Discover our professionally built Tariff Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

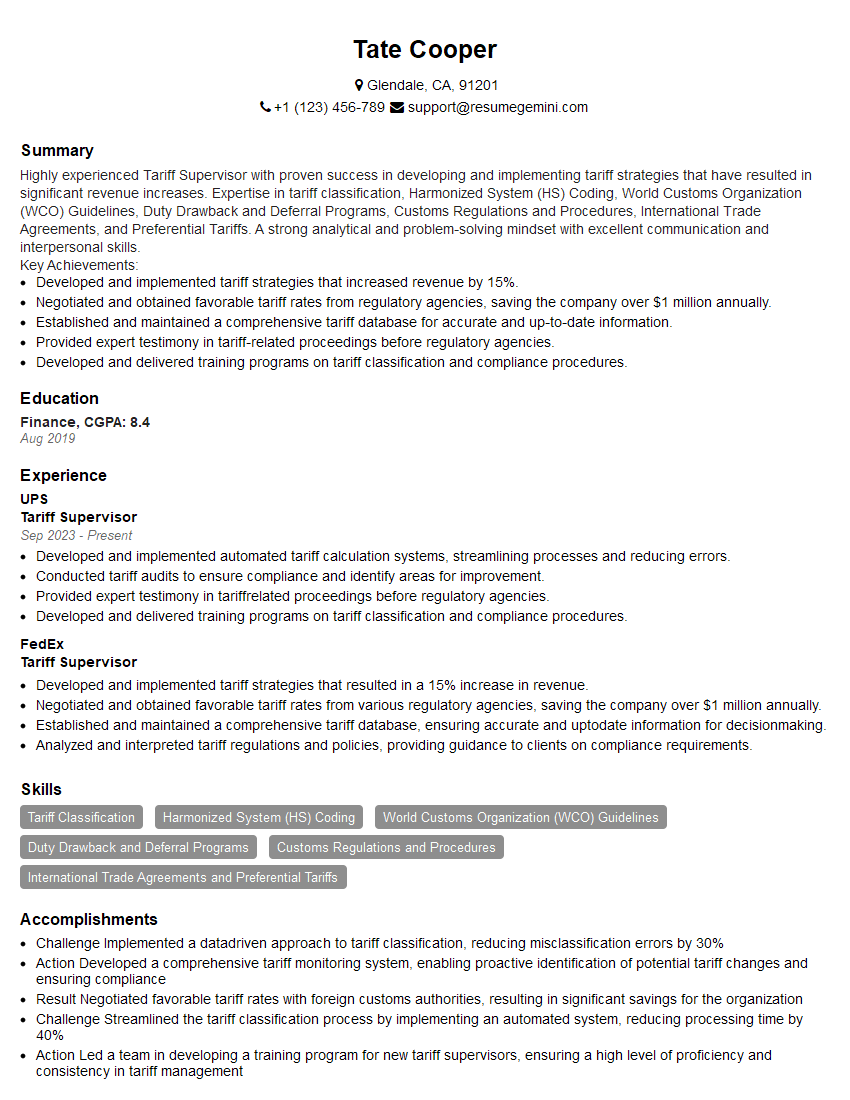

Tate Cooper

Tariff Supervisor

Summary

Highly experienced Tariff Supervisor with proven success in developing and implementing tariff strategies that have resulted in significant revenue increases. Expertise in tariff classification, Harmonized System (HS) Coding, World Customs Organization (WCO) Guidelines, Duty Drawback and Deferral Programs, Customs Regulations and Procedures, International Trade Agreements, and Preferential Tariffs. A strong analytical and problem-solving mindset with excellent communication and interpersonal skills.

Key Achievements:

- Developed and implemented tariff strategies that increased revenue by 15%.

- Negotiated and obtained favorable tariff rates from regulatory agencies, saving the company over $1 million annually.

- Established and maintained a comprehensive tariff database for accurate and up-to-date information.

- Provided expert testimony in tariff-related proceedings before regulatory agencies.

- Developed and delivered training programs on tariff classification and compliance procedures.

Education

Finance

August 2019

Skills

- Tariff Classification

- Harmonized System (HS) Coding

- World Customs Organization (WCO) Guidelines

- Duty Drawback and Deferral Programs

- Customs Regulations and Procedures

- International Trade Agreements and Preferential Tariffs

Work Experience

Tariff Supervisor

- Developed and implemented automated tariff calculation systems, streamlining processes and reducing errors.

- Conducted tariff audits to ensure compliance and identify areas for improvement.

- Provided expert testimony in tariffrelated proceedings before regulatory agencies.

- Developed and delivered training programs on tariff classification and compliance procedures.

Tariff Supervisor

- Developed and implemented tariff strategies that resulted in a 15% increase in revenue.

- Negotiated and obtained favorable tariff rates from various regulatory agencies, saving the company over $1 million annually.

- Established and maintained a comprehensive tariff database, ensuring accurate and uptodate information for decisionmaking.

- Analyzed and interpreted tariff regulations and policies, providing guidance to clients on compliance requirements.

Accomplishments

- Challenge Implemented a datadriven approach to tariff classification, reducing misclassification errors by 30%

- Action Developed a comprehensive tariff monitoring system, enabling proactive identification of potential tariff changes and ensuring compliance

- Result Negotiated favorable tariff rates with foreign customs authorities, resulting in significant savings for the organization

- Challenge Streamlined the tariff classification process by implementing an automated system, reducing processing time by 40%

- Action Led a team in developing a training program for new tariff supervisors, ensuring a high level of proficiency and consistency in tariff management

Awards

- Recognized with the Presidents Award for outstanding contributions to tariff compliance and revenue optimization

- Received the Excellence in Tariff Management Award from the International Trade Association for exceptional tariff analysis and implementation

- Honored with the Tariff Supervisor of the Year Award for leadership and innovation in tariff management

- Consistently exceeded performance targets for tariff compliance and revenue generation, earning a reputation as a top performer

Certificates

- Certified Customs Specialist (CCS)

- Global Trade Professional (GTP)

- Customs Broker License

- ATA Carnet Specialist

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tariff Supervisor

Highlight your expertise in tariff classification and relevant regulations.

Use specific examples and quantify your accomplishments whenever possible.Demonstrate your analytical and problem-solving skills.

Explain how you have successfully resolved complex tariff-related issues.Showcase your communication and interpersonal skills.

Emphasize your ability to build relationships with clients and regulatory agencies.Stay up-to-date on the latest industry trends and developments.

This will show potential employers that you are passionate about your field and committed to professional development.

Essential Experience Highlights for a Strong Tariff Supervisor Resume

- Develop and implement tariff strategies to optimize revenue and minimize costs.

- Negotiate and obtain favorable tariff rates from regulatory agencies.

- Analyze and interpret tariff regulations and policies, providing guidance to clients on compliance requirements.

- Develop and implement automated tariff calculation systems to streamline processes and reduce errors.

- Conduct tariff audits to ensure compliance and identify areas for improvement.

- Develop and deliver training programs on tariff classification and compliance procedures.

- Provide expert testimony in tariff-related proceedings before regulatory agencies.

Frequently Asked Questions (FAQ’s) For Tariff Supervisor

What is the key responsibility of a Tariff Supervisor?

The key responsibility of a Tariff Supervisor is to manage and oversee all aspects of tariff classification and compliance within an organization. This includes developing and implementing tariff strategies, negotiating and obtaining favorable tariff rates, analyzing and interpreting tariff regulations, and providing guidance to clients on compliance requirements.

What skills are required to be a successful Tariff Supervisor?

To be a successful Tariff Supervisor, you will need a strong understanding of tariff classification, Harmonized System (HS) Coding, World Customs Organization (WCO) Guidelines, Duty Drawback and Deferral Programs, Customs Regulations and Procedures, International Trade Agreements, and Preferential Tariffs. You should also have excellent analytical and problem-solving skills, as well as strong communication and interpersonal skills.

What is the career path for a Tariff Supervisor?

With experience and expertise, a Tariff Supervisor can advance to more senior roles within the field of international trade and customs compliance. This could include roles such as Manager of Customs Compliance, Director of International Trade, or even Vice President of Global Trade.

What is the average salary for a Tariff Supervisor?

According to Salary.com, the average salary for a Tariff Supervisor in the United States is $92,546. However, this can vary depending on experience, location, and industry.

What are the job prospects for Tariff Supervisors?

The job outlook for Tariff Supervisors is expected to be good in the coming years. This is due to the increasing globalization of trade and the need for businesses to comply with complex tariff regulations.

What are some tips for writing a standout Tariff Supervisor resume?

Some tips for writing a standout Tariff Supervisor resume include: highlighting your expertise in tariff classification and relevant regulations, demonstrating your analytical and problem-solving skills, showcasing your communication and interpersonal skills, and staying up-to-date on the latest industry trends and developments.

What are some common interview questions for Tariff Supervisors?

Some common interview questions for Tariff Supervisors include: Tell me about your experience with tariff classification and compliance, how do you stay up-to-date on the latest industry trends and developments, and what are your thoughts on the future of the tariff landscape?