Are you a seasoned Tax Accountant seeking a new career path? Discover our professionally built Tax Accountant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

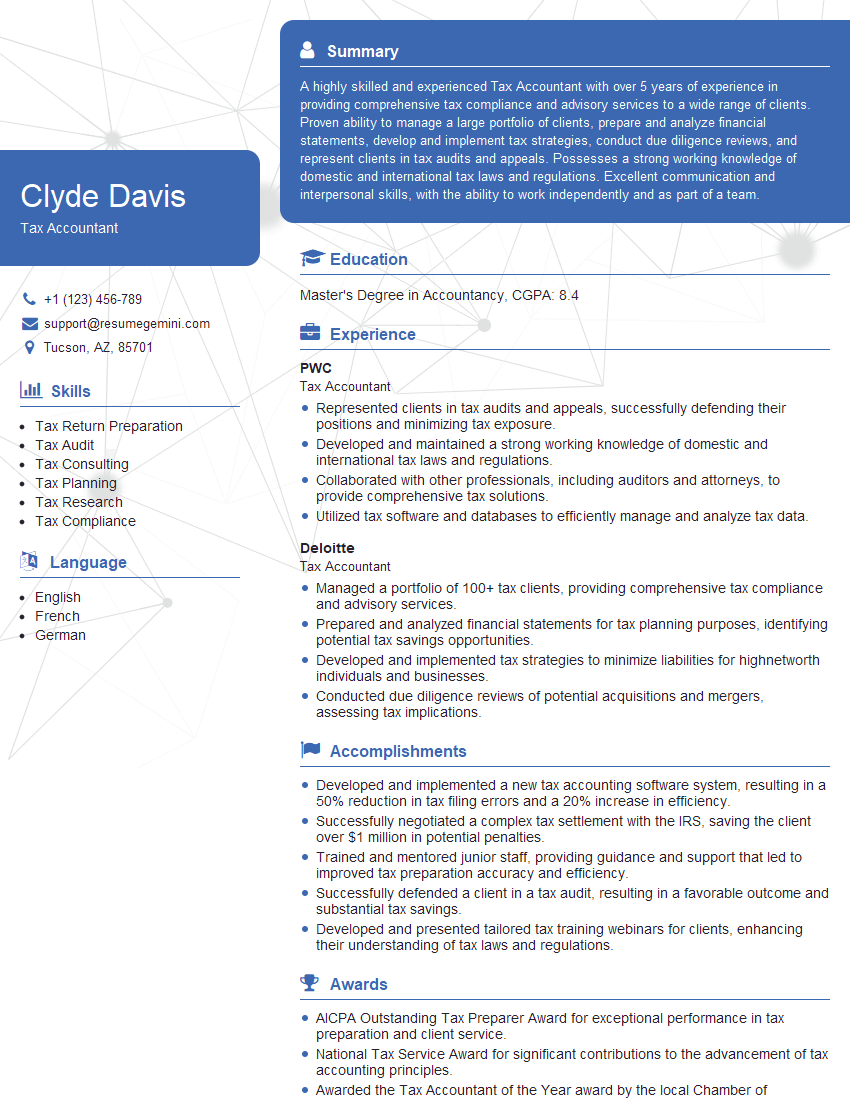

Clyde Davis

Tax Accountant

Summary

A highly skilled and experienced Tax Accountant with over 5 years of experience in providing comprehensive tax compliance and advisory services to a wide range of clients. Proven ability to manage a large portfolio of clients, prepare and analyze financial statements, develop and implement tax strategies, conduct due diligence reviews, and represent clients in tax audits and appeals. Possesses a strong working knowledge of domestic and international tax laws and regulations. Excellent communication and interpersonal skills, with the ability to work independently and as part of a team.

Education

Master’s Degree in Accountancy

December 2017

Skills

- Tax Return Preparation

- Tax Audit

- Tax Consulting

- Tax Planning

- Tax Research

- Tax Compliance

Work Experience

Tax Accountant

- Represented clients in tax audits and appeals, successfully defending their positions and minimizing tax exposure.

- Developed and maintained a strong working knowledge of domestic and international tax laws and regulations.

- Collaborated with other professionals, including auditors and attorneys, to provide comprehensive tax solutions.

- Utilized tax software and databases to efficiently manage and analyze tax data.

Tax Accountant

- Managed a portfolio of 100+ tax clients, providing comprehensive tax compliance and advisory services.

- Prepared and analyzed financial statements for tax planning purposes, identifying potential tax savings opportunities.

- Developed and implemented tax strategies to minimize liabilities for highnetworth individuals and businesses.

- Conducted due diligence reviews of potential acquisitions and mergers, assessing tax implications.

Accomplishments

- Developed and implemented a new tax accounting software system, resulting in a 50% reduction in tax filing errors and a 20% increase in efficiency.

- Successfully negotiated a complex tax settlement with the IRS, saving the client over $1 million in potential penalties.

- Trained and mentored junior staff, providing guidance and support that led to improved tax preparation accuracy and efficiency.

- Successfully defended a client in a tax audit, resulting in a favorable outcome and substantial tax savings.

- Developed and presented tailored tax training webinars for clients, enhancing their understanding of tax laws and regulations.

Awards

- AICPA Outstanding Tax Preparer Award for exceptional performance in tax preparation and client service.

- National Tax Service Award for significant contributions to the advancement of tax accounting principles.

- Awarded the Tax Accountant of the Year award by the local Chamber of Commerce for exceptional expertise and dedication.

- Received the Outstanding Achievement Award from the industry trade association for innovative tax planning strategies.

Certificates

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

- Certified Internal Auditor (CIA)

- Certified Tax Specialist (CTS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Accountant

- Highlight your technical skills and experience in tax accounting, including tax return preparation, auditing, and consulting.

- Showcase your knowledge of tax laws and regulations, both domestic and international.

- Quantify your accomplishments and provide specific examples of how you have helped clients reduce their tax liability.

- Demonstrate your ability to work independently and as part of a team, and highlight your communication and interpersonal skills.

Essential Experience Highlights for a Strong Tax Accountant Resume

- Managed a portfolio of 100+ tax clients, providing comprehensive tax compliance and advisory services.

- Prepared and analyzed financial statements for tax planning purposes, identifying potential tax savings opportunities.

- Developed and implemented tax strategies to minimize liabilities for high-net-worth individuals and businesses.

- Conducted due diligence reviews of potential acquisitions and mergers, assessing tax implications.

- Represented clients in tax audits and appeals, successfully defending their positions and minimizing tax exposure.

- Developed and maintained a strong working knowledge of domestic and international tax laws and regulations.

- Collaborated with other professionals, including auditors and attorneys, to provide comprehensive tax solutions.

Frequently Asked Questions (FAQ’s) For Tax Accountant

What are the key skills and qualifications required to be a successful Tax Accountant?

The key skills and qualifications required to be a successful Tax Accountant include a strong understanding of tax laws and regulations, experience in tax return preparation and auditing, and excellent communication and interpersonal skills.

What are the career opportunities for Tax Accountants?

Tax Accountants can work in a variety of settings, including public accounting firms, corporations, and government agencies. They can also specialize in a particular area of tax, such as international taxation or estate planning.

What is the average salary for Tax Accountants?

The average salary for Tax Accountants varies depending on their experience, location, and employer. According to the U.S. Bureau of Labor Statistics, the median annual salary for Tax Accountants was $73,580 in May 2021.

What are the job growth prospects for Tax Accountants?

The job growth prospects for Tax Accountants are expected to be good over the next few years. The U.S. Bureau of Labor Statistics projects that employment of Tax Accountants will grow by 7% from 2021 to 2031, faster than the average for all occupations.

What are the challenges facing Tax Accountants?

Tax Accountants face a number of challenges, including the ever-changing tax laws and regulations, the need to keep up with new technologies, and the increasing complexity of tax returns.

What are the rewards of being a Tax Accountant?

The rewards of being a Tax Accountant include the opportunity to help clients save money on their taxes, the satisfaction of knowing that you are making a difference in their lives, and the potential for a high salary.