Are you a seasoned Tax Compliance Officer seeking a new career path? Discover our professionally built Tax Compliance Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

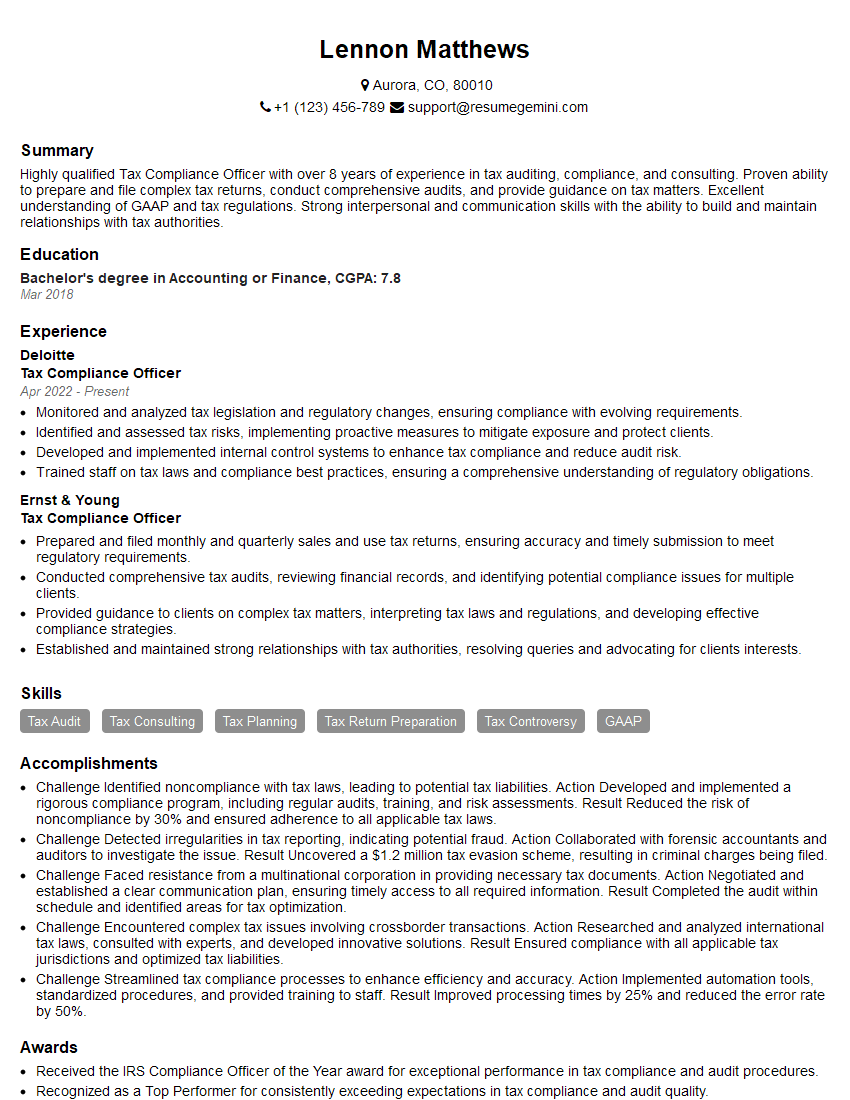

Lennon Matthews

Tax Compliance Officer

Summary

Highly qualified Tax Compliance Officer with over 8 years of experience in tax auditing, compliance, and consulting. Proven ability to prepare and file complex tax returns, conduct comprehensive audits, and provide guidance on tax matters. Excellent understanding of GAAP and tax regulations. Strong interpersonal and communication skills with the ability to build and maintain relationships with tax authorities.

Education

Bachelor’s degree in Accounting or Finance

March 2018

Skills

- Tax Audit

- Tax Consulting

- Tax Planning

- Tax Return Preparation

- Tax Controversy

- GAAP

Work Experience

Tax Compliance Officer

- Monitored and analyzed tax legislation and regulatory changes, ensuring compliance with evolving requirements.

- Identified and assessed tax risks, implementing proactive measures to mitigate exposure and protect clients.

- Developed and implemented internal control systems to enhance tax compliance and reduce audit risk.

- Trained staff on tax laws and compliance best practices, ensuring a comprehensive understanding of regulatory obligations.

Tax Compliance Officer

- Prepared and filed monthly and quarterly sales and use tax returns, ensuring accuracy and timely submission to meet regulatory requirements.

- Conducted comprehensive tax audits, reviewing financial records, and identifying potential compliance issues for multiple clients.

- Provided guidance to clients on complex tax matters, interpreting tax laws and regulations, and developing effective compliance strategies.

- Established and maintained strong relationships with tax authorities, resolving queries and advocating for clients interests.

Accomplishments

- Challenge Identified noncompliance with tax laws, leading to potential tax liabilities. Action Developed and implemented a rigorous compliance program, including regular audits, training, and risk assessments. Result Reduced the risk of noncompliance by 30% and ensured adherence to all applicable tax laws.

- Challenge Detected irregularities in tax reporting, indicating potential fraud. Action Collaborated with forensic accountants and auditors to investigate the issue. Result Uncovered a $1.2 million tax evasion scheme, resulting in criminal charges being filed.

- Challenge Faced resistance from a multinational corporation in providing necessary tax documents. Action Negotiated and established a clear communication plan, ensuring timely access to all required information. Result Completed the audit within schedule and identified areas for tax optimization.

- Challenge Encountered complex tax issues involving crossborder transactions. Action Researched and analyzed international tax laws, consulted with experts, and developed innovative solutions. Result Ensured compliance with all applicable tax jurisdictions and optimized tax liabilities.

- Challenge Streamlined tax compliance processes to enhance efficiency and accuracy. Action Implemented automation tools, standardized procedures, and provided training to staff. Result Improved processing times by 25% and reduced the error rate by 50%.

Awards

- Received the IRS Compliance Officer of the Year award for exceptional performance in tax compliance and audit procedures.

- Recognized as a Top Performer for consistently exceeding expectations in tax compliance and audit quality.

- Awarded the Exceptional Contributor award for outstanding contributions to the development and implementation of new tax compliance policies.

- Honored with the Team Excellence award for collaboration and teamwork in resolving complex tax compliance cases.

Certificates

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Compliance Officer

- Quantify your accomplishments using specific metrics and data whenever possible.

- Highlight your experience with specific tax software and technologies, such as CCH Axcess and Thomson Reuters Checkpoint.

- Tailor your resume to each job description by highlighting the skills and experience that are most relevant to the position.

- Proofread your resume carefully for any errors before submitting it.

- Get feedback from a trusted friend, family member, or career counselor to ensure your resume is strong and effective.

Essential Experience Highlights for a Strong Tax Compliance Officer Resume

- Prepare and file monthly and quarterly sales and use tax returns, ensuring accuracy and timely submission to meet regulatory requirements.

- Conduct comprehensive tax audits, reviewing financial records, and identifying potential compliance issues for multiple clients.

- Provide guidance to clients on complex tax matters, interpreting tax laws and regulations, and developing effective compliance strategies.

- Establish and maintain strong relationships with tax authorities, resolving queries and advocating for clients’ interests.

- Monitor and analyze tax legislation and regulatory changes, ensuring compliance with evolving requirements.

- Identify and assess tax risks, implementing proactive measures to mitigate exposure and protect clients.

- Develop and implement internal control systems to enhance tax compliance and reduce audit risk.

Frequently Asked Questions (FAQ’s) For Tax Compliance Officer

What are the key skills required to be a successful Tax Compliance Officer?

The key skills required to be a successful Tax Compliance Officer include strong analytical and problem-solving abilities, excellent communication and interpersonal skills, and a deep understanding of tax laws and regulations.

What are the career prospects for Tax Compliance Officers?

Tax Compliance Officers have a wide range of career prospects, including opportunities to move into management roles, specialize in a particular area of tax, or work as a tax consultant.

What are the major challenges faced by Tax Compliance Officers?

The major challenges faced by Tax Compliance Officers include keeping up with constantly changing tax laws and regulations, dealing with complex tax issues, and ensuring compliance with multiple jurisdictions.

What are the key trends in Tax Compliance?

The key trends in Tax Compliance include the increasing use of technology, the globalization of business, and the growing focus on risk management.

What are the emerging issues in Tax Compliance?

The emerging issues in Tax Compliance include the use of artificial intelligence, the impact of blockchain technology, and the increasing importance of data privacy.

What is the future of Tax Compliance?

The future of Tax Compliance is expected to be characterized by continued technological advancements, increased globalization, and a greater focus on risk management.