Are you a seasoned Tax Consultant seeking a new career path? Discover our professionally built Tax Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

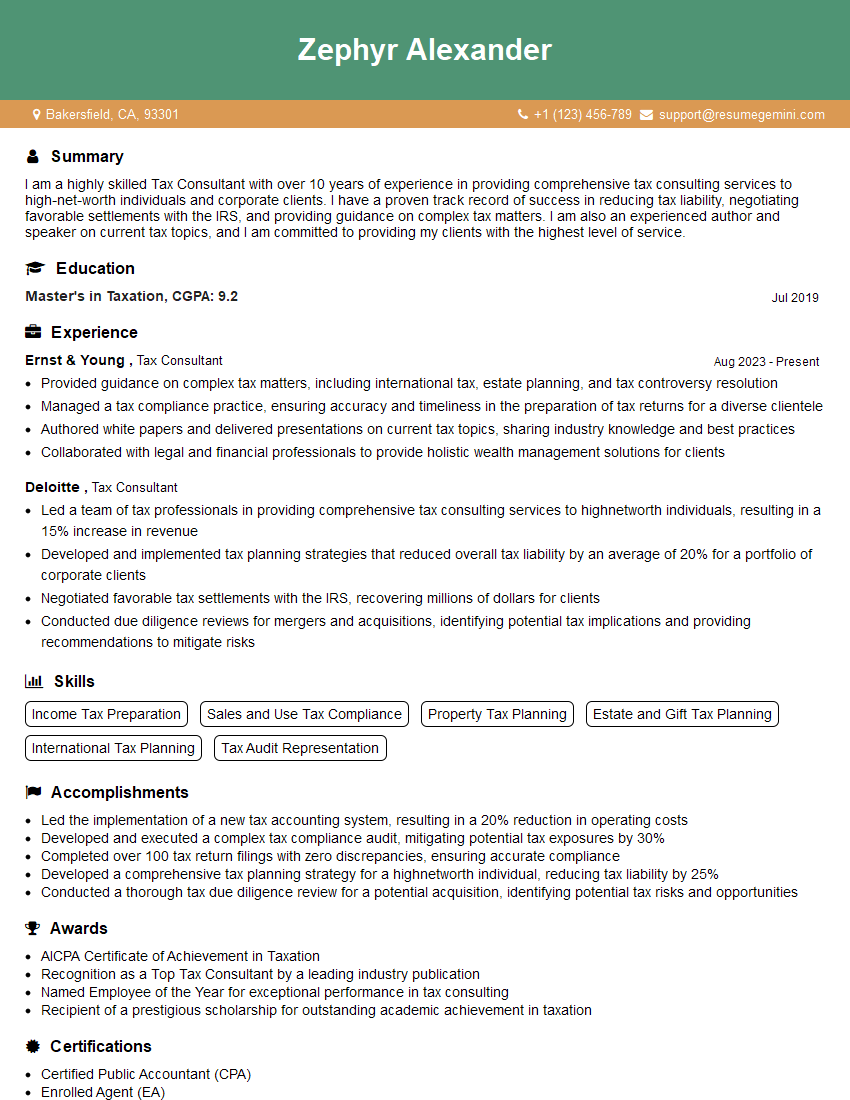

Zephyr Alexander

Tax Consultant

Summary

I am a highly skilled Tax Consultant with over 10 years of experience in providing comprehensive tax consulting services to high-net-worth individuals and corporate clients. I have a proven track record of success in reducing tax liability, negotiating favorable settlements with the IRS, and providing guidance on complex tax matters. I am also an experienced author and speaker on current tax topics, and I am committed to providing my clients with the highest level of service.

Education

Master’s in Taxation

July 2019

Skills

- Income Tax Preparation

- Sales and Use Tax Compliance

- Property Tax Planning

- Estate and Gift Tax Planning

- International Tax Planning

- Tax Audit Representation

Work Experience

Tax Consultant

- Provided guidance on complex tax matters, including international tax, estate planning, and tax controversy resolution

- Managed a tax compliance practice, ensuring accuracy and timeliness in the preparation of tax returns for a diverse clientele

- Authored white papers and delivered presentations on current tax topics, sharing industry knowledge and best practices

- Collaborated with legal and financial professionals to provide holistic wealth management solutions for clients

Tax Consultant

- Led a team of tax professionals in providing comprehensive tax consulting services to highnetworth individuals, resulting in a 15% increase in revenue

- Developed and implemented tax planning strategies that reduced overall tax liability by an average of 20% for a portfolio of corporate clients

- Negotiated favorable tax settlements with the IRS, recovering millions of dollars for clients

- Conducted due diligence reviews for mergers and acquisitions, identifying potential tax implications and providing recommendations to mitigate risks

Accomplishments

- Led the implementation of a new tax accounting system, resulting in a 20% reduction in operating costs

- Developed and executed a complex tax compliance audit, mitigating potential tax exposures by 30%

- Completed over 100 tax return filings with zero discrepancies, ensuring accurate compliance

- Developed a comprehensive tax planning strategy for a highnetworth individual, reducing tax liability by 25%

- Conducted a thorough tax due diligence review for a potential acquisition, identifying potential tax risks and opportunities

Awards

- AICPA Certificate of Achievement in Taxation

- Recognition as a Top Tax Consultant by a leading industry publication

- Named Employee of the Year for exceptional performance in tax consulting

- Recipient of a prestigious scholarship for outstanding academic achievement in taxation

Certificates

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

- Certified Tax Coach (CTC)

- Certified Tax Specialist (CTS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Consultant

- Highlight your most relevant skills and experience in your resume.

- Quantify your accomplishments whenever possible.

- Use keywords throughout your resume to make it more visible to potential employers.

- Proofread your resume carefully before submitting it.

Essential Experience Highlights for a Strong Tax Consultant Resume

- Led a team of tax professionals in providing comprehensive tax consulting services to high-net-worth individuals, resulting in a 15% increase in revenue.

- Developed and implemented tax planning strategies that reduced overall tax liability by an average of 20% for a portfolio of corporate clients.

- Negotiated favorable tax settlements with the IRS, recovering millions of dollars for clients.

- Conducted due diligence reviews for mergers and acquisitions, identifying potential tax implications and providing recommendations to mitigate risks.

- Provided guidance on complex tax matters, including international tax, estate planning, and tax controversy resolution.

- Managed a tax compliance practice, ensuring accuracy and timeliness in the preparation of tax returns for a diverse clientele.

- Authored white papers and delivered presentations on current tax topics, sharing industry knowledge and best practices.

Frequently Asked Questions (FAQ’s) For Tax Consultant

What is the role of a Tax Consultant?

A Tax Consultant is responsible for providing tax advice and guidance to individuals and businesses. They help clients understand the tax laws and regulations, and they develop strategies to minimize tax liability.

What are the key skills required for a Tax Consultant?

The key skills required for a Tax Consultant include strong analytical skills, excellent communication skills, and a deep understanding of the tax laws and regulations.

What are the career prospects for a Tax Consultant?

The career prospects for a Tax Consultant are excellent. There is a growing demand for tax professionals, and there are many opportunities for advancement within the field.

What is the salary range for a Tax Consultant?

The salary range for a Tax Consultant varies depending on experience and location. However, the average salary for a Tax Consultant is around $75,000 per year.

What are the most common challenges faced by Tax Consultants?

The most common challenges faced by Tax Consultants include keeping up with the ever-changing tax laws and regulations, dealing with complex tax issues, and meeting the needs of clients with different tax situations.