Are you a seasoned Tax Manager seeking a new career path? Discover our professionally built Tax Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

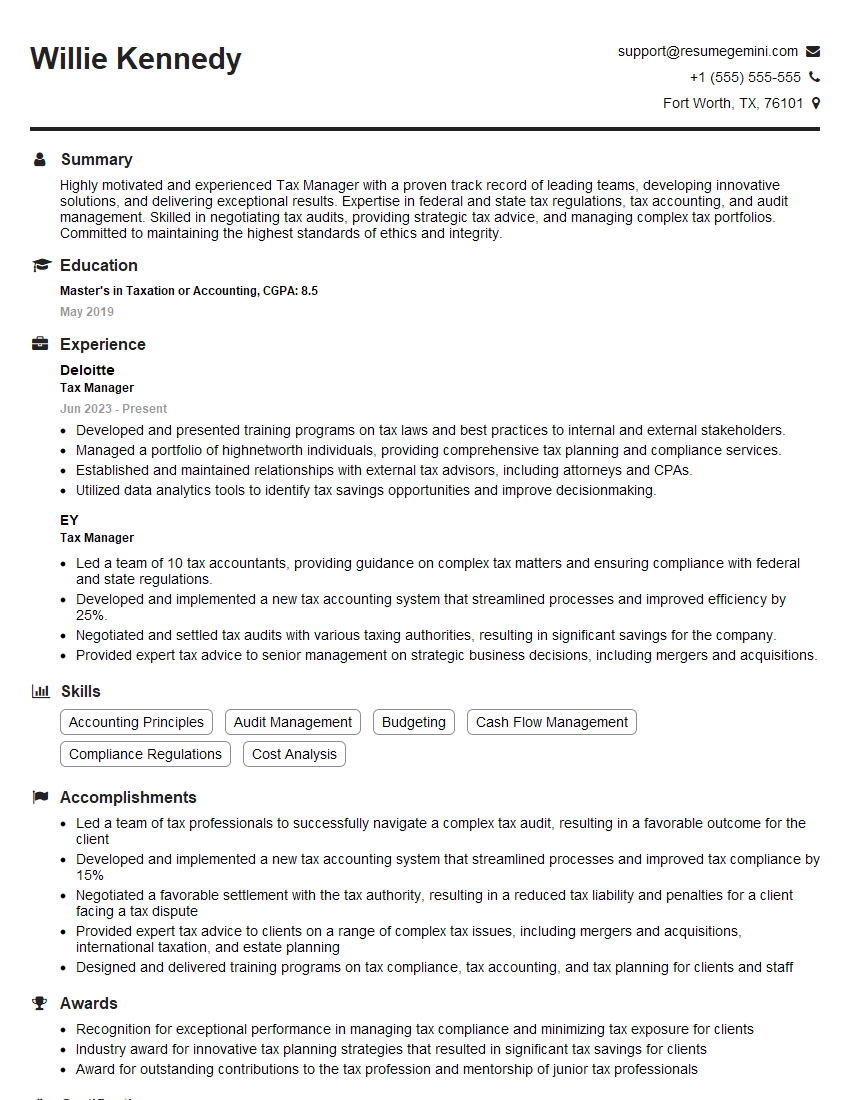

Willie Kennedy

Tax Manager

Summary

Highly motivated and experienced Tax Manager with a proven track record of leading teams, developing innovative solutions, and delivering exceptional results. Expertise in federal and state tax regulations, tax accounting, and audit management. Skilled in negotiating tax audits, providing strategic tax advice, and managing complex tax portfolios. Committed to maintaining the highest standards of ethics and integrity.

Education

Master’s in Taxation or Accounting

May 2019

Skills

- Accounting Principles

- Audit Management

- Budgeting

- Cash Flow Management

- Compliance Regulations

- Cost Analysis

Work Experience

Tax Manager

- Developed and presented training programs on tax laws and best practices to internal and external stakeholders.

- Managed a portfolio of highnetworth individuals, providing comprehensive tax planning and compliance services.

- Established and maintained relationships with external tax advisors, including attorneys and CPAs.

- Utilized data analytics tools to identify tax savings opportunities and improve decisionmaking.

Tax Manager

- Led a team of 10 tax accountants, providing guidance on complex tax matters and ensuring compliance with federal and state regulations.

- Developed and implemented a new tax accounting system that streamlined processes and improved efficiency by 25%.

- Negotiated and settled tax audits with various taxing authorities, resulting in significant savings for the company.

- Provided expert tax advice to senior management on strategic business decisions, including mergers and acquisitions.

Accomplishments

- Led a team of tax professionals to successfully navigate a complex tax audit, resulting in a favorable outcome for the client

- Developed and implemented a new tax accounting system that streamlined processes and improved tax compliance by 15%

- Negotiated a favorable settlement with the tax authority, resulting in a reduced tax liability and penalties for a client facing a tax dispute

- Provided expert tax advice to clients on a range of complex tax issues, including mergers and acquisitions, international taxation, and estate planning

- Designed and delivered training programs on tax compliance, tax accounting, and tax planning for clients and staff

Awards

- Recognition for exceptional performance in managing tax compliance and minimizing tax exposure for clients

- Industry award for innovative tax planning strategies that resulted in significant tax savings for clients

- Award for outstanding contributions to the tax profession and mentorship of junior tax professionals

Certificates

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Chartered Global Management Accountant (CGMA)

- Enrolled Agent (EA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Manager

- Showcase your expertise in tax accounting, auditing, and compliance.

- Highlight your leadership skills and ability to manage a team effectively.

- Quantify your accomplishments to demonstrate the impact of your work.

- Use keywords relevant to the job description to optimize your resume for ATS.

- Proofread your resume carefully before submitting it.

Essential Experience Highlights for a Strong Tax Manager Resume

- Managed a team of 10 tax accountants, providing guidance on complex tax matters and ensuring compliance with federal and state regulations.

- Developed and implemented a new tax accounting system that streamlined processes and improved efficiency by 25%.

- Negotiated and settled tax audits with various taxing authorities, resulting in significant savings for the company.

- Provided expert tax advice to senior management on strategic business decisions, including mergers and acquisitions.

- Developed and presented training programs on tax laws and best practices to internal and external stakeholders.

- Managed a portfolio of high-net-worth individuals, providing comprehensive tax planning and compliance services.

- Established and maintained relationships with external tax advisors, including attorneys and CPAs.

Frequently Asked Questions (FAQ’s) For Tax Manager

What are the key skills and qualifications required for a Tax Manager?

Key skills and qualifications include a Master’s in Taxation or Accounting, expertise in tax accounting, auditing, and compliance, strong leadership and communication skills, and experience managing a team.

What are the primary responsibilities of a Tax Manager?

Primary responsibilities include managing a team of tax professionals, developing and implementing tax strategies, negotiating with tax authorities, and providing tax advice to clients.

What are the career prospects for a Tax Manager?

Tax Managers can advance to roles such as Tax Director, Controller, or CFO, or specialize in areas such as international taxation or tax consulting.

What is the average salary for a Tax Manager?

The average salary for a Tax Manager in the United States is approximately $120,000 per year.

What are the challenges faced by Tax Managers?

Tax Managers face challenges such as the constant evolution of tax laws, the need to stay up-to-date on tax regulations, and the pressure to minimize tax liabilities for clients while ensuring compliance.

What are the key industry trends impacting Tax Managers?

Key industry trends impacting Tax Managers include the increasing globalization of businesses, the growing complexity of tax laws, and the use of technology in tax management.