Are you a seasoned Tax Preparer seeking a new career path? Discover our professionally built Tax Preparer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

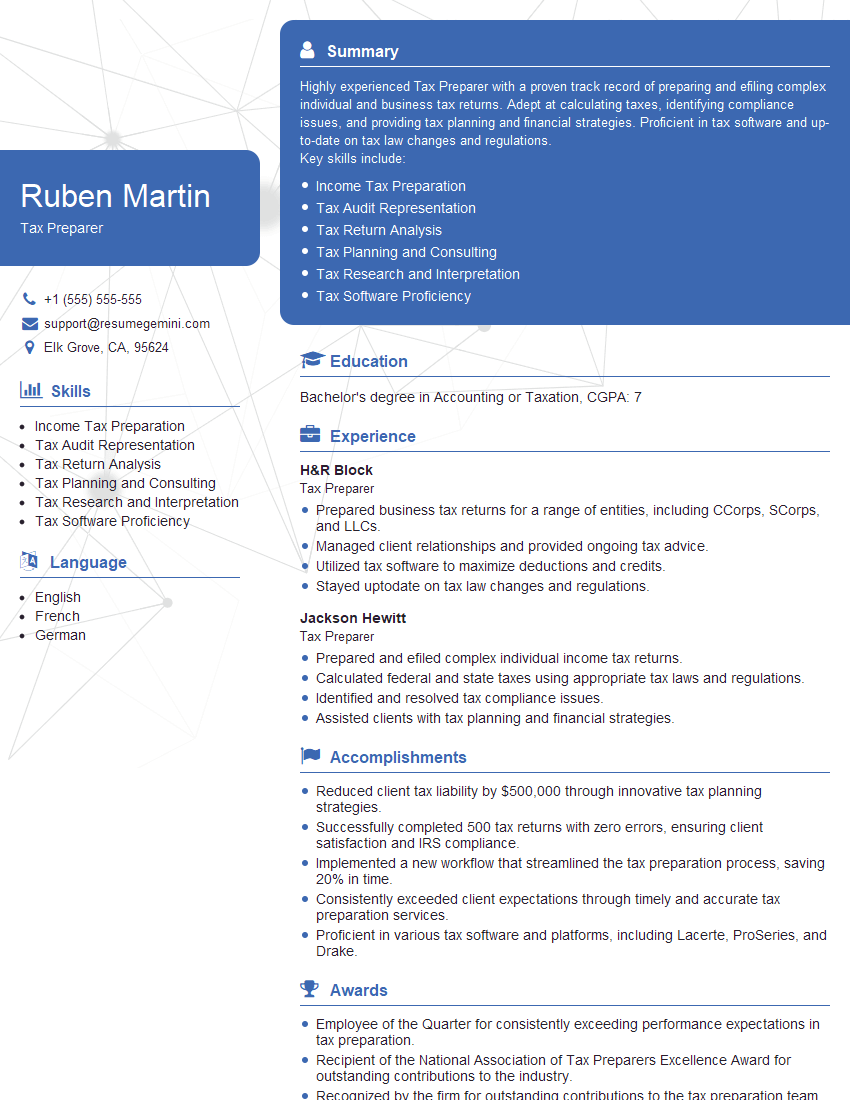

Ruben Martin

Tax Preparer

Summary

Highly experienced Tax Preparer with a proven track record of preparing and efiling complex individual and business tax returns. Adept at calculating taxes, identifying compliance issues, and providing tax planning and financial strategies. Proficient in tax software and up-to-date on tax law changes and regulations.

Key skills include:

- Income Tax Preparation

- Tax Audit Representation

- Tax Return Analysis

- Tax Planning and Consulting

- Tax Research and Interpretation

- Tax Software Proficiency

Education

Bachelor’s degree in Accounting or Taxation

December 2017

Skills

- Income Tax Preparation

- Tax Audit Representation

- Tax Return Analysis

- Tax Planning and Consulting

- Tax Research and Interpretation

- Tax Software Proficiency

Work Experience

Tax Preparer

- Prepared business tax returns for a range of entities, including CCorps, SCorps, and LLCs.

- Managed client relationships and provided ongoing tax advice.

- Utilized tax software to maximize deductions and credits.

- Stayed uptodate on tax law changes and regulations.

Tax Preparer

- Prepared and efiled complex individual income tax returns.

- Calculated federal and state taxes using appropriate tax laws and regulations.

- Identified and resolved tax compliance issues.

- Assisted clients with tax planning and financial strategies.

Accomplishments

- Reduced client tax liability by $500,000 through innovative tax planning strategies.

- Successfully completed 500 tax returns with zero errors, ensuring client satisfaction and IRS compliance.

- Implemented a new workflow that streamlined the tax preparation process, saving 20% in time.

- Consistently exceeded client expectations through timely and accurate tax preparation services.

- Proficient in various tax software and platforms, including Lacerte, ProSeries, and Drake.

Awards

- Employee of the Quarter for consistently exceeding performance expectations in tax preparation.

- Recipient of the National Association of Tax Preparers Excellence Award for outstanding contributions to the industry.

- Recognized by the firm for outstanding contributions to the tax preparation team.

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- IRS Enrolled Agent (EA)

- Registered Tax Return Preparer (RTRP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Preparer

- Highlight your technical skills and proficiency in tax preparation software.

- Quantify your accomplishments and provide specific examples of how you have saved clients money or resolved complex tax issues.

- Demonstrate your understanding of tax laws and regulations, including any specialized knowledge or certifications.

- Showcase your ability to work independently and manage multiple clients effectively.

- Emphasize your commitment to continuing education and staying up-to-date on tax law changes.

Essential Experience Highlights for a Strong Tax Preparer Resume

- Prepare and efile complex individual and business income tax returns, ensuring accuracy and compliance.

- Calculate federal and state taxes using appropriate tax laws and regulations, maximizing deductions and credits.

- Identify and resolve tax compliance issues, ensuring clients meet their tax obligations.

- Assist clients with tax planning and financial strategies, optimizing their tax positions.

- Utilize tax software to streamline processes and enhance efficiency.

- Stay up-to-date on tax law changes and regulations, ensuring expertise and compliance.

- Manage client relationships, providing personalized tax advice and support.

Frequently Asked Questions (FAQ’s) For Tax Preparer

What education and qualifications are required to become a Tax Preparer?

Most Tax Preparers have a bachelor’s degree in accounting or taxation. Some may also have a Master’s degree in taxation or a related field.

What are the key responsibilities of a Tax Preparer?

Tax Preparers are responsible for preparing and filing tax returns for individuals and businesses. They must stay up-to-date on tax laws and regulations, and they must be able to identify and resolve tax compliance issues.

What skills are important for a successful Tax Preparer?

Tax Preparers need strong analytical and problem-solving skills. They must also be able to communicate effectively with clients and tax authorities.

What is the job outlook for Tax Preparers?

The job outlook for Tax Preparers is expected to be good in the coming years. The demand for tax preparation services is expected to grow as the tax code becomes more complex.

How can I advance my career as a Tax Preparer?

Tax Preparers can advance their careers by obtaining additional certifications and training. They can also specialize in a particular area of taxation, such as international taxation or estate planning.

What is the average salary for a Tax Preparer?

The average salary for a Tax Preparer is around $50,000 per year. However, salaries can vary depending on experience, location, and employer.

What are the benefits of working as a Tax Preparer?

Tax Preparers enjoy a variety of benefits, including flexible work hours, opportunities for advancement, and the satisfaction of helping others.

What are the challenges of working as a Tax Preparer?

Tax Preparers face a number of challenges, including the need to stay up-to-date on tax laws and regulations, the pressure to meet deadlines, and the potential for liability if they make a mistake on a tax return.