Are you a seasoned Tax Representative seeking a new career path? Discover our professionally built Tax Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

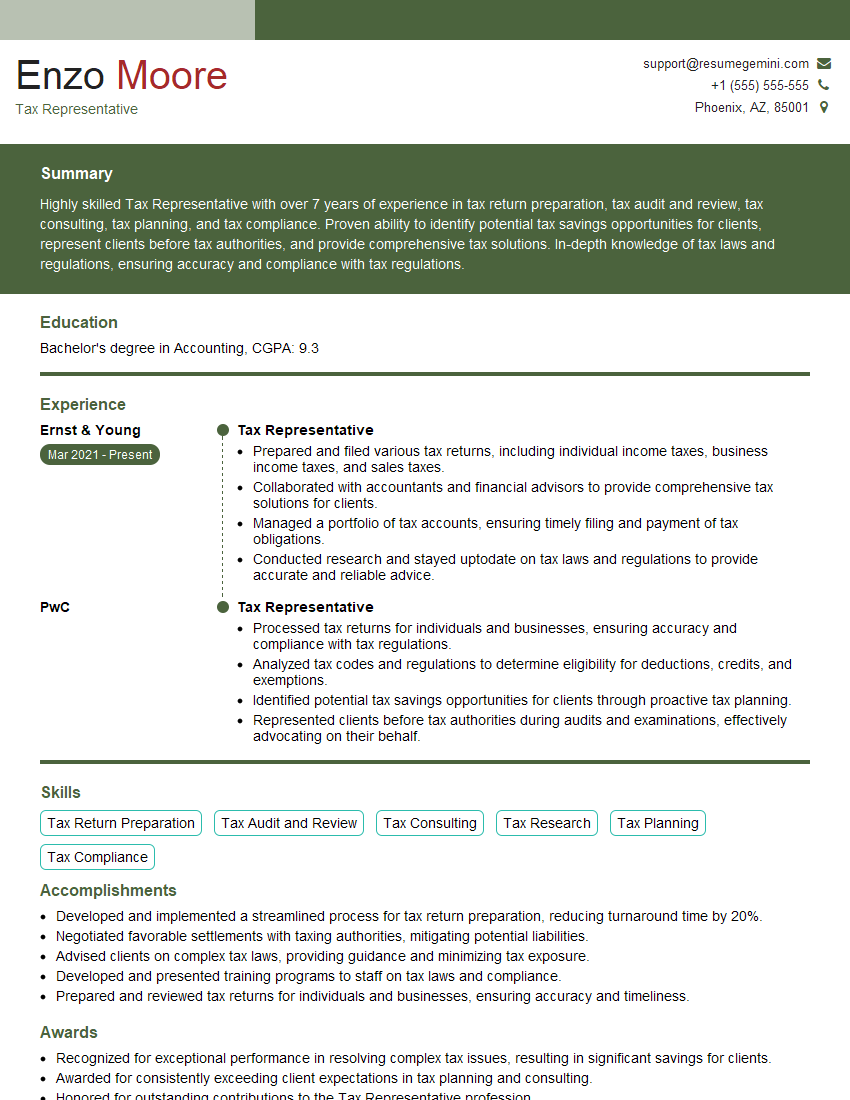

Enzo Moore

Tax Representative

Summary

Highly skilled Tax Representative with over 7 years of experience in tax return preparation, tax audit and review, tax consulting, tax planning, and tax compliance. Proven ability to identify potential tax savings opportunities for clients, represent clients before tax authorities, and provide comprehensive tax solutions. In-depth knowledge of tax laws and regulations, ensuring accuracy and compliance with tax regulations.

Education

Bachelor’s degree in Accounting

February 2017

Skills

- Tax Return Preparation

- Tax Audit and Review

- Tax Consulting

- Tax Research

- Tax Planning

- Tax Compliance

Work Experience

Tax Representative

- Prepared and filed various tax returns, including individual income taxes, business income taxes, and sales taxes.

- Collaborated with accountants and financial advisors to provide comprehensive tax solutions for clients.

- Managed a portfolio of tax accounts, ensuring timely filing and payment of tax obligations.

- Conducted research and stayed uptodate on tax laws and regulations to provide accurate and reliable advice.

Tax Representative

- Processed tax returns for individuals and businesses, ensuring accuracy and compliance with tax regulations.

- Analyzed tax codes and regulations to determine eligibility for deductions, credits, and exemptions.

- Identified potential tax savings opportunities for clients through proactive tax planning.

- Represented clients before tax authorities during audits and examinations, effectively advocating on their behalf.

Accomplishments

- Developed and implemented a streamlined process for tax return preparation, reducing turnaround time by 20%.

- Negotiated favorable settlements with taxing authorities, mitigating potential liabilities.

- Advised clients on complex tax laws, providing guidance and minimizing tax exposure.

- Developed and presented training programs to staff on tax laws and compliance.

- Prepared and reviewed tax returns for individuals and businesses, ensuring accuracy and timeliness.

Awards

- Recognized for exceptional performance in resolving complex tax issues, resulting in significant savings for clients.

- Awarded for consistently exceeding client expectations in tax planning and consulting.

- Honored for outstanding contributions to the Tax Representative profession.

- Certified Tax Representative with a proven track record of accuracy and compliance.

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Accredited Tax Advisor (ATA)

- Taxation Specialist

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Representative

- Highlight your technical skills and knowledge of tax laws and regulations.

- Showcase your ability to analyze complex tax situations and identify potential tax savings opportunities.

- Emphasize your communication and interpersonal skills, as you will be interacting with clients and tax authorities.

- Include any relevant certifications or professional development courses you have completed.

Essential Experience Highlights for a Strong Tax Representative Resume

- Processed tax returns for individuals and businesses, ensuring accuracy and compliance with tax regulations.

- Analyzed tax codes and regulations to determine eligibility for deductions, credits, and exemptions.

- Identified potential tax savings opportunities for clients through proactive tax planning.

- Represented clients before tax authorities during audits and examinations, effectively advocating on their behalf.

- Prepared and filed various tax returns, including individual income taxes, business income taxes, and sales taxes.

- Collaborated with accountants and financial advisors to provide comprehensive tax solutions for clients.

Frequently Asked Questions (FAQ’s) For Tax Representative

What are the key skills and qualifications for a Tax Representative?

A Tax Representative typically requires a bachelor’s degree in accounting, along with strong analytical, communication, and interpersonal skills. They should have a deep understanding of tax laws and regulations, as well as experience in tax return preparation, tax audit and review, and tax planning.

What are the primary responsibilities of a Tax Representative?

The primary responsibilities of a Tax Representative include preparing and filing tax returns, representing clients before tax authorities, identifying potential tax savings opportunities, and providing tax planning advice. They may also be responsible for conducting research and staying up-to-date on tax laws and regulations.

What are the career prospects for a Tax Representative?

Tax Representatives with strong skills and experience can advance to senior positions within their organization or move into other related fields, such as tax accounting or financial planning. Some may also choose to start their own tax preparation or consulting business.

What are the challenges faced by Tax Representatives?

Tax Representatives face a number of challenges, including the need to stay up-to-date on constantly changing tax laws and regulations. They may also face pressure to meet deadlines and manage multiple clients.

What is the job outlook for Tax Representatives?

The job outlook for Tax Representatives is expected to grow faster than average in the coming years due to the increasing complexity of tax laws and regulations. As businesses and individuals become more aware of the importance of tax planning, the demand for qualified Tax Representatives is likely to increase.