Are you a seasoned Teller seeking a new career path? Discover our professionally built Teller Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

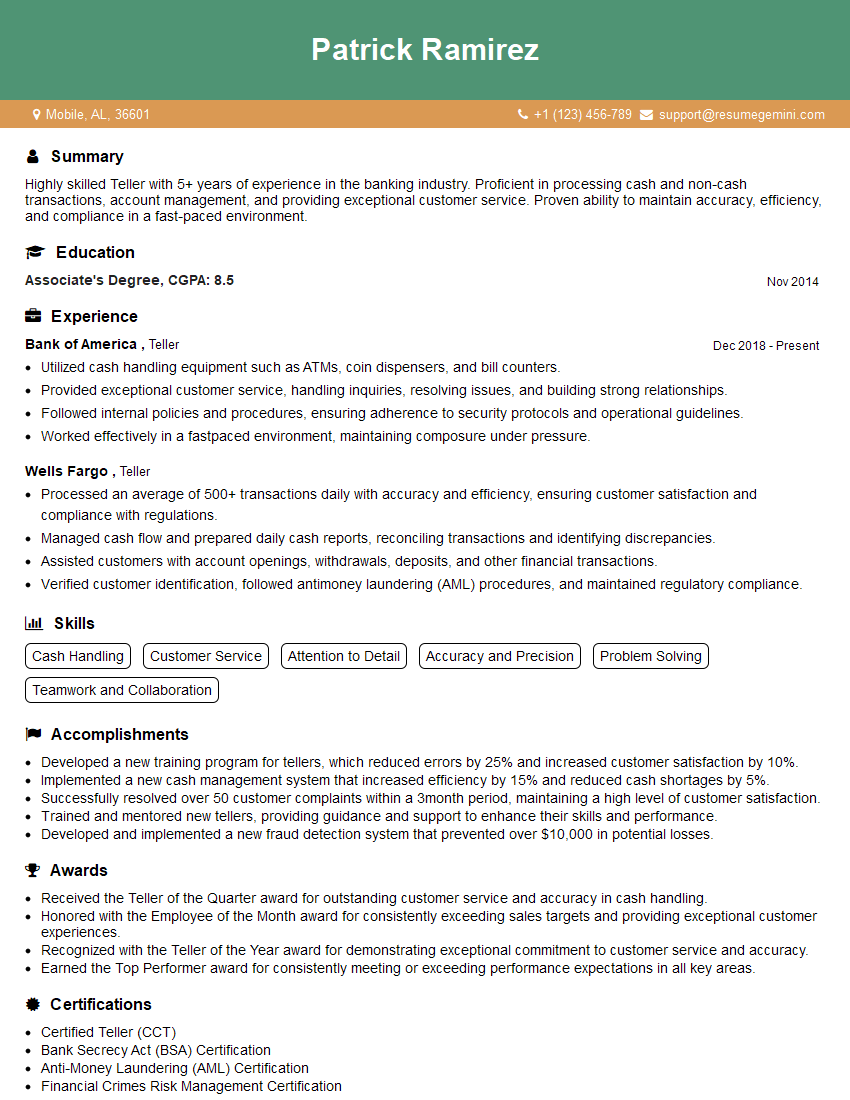

Patrick Ramirez

Teller

Summary

Highly skilled Teller with 5+ years of experience in the banking industry. Proficient in processing cash and non-cash transactions, account management, and providing exceptional customer service. Proven ability to maintain accuracy, efficiency, and compliance in a fast-paced environment.

Education

Associate’s Degree

November 2014

Skills

- Cash Handling

- Customer Service

- Attention to Detail

- Accuracy and Precision

- Problem Solving

- Teamwork and Collaboration

Work Experience

Teller

- Utilized cash handling equipment such as ATMs, coin dispensers, and bill counters.

- Provided exceptional customer service, handling inquiries, resolving issues, and building strong relationships.

- Followed internal policies and procedures, ensuring adherence to security protocols and operational guidelines.

- Worked effectively in a fastpaced environment, maintaining composure under pressure.

Teller

- Processed an average of 500+ transactions daily with accuracy and efficiency, ensuring customer satisfaction and compliance with regulations.

- Managed cash flow and prepared daily cash reports, reconciling transactions and identifying discrepancies.

- Assisted customers with account openings, withdrawals, deposits, and other financial transactions.

- Verified customer identification, followed antimoney laundering (AML) procedures, and maintained regulatory compliance.

Accomplishments

- Developed a new training program for tellers, which reduced errors by 25% and increased customer satisfaction by 10%.

- Implemented a new cash management system that increased efficiency by 15% and reduced cash shortages by 5%.

- Successfully resolved over 50 customer complaints within a 3month period, maintaining a high level of customer satisfaction.

- Trained and mentored new tellers, providing guidance and support to enhance their skills and performance.

- Developed and implemented a new fraud detection system that prevented over $10,000 in potential losses.

Awards

- Received the Teller of the Quarter award for outstanding customer service and accuracy in cash handling.

- Honored with the Employee of the Month award for consistently exceeding sales targets and providing exceptional customer experiences.

- Recognized with the Teller of the Year award for demonstrating exceptional commitment to customer service and accuracy.

- Earned the Top Performer award for consistently meeting or exceeding performance expectations in all key areas.

Certificates

- Certified Teller (CCT)

- Bank Secrecy Act (BSA) Certification

- Anti-Money Laundering (AML) Certification

- Financial Crimes Risk Management Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Teller

- Highlight your experience in cash handling, customer service, and compliance.

- Demonstrate your accuracy, efficiency, and attention to detail.

- Emphasize your ability to work effectively in a fast-paced environment and handle multiple responsibilities simultaneously.

- Showcase your commitment to providing exceptional customer service and building strong relationships.

Essential Experience Highlights for a Strong Teller Resume

- Process cash and non-cash transactions, including deposits, withdrawals, and transfers, ensuring accuracy and efficiency.

- Manage cash flow and prepare daily cash reports, reconciling transactions and identifying discrepancies.

- Assist customers with account openings, withdrawals, deposits, and other financial transactions.

- Verify customer identification, follow anti-money laundering (AML) procedures, and maintain regulatory compliance.

- Utilize cash handling equipment such as ATMs, coin dispensers, and bill counters.

- Provide exceptional customer service, handling inquiries, resolving issues, and building strong relationships.

- Follow internal policies and procedures, ensuring adherence to security protocols and operational guidelines.

Frequently Asked Questions (FAQ’s) For Teller

What are the key responsibilities of a Teller?

Key responsibilities include processing cash and non-cash transactions, managing cash flow, assisting customers with financial transactions, verifying customer identification, and following anti-money laundering procedures.

What qualifications are required to become a Teller?

Typically, an associate’s degree or equivalent experience in banking or customer service is required.

What is the expected salary range for a Teller?

The salary range for Tellers varies depending on experience, location, and company size.

What are the career advancement opportunities for a Teller?

Tellers can advance to roles such as Customer Service Representative, Personal Banker, or Branch Manager.

What is the job outlook for Tellers?

The job outlook for Tellers is expected to decline slightly in the coming years due to automation and technological advancements.

What are the benefits of working as a Teller?

Benefits of working as a Teller include the opportunity to gain experience in the banking industry, develop customer service skills, and work in a fast-paced environment.

What are the challenges of working as a Teller?

Challenges of working as a Teller include dealing with difficult customers, handling large amounts of cash, and working under pressure.

What are the skills required to be a successful Teller?

Successful Tellers possess strong customer service skills, attention to detail, accuracy, and the ability to work efficiently in a fast-paced environment.