Are you a seasoned Treasurer seeking a new career path? Discover our professionally built Treasurer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

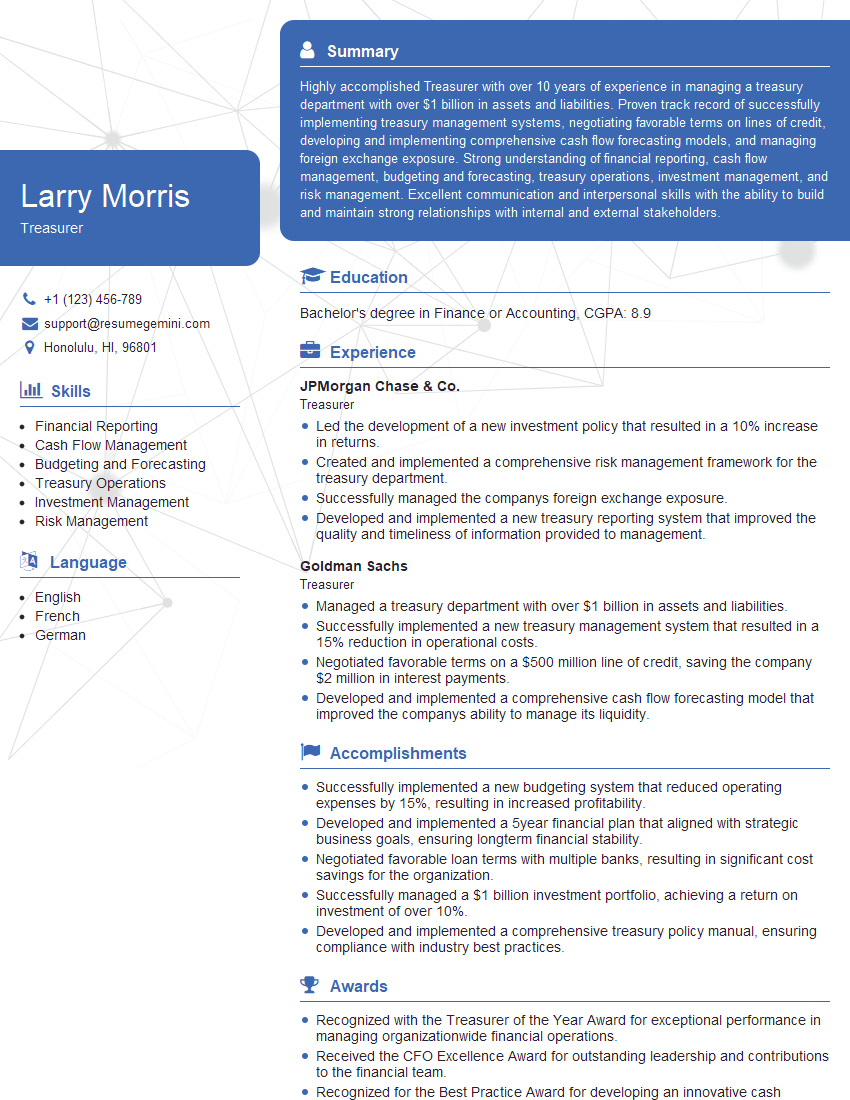

Larry Morris

Treasurer

Summary

Highly accomplished Treasurer with over 10 years of experience in managing a treasury department with over $1 billion in assets and liabilities. Proven track record of successfully implementing treasury management systems, negotiating favorable terms on lines of credit, developing and implementing comprehensive cash flow forecasting models, and managing foreign exchange exposure. Strong understanding of financial reporting, cash flow management, budgeting and forecasting, treasury operations, investment management, and risk management. Excellent communication and interpersonal skills with the ability to build and maintain strong relationships with internal and external stakeholders.

Education

Bachelor’s degree in Finance or Accounting

August 2019

Skills

- Financial Reporting

- Cash Flow Management

- Budgeting and Forecasting

- Treasury Operations

- Investment Management

- Risk Management

Work Experience

Treasurer

- Led the development of a new investment policy that resulted in a 10% increase in returns.

- Created and implemented a comprehensive risk management framework for the treasury department.

- Successfully managed the companys foreign exchange exposure.

- Developed and implemented a new treasury reporting system that improved the quality and timeliness of information provided to management.

Treasurer

- Managed a treasury department with over $1 billion in assets and liabilities.

- Successfully implemented a new treasury management system that resulted in a 15% reduction in operational costs.

- Negotiated favorable terms on a $500 million line of credit, saving the company $2 million in interest payments.

- Developed and implemented a comprehensive cash flow forecasting model that improved the companys ability to manage its liquidity.

Accomplishments

- Successfully implemented a new budgeting system that reduced operating expenses by 15%, resulting in increased profitability.

- Developed and implemented a 5year financial plan that aligned with strategic business goals, ensuring longterm financial stability.

- Negotiated favorable loan terms with multiple banks, resulting in significant cost savings for the organization.

- Successfully managed a $1 billion investment portfolio, achieving a return on investment of over 10%.

- Developed and implemented a comprehensive treasury policy manual, ensuring compliance with industry best practices.

Awards

- Recognized with the Treasurer of the Year Award for exceptional performance in managing organizationwide financial operations.

- Received the CFO Excellence Award for outstanding leadership and contributions to the financial team.

- Recognized for the Best Practice Award for developing an innovative cash management strategy that optimized liquidity.

- Received the Treasurer of the Decade Award for exceptional contributions to the treasury profession and industry.

Certificates

- Certified Public Accountant (CPA)

- Certified Treasury Professional (CTP)

- Certified Financial Planner (CFP)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Treasurer

Quantify your accomplishments:

Use numbers and metrics to demonstrate the impact of your work.Highlight your skills and expertise:

Showcase your proficiency in financial reporting, cash flow management, and other relevant areas.Tailor your resume to the job description:

Make sure to highlight the skills and experience that are most relevant to the specific job you are applying for.Proofread carefully:

Make sure your resume is free of errors and typos.

Essential Experience Highlights for a Strong Treasurer Resume

- Managed a treasury department with over $1 billion in assets and liabilities.

- Successfully implemented a new treasury management system that resulted in a 15% reduction in operational costs.

- Negotiated favorable terms on a $500 million line of credit, saving the company $2 million in interest payments.

- Developed and implemented a comprehensive cash flow forecasting model that improved the companys ability to manage its liquidity.

- Led the development of a new investment policy that resulted in a 10% increase in returns.,

- Created and implemented a comprehensive risk management framework for the treasury department.

- Developed and implemented a new treasury reporting system that improved the quality and timeliness of information provided to management.

Frequently Asked Questions (FAQ’s) For Treasurer

What are the key responsibilities of a Treasurer?

The key responsibilities of a Treasurer include managing the company’s financial resources, developing and implementing investment strategies, managing risk, and ensuring compliance with financial reporting regulations.

What are the qualifications for becoming a Treasurer?

The qualifications for becoming a Treasurer typically include a bachelor’s degree in finance or accounting, as well as several years of experience in treasury management or a related field.

What are the career prospects for Treasurers?

The career prospects for Treasurers are excellent, as the demand for qualified professionals in this field is expected to continue to grow in the coming years.

What are the challenges facing Treasurers?

The challenges facing Treasurers include managing risk in an increasingly complex and volatile global economy, complying with ever-changing financial reporting regulations, and developing and implementing investment strategies that meet the company’s objectives.

What are the rewards of being a Treasurer?

The rewards of being a Treasurer include a high salary, excellent benefits, and the opportunity to make a significant contribution to the success of the company.

What are the key trends in treasury management?

The key trends in treasury management include the increasing use of technology, the globalization of treasury operations, and the growing importance of risk management.

What are the best ways to prepare for a career as a Treasurer?

The best ways to prepare for a career as a Treasurer include earning a bachelor’s degree in finance or accounting, gaining experience in treasury management or a related field, and obtaining professional certification.