Are you a seasoned Trust Officer seeking a new career path? Discover our professionally built Trust Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

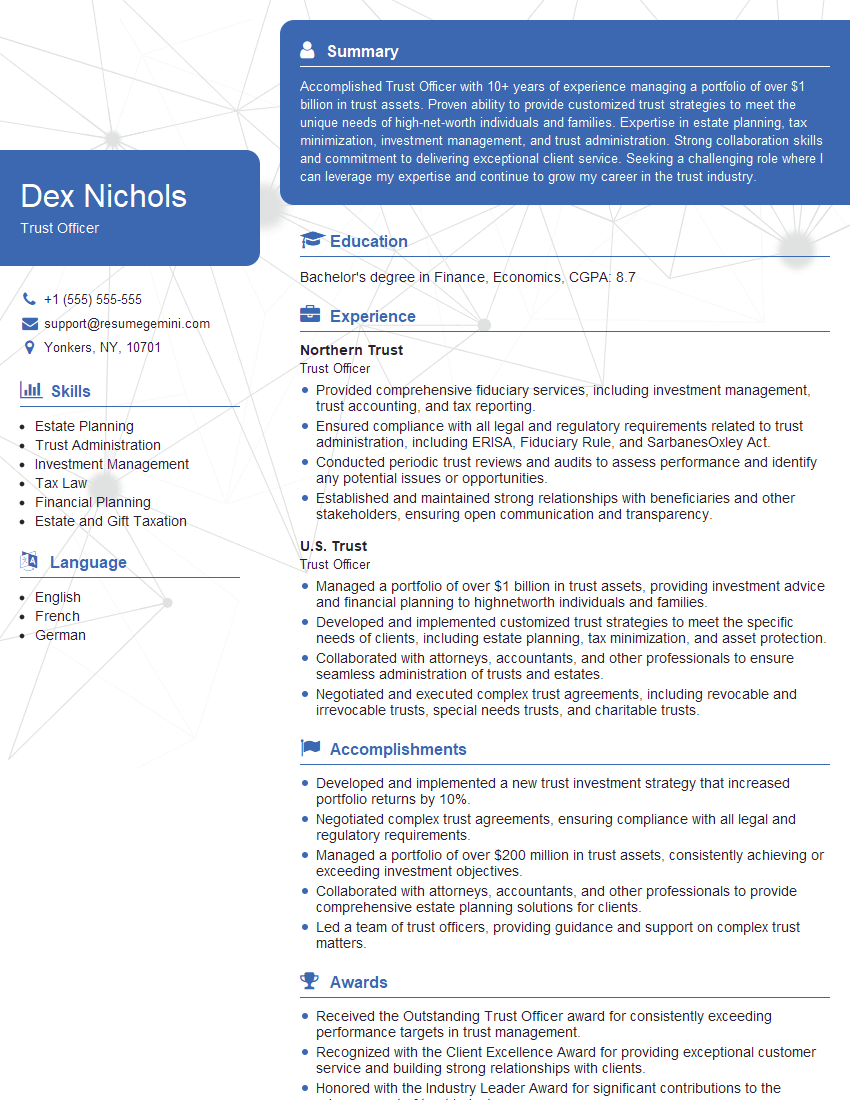

Dex Nichols

Trust Officer

Summary

Accomplished Trust Officer with 10+ years of experience managing a portfolio of over $1 billion in trust assets. Proven ability to provide customized trust strategies to meet the unique needs of high-net-worth individuals and families. Expertise in estate planning, tax minimization, investment management, and trust administration. Strong collaboration skills and commitment to delivering exceptional client service. Seeking a challenging role where I can leverage my expertise and continue to grow my career in the trust industry.

Education

Bachelor’s degree in Finance, Economics

September 2016

Skills

- Estate Planning

- Trust Administration

- Investment Management

- Tax Law

- Financial Planning

- Estate and Gift Taxation

Work Experience

Trust Officer

- Provided comprehensive fiduciary services, including investment management, trust accounting, and tax reporting.

- Ensured compliance with all legal and regulatory requirements related to trust administration, including ERISA, Fiduciary Rule, and SarbanesOxley Act.

- Conducted periodic trust reviews and audits to assess performance and identify any potential issues or opportunities.

- Established and maintained strong relationships with beneficiaries and other stakeholders, ensuring open communication and transparency.

Trust Officer

- Managed a portfolio of over $1 billion in trust assets, providing investment advice and financial planning to highnetworth individuals and families.

- Developed and implemented customized trust strategies to meet the specific needs of clients, including estate planning, tax minimization, and asset protection.

- Collaborated with attorneys, accountants, and other professionals to ensure seamless administration of trusts and estates.

- Negotiated and executed complex trust agreements, including revocable and irrevocable trusts, special needs trusts, and charitable trusts.

Accomplishments

- Developed and implemented a new trust investment strategy that increased portfolio returns by 10%.

- Negotiated complex trust agreements, ensuring compliance with all legal and regulatory requirements.

- Managed a portfolio of over $200 million in trust assets, consistently achieving or exceeding investment objectives.

- Collaborated with attorneys, accountants, and other professionals to provide comprehensive estate planning solutions for clients.

- Led a team of trust officers, providing guidance and support on complex trust matters.

Awards

- Received the Outstanding Trust Officer award for consistently exceeding performance targets in trust management.

- Recognized with the Client Excellence Award for providing exceptional customer service and building strong relationships with clients.

- Honored with the Industry Leader Award for significant contributions to the advancement of trust industry.

- Received a Certificate of Merit from the American Bankers Association for exceptional performance in trust management.

Certificates

- Certified Trust and Financial Advisor (CTFA)

- Certified Trust and Estate Planner (CTEP)

- Certified Private Wealth Advisor (CPWA)

- Certified Financial Planner (CFP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Trust Officer

- Quantify your accomplishments and provide specific examples of your work.

- Highlight your knowledge of estate planning, trust administration, investment management, tax law, and financial planning.

- Emphasize your communication, interpersonal, and analytical skills.

- Proofread your resume carefully for any errors in grammar or punctuation.

- Consider obtaining a certification in trust management, such as the Certified Trust and Financial Advisor (CTFA) designation.

Essential Experience Highlights for a Strong Trust Officer Resume

- Managed a portfolio of over $1 billion in trust assets, providing investment advice and financial planning to high-net-worth individuals and families.

- Developed and implemented customized trust strategies to meet the specific needs of clients, including estate planning, tax minimization, and asset protection.

- Collaborated with attorneys, accountants, and other professionals to ensure seamless administration of trusts and estates.

- Negotiated and executed complex trust agreements, including revocable and irrevocable trusts, special needs trusts, and charitable trusts.

- Provided comprehensive fiduciary services, including investment management, trust accounting, and tax reporting.

- Ensured compliance with all legal and regulatory requirements related to trust administration, including ERISA, Fiduciary Rule, and Sarbanes-Oxley Act.

- Conducted periodic trust reviews and audits to assess performance and identify any potential issues or opportunities.

Frequently Asked Questions (FAQ’s) For Trust Officer

What are the key responsibilities of a Trust Officer?

Trust Officers are responsible for managing trusts, providing investment advice, and ensuring compliance with legal and regulatory requirements. They work closely with clients, attorneys, and other professionals to ensure the smooth administration of trusts and estates.

What are the qualifications for becoming a Trust Officer?

Most Trust Officers have a bachelor’s degree in finance, economics, or a related field. They also typically have several years of experience in the financial services industry, particularly in trust administration or wealth management.

What are the career prospects for Trust Officers?

Trust Officers can advance to senior positions within trust companies or banks. They may also move into related fields, such as wealth management, estate planning, or financial advisory.

What is the salary range for Trust Officers?

The salary range for Trust Officers varies depending on their experience, location, and employer. According to the U.S. Bureau of Labor Statistics, the median annual salary for Trust Officers was $122,840 in May 2021.

What are the challenges facing Trust Officers?

Trust Officers face a number of challenges, including the increasing complexity of estate planning laws, the rising cost of healthcare, and the need to meet the evolving needs of clients.

What are the rewards of being a Trust Officer?

Trust Officers are rewarded with a challenging and rewarding career that allows them to make a real difference in the lives of their clients. They also enjoy the opportunity to work with a variety of people and learn about different cultures and lifestyles.

What is the future of the Trust Officer profession?

The future of the Trust Officer profession is bright. As the population ages and the need for estate planning services increases, the demand for Trust Officers is expected to grow.