Are you a seasoned Trustee seeking a new career path? Discover our professionally built Trustee Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

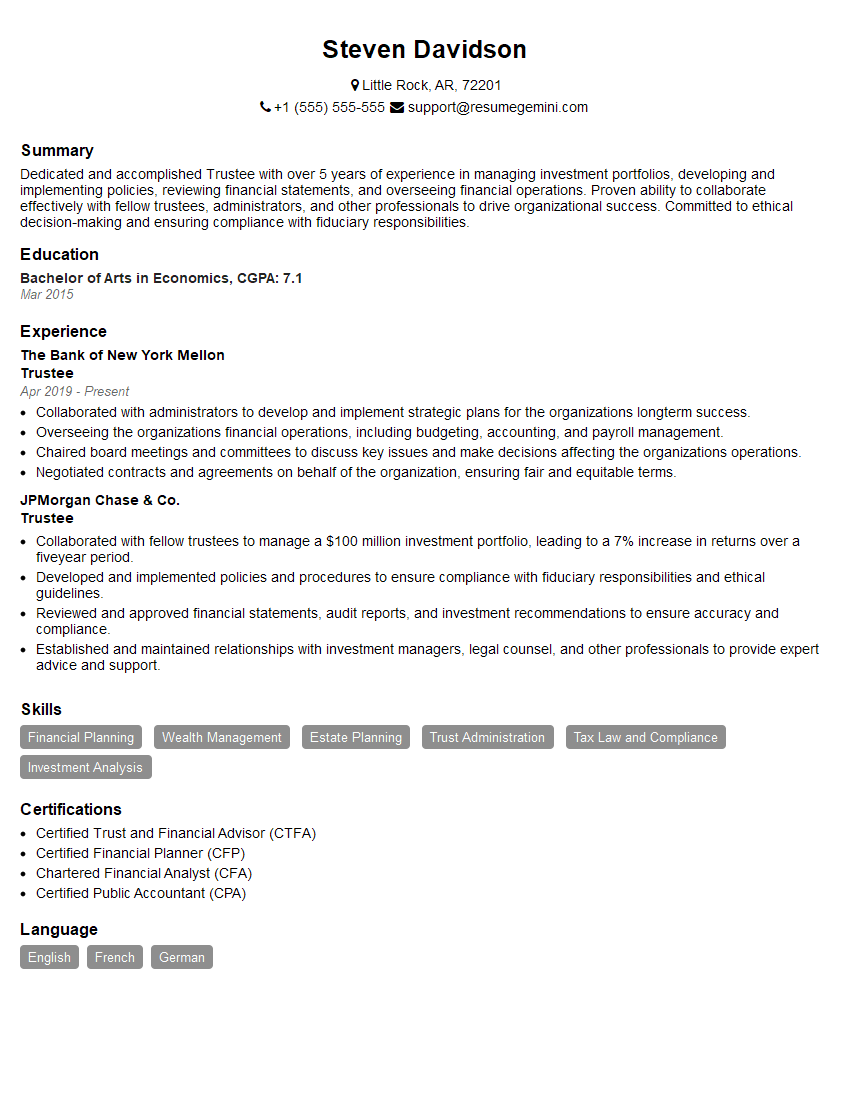

Steven Davidson

Trustee

Summary

Dedicated and accomplished Trustee with over 5 years of experience in managing investment portfolios, developing and implementing policies, reviewing financial statements, and overseeing financial operations. Proven ability to collaborate effectively with fellow trustees, administrators, and other professionals to drive organizational success. Committed to ethical decision-making and ensuring compliance with fiduciary responsibilities.

Education

Bachelor of Arts in Economics

March 2015

Skills

- Financial Planning

- Wealth Management

- Estate Planning

- Trust Administration

- Tax Law and Compliance

- Investment Analysis

Work Experience

Trustee

- Collaborated with administrators to develop and implement strategic plans for the organizations longterm success.

- Overseeing the organizations financial operations, including budgeting, accounting, and payroll management.

- Chaired board meetings and committees to discuss key issues and make decisions affecting the organizations operations.

- Negotiated contracts and agreements on behalf of the organization, ensuring fair and equitable terms.

Trustee

- Collaborated with fellow trustees to manage a $100 million investment portfolio, leading to a 7% increase in returns over a fiveyear period.

- Developed and implemented policies and procedures to ensure compliance with fiduciary responsibilities and ethical guidelines.

- Reviewed and approved financial statements, audit reports, and investment recommendations to ensure accuracy and compliance.

- Established and maintained relationships with investment managers, legal counsel, and other professionals to provide expert advice and support.

Certificates

- Certified Trust and Financial Advisor (CTFA)

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Trustee

Highlight your financial management skills.

Trustees are responsible for managing large sums of money, so it’s important to have a strong understanding of financial planning, wealth management, and investment analysis.Demonstrate your commitment to ethics and compliance.

Trustees must act in the best interests of the beneficiaries, so it’s important to have a strong ethical compass and a commitment to following all applicable laws and regulations.Show your ability to work collaboratively.

Trustees often work with other trustees, administrators, and professionals, so it’s important to be able to work effectively in a team environment.Tailor your resume to each job you apply for.

Take the time to read the job description carefully and highlight the skills and experience that are most relevant to the position.Proofread your resume carefully before submitting it.

Make sure there are no errors in grammar or spelling, and that your resume is formatted in a professional manner.

Essential Experience Highlights for a Strong Trustee Resume

- Managed a $100 million investment portfolio, leading to a 7% increase in returns over a five-year period.

- Developed and implemented policies and procedures to ensure compliance with fiduciary responsibilities and ethical guidelines.

- Collaborated with fellow trustees to make decisions affecting the organization’s operations.

- Overseeing the organization’s financial operations, including budgeting, accounting, and payroll management.

- Negotiated contracts and agreements on behalf of the organization, ensuring fair and equitable terms.

- Established and maintained relationships with investment managers, legal counsel, and other professionals to provide expert advice and support.

Frequently Asked Questions (FAQ’s) For Trustee

What is the role of a Trustee?

A Trustee is a person or organization that is appointed to manage the assets of a trust. Trustees have a fiduciary duty to act in the best interests of the beneficiaries of the trust.

What are the qualifications to become a Trustee?

There are no specific educational requirements to become a Trustee, but most Trustees have a background in finance, law, or accounting.

What are the responsibilities of a Trustee?

The responsibilities of a Trustee include managing the trust’s assets, investing the trust’s money, and distributing the trust’s income and principal to the beneficiaries.

How much do Trustees make?

The salary of a Trustee varies depending on the size of the trust and the complexity of the Trustee’s responsibilities.

What is the difference between a Trustee and an Executor?

A Trustee is appointed to manage the assets of a trust, while an Executor is appointed to administer the estate of a deceased person.

What is the difference between a Trustee and a Guardian?

A Trustee is appointed to manage the assets of a trust, while a Guardian is appointed to care for the person and property of a minor or incapacitated person.

What is the difference between a Trustee and a Conservator?

A Trustee is appointed to manage the assets of a trust, while a Conservator is appointed to manage the finances of an incapacitated person.