Are you a seasoned Underwriter seeking a new career path? Discover our professionally built Underwriter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

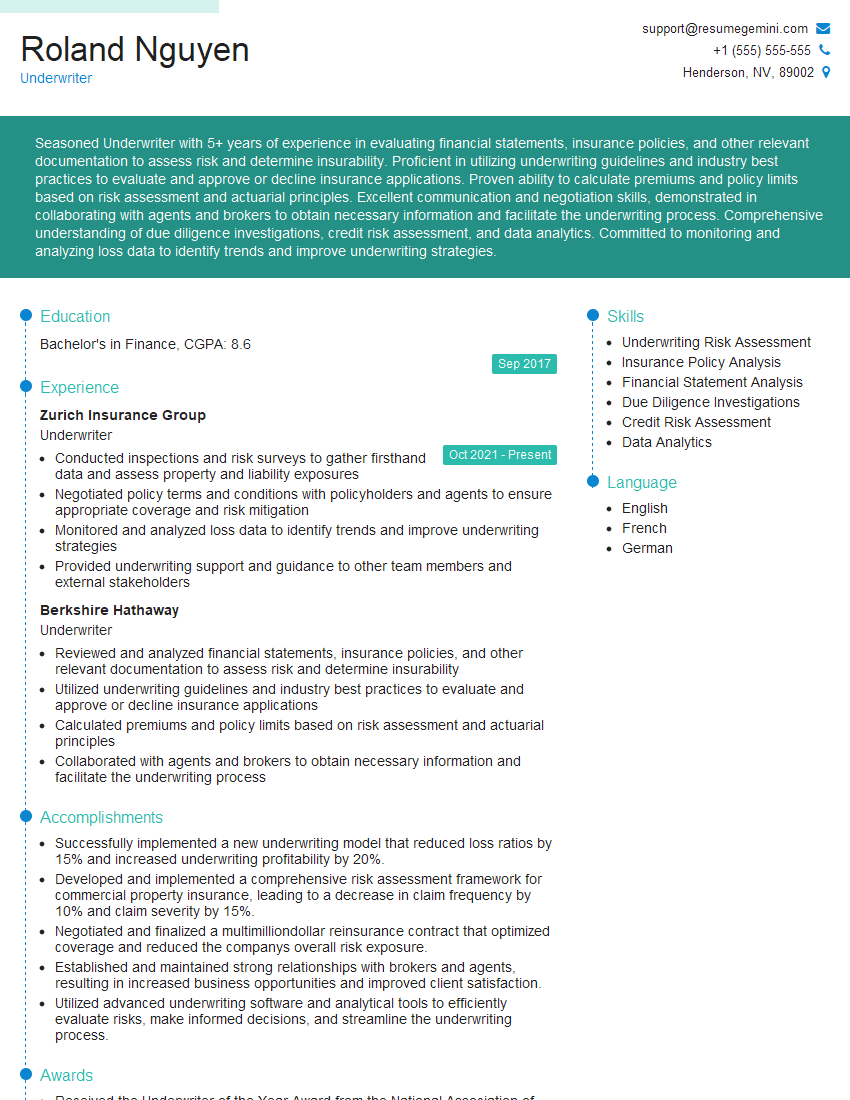

Roland Nguyen

Underwriter

Summary

Seasoned Underwriter with 5+ years of experience in evaluating financial statements, insurance policies, and other relevant documentation to assess risk and determine insurability. Proficient in utilizing underwriting guidelines and industry best practices to evaluate and approve or decline insurance applications. Proven ability to calculate premiums and policy limits based on risk assessment and actuarial principles. Excellent communication and negotiation skills, demonstrated in collaborating with agents and brokers to obtain necessary information and facilitate the underwriting process. Comprehensive understanding of due diligence investigations, credit risk assessment, and data analytics. Committed to monitoring and analyzing loss data to identify trends and improve underwriting strategies.

Education

Bachelor’s in Finance

September 2017

Skills

- Underwriting Risk Assessment

- Insurance Policy Analysis

- Financial Statement Analysis

- Due Diligence Investigations

- Credit Risk Assessment

- Data Analytics

Work Experience

Underwriter

- Conducted inspections and risk surveys to gather firsthand data and assess property and liability exposures

- Negotiated policy terms and conditions with policyholders and agents to ensure appropriate coverage and risk mitigation

- Monitored and analyzed loss data to identify trends and improve underwriting strategies

- Provided underwriting support and guidance to other team members and external stakeholders

Underwriter

- Reviewed and analyzed financial statements, insurance policies, and other relevant documentation to assess risk and determine insurability

- Utilized underwriting guidelines and industry best practices to evaluate and approve or decline insurance applications

- Calculated premiums and policy limits based on risk assessment and actuarial principles

- Collaborated with agents and brokers to obtain necessary information and facilitate the underwriting process

Accomplishments

- Successfully implemented a new underwriting model that reduced loss ratios by 15% and increased underwriting profitability by 20%.

- Developed and implemented a comprehensive risk assessment framework for commercial property insurance, leading to a decrease in claim frequency by 10% and claim severity by 15%.

- Negotiated and finalized a multimilliondollar reinsurance contract that optimized coverage and reduced the companys overall risk exposure.

- Established and maintained strong relationships with brokers and agents, resulting in increased business opportunities and improved client satisfaction.

- Utilized advanced underwriting software and analytical tools to efficiently evaluate risks, make informed decisions, and streamline the underwriting process.

Awards

- Received the Underwriter of the Year Award from the National Association of Insurance Underwriters for outstanding performance and contributions to the insurance industry.

- Honored with the Risk Manager of the Year Award from the Insurance Information Institute for demonstrating excellence in risk management and underwriting.

Certificates

- Associate in Underwriting (AU)

- Certified Insurance Underwriter (CIU)

- Associate in Reinsurance (ARe)

- Chartered Property Casualty Underwriter (CPCU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Underwriter

- Highlight your understanding of underwriting principles and industry best practices.

- Showcase your analytical skills and ability to interpret financial data.

- Emphasize your experience in risk assessment and loss analysis.

- Demonstrate your ability to communicate complex underwriting concepts clearly and effectively.

Essential Experience Highlights for a Strong Underwriter Resume

- Review and analyze financial statements, insurance policies, and other relevant documentation to assess risk and determine insurability.

- Utilize underwriting guidelines and industry best practices to evaluate and approve or decline insurance applications.

- Calculate premiums and policy limits based on risk assessment and actuarial principles.

- Collaborate with agents and brokers to obtain necessary information and facilitate the underwriting process.

- Conduct inspections and risk surveys to gather firsthand data and assess property and liability exposures.

- Negotiate policy terms and conditions with policyholders and agents to ensure appropriate coverage and risk mitigation.

Frequently Asked Questions (FAQ’s) For Underwriter

What is the role of an Underwriter?

An Underwriter assesses risk and determines the insurability of individuals or businesses seeking insurance coverage.

What skills are required to be a successful Underwriter?

Underwriters need strong analytical, financial, and communication skills, as well as a deep understanding of insurance principles and risk assessment techniques.

What is the career path for an Underwriter?

Underwriters can advance to senior underwriting roles, management positions, or specialize in specific areas of insurance, such as property, casualty, or life insurance.

What is the salary range for Underwriters?

The salary range for Underwriters varies depending on experience, location, and industry, but typically falls between $60,000 and $100,000 per year.

What is the job outlook for Underwriters?

The job outlook for Underwriters is expected to be positive in the coming years due to the increasing demand for insurance coverage.