Are you a seasoned Underwriting Assistant seeking a new career path? Discover our professionally built Underwriting Assistant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

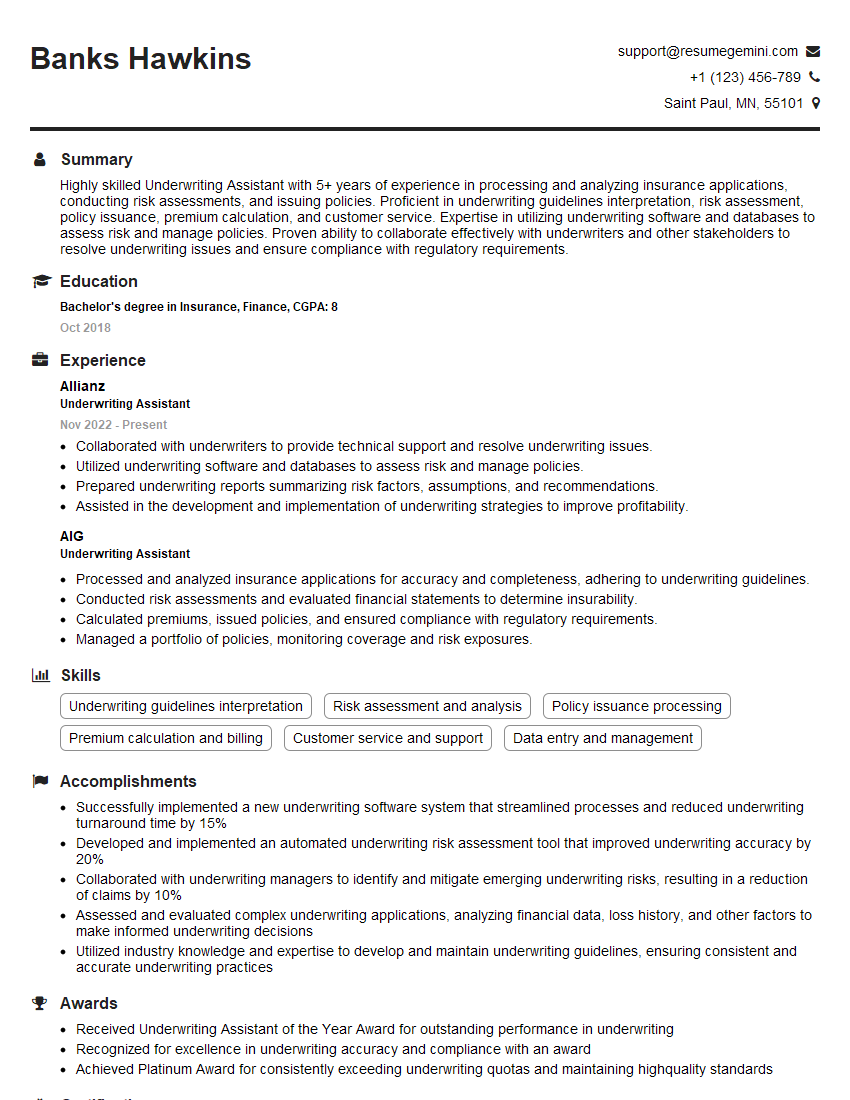

Banks Hawkins

Underwriting Assistant

Summary

Highly skilled Underwriting Assistant with 5+ years of experience in processing and analyzing insurance applications, conducting risk assessments, and issuing policies. Proficient in underwriting guidelines interpretation, risk assessment, policy issuance, premium calculation, and customer service. Expertise in utilizing underwriting software and databases to assess risk and manage policies. Proven ability to collaborate effectively with underwriters and other stakeholders to resolve underwriting issues and ensure compliance with regulatory requirements.

Education

Bachelor’s degree in Insurance, Finance

October 2018

Skills

- Underwriting guidelines interpretation

- Risk assessment and analysis

- Policy issuance processing

- Premium calculation and billing

- Customer service and support

- Data entry and management

Work Experience

Underwriting Assistant

- Collaborated with underwriters to provide technical support and resolve underwriting issues.

- Utilized underwriting software and databases to assess risk and manage policies.

- Prepared underwriting reports summarizing risk factors, assumptions, and recommendations.

- Assisted in the development and implementation of underwriting strategies to improve profitability.

Underwriting Assistant

- Processed and analyzed insurance applications for accuracy and completeness, adhering to underwriting guidelines.

- Conducted risk assessments and evaluated financial statements to determine insurability.

- Calculated premiums, issued policies, and ensured compliance with regulatory requirements.

- Managed a portfolio of policies, monitoring coverage and risk exposures.

Accomplishments

- Successfully implemented a new underwriting software system that streamlined processes and reduced underwriting turnaround time by 15%

- Developed and implemented an automated underwriting risk assessment tool that improved underwriting accuracy by 20%

- Collaborated with underwriting managers to identify and mitigate emerging underwriting risks, resulting in a reduction of claims by 10%

- Assessed and evaluated complex underwriting applications, analyzing financial data, loss history, and other factors to make informed underwriting decisions

- Utilized industry knowledge and expertise to develop and maintain underwriting guidelines, ensuring consistent and accurate underwriting practices

Awards

- Received Underwriting Assistant of the Year Award for outstanding performance in underwriting

- Recognized for excellence in underwriting accuracy and compliance with an award

- Achieved Platinum Award for consistently exceeding underwriting quotas and maintaining highquality standards

Certificates

- Associate in Underwriting (AU)

- Certified Underwriter (CU)

- Certified Insurance Counselor (CIC)

- Associate in Risk Management (ARM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Underwriting Assistant

- Highlight your experience in underwriting and risk assessment.

- Quantify your accomplishments to demonstrate your impact on the business.

- Showcase your knowledge of insurance regulations and industry best practices.

- Demonstrate your strong communication and interpersonal skills.

Essential Experience Highlights for a Strong Underwriting Assistant Resume

- Process and analyze insurance applications for accuracy and completeness, adhering to underwriting guidelines.

- Conduct risk assessments and evaluate financial statements to determine insurability.

- Calculate premiums, issue policies, and ensure compliance with regulatory requirements.

- Manage a portfolio of policies, monitoring coverage and risk exposures.

- Collaborate with underwriters to provide technical support and resolve underwriting issues.

- Utilize underwriting software and databases to assess risk and manage policies.

- Prepare underwriting reports summarizing risk factors, assumptions, and recommendations.

Frequently Asked Questions (FAQ’s) For Underwriting Assistant

What is the primary role of an Underwriting Assistant?

The primary role of an Underwriting Assistant is to assist underwriters in the process of evaluating and approving insurance applications by analyzing risk, processing applications, and ensuring compliance with underwriting guidelines and regulations.

What qualifications are required to become an Underwriting Assistant?

Typically, an Underwriting Assistant position requires a minimum of a bachelor’s degree in insurance, finance, or a related field, along with some experience in the insurance industry or in a related role, such as customer service or data entry.

What are the key skills and abilities needed to be successful in this role?

Key skills and abilities include strong analytical and problem-solving skills, attention to detail, proficiency in Microsoft Office Suite, and excellent communication and interpersonal skills.

What are the career advancement opportunities for an Underwriting Assistant?

Underwriting Assistants can advance their careers by gaining more experience and knowledge in the insurance industry, pursuing professional development opportunities, and obtaining certifications, such as the Associate in Underwriting (AU) designation offered by the Insurance Institute of America (IIA).

What is the average salary range for an Underwriting Assistant?

The average salary range for an Underwriting Assistant can vary depending on factors such as experience, location, and company size. According to Salary.com, the average salary for an Underwriting Assistant in the United States is around $55,000 per year.

What are some tips for writing a standout Underwriting Assistant resume?

To write a standout Underwriting Assistant resume, focus on highlighting your relevant skills and experience, quantifying your accomplishments, and tailoring your resume to the specific job you are applying for.

What are some common interview questions for Underwriting Assistant positions?

Common interview questions for Underwriting Assistant positions may include questions about your experience in underwriting and risk assessment, your knowledge of insurance regulations, and your ability to work independently and as part of a team.