Are you a seasoned Vault Teller seeking a new career path? Discover our professionally built Vault Teller Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

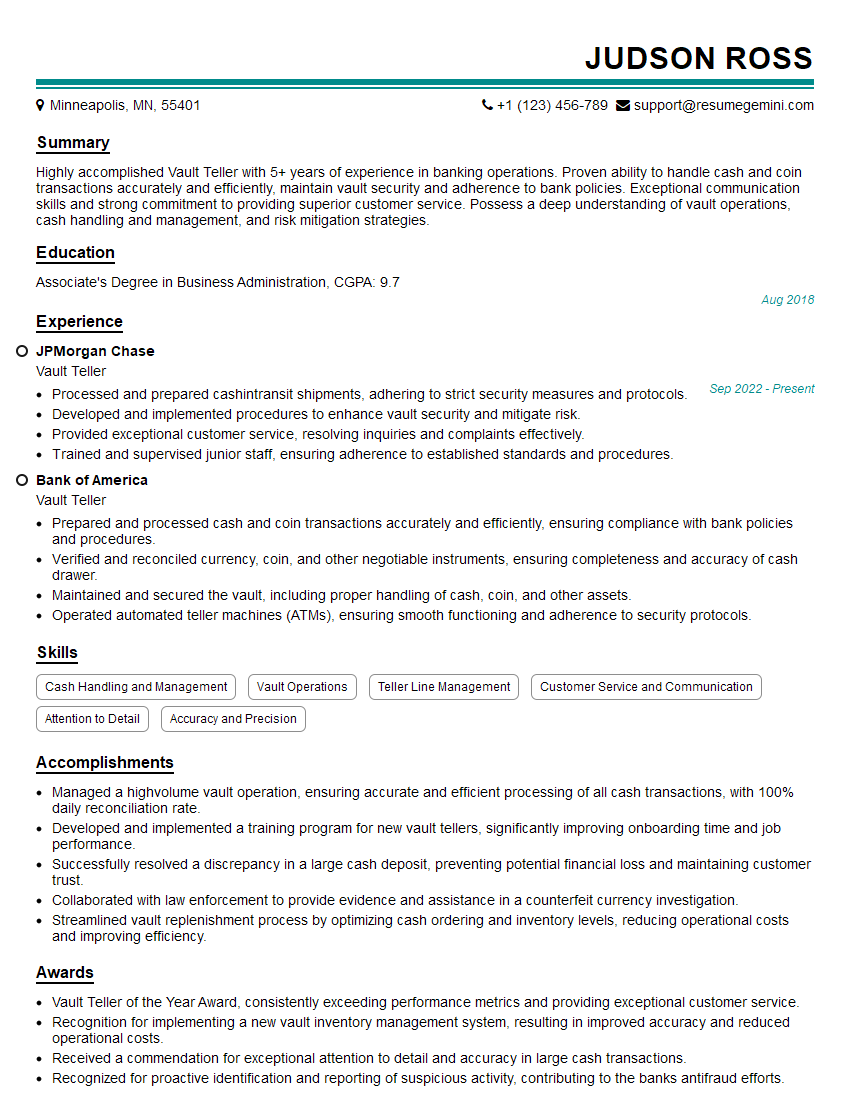

Judson Ross

Vault Teller

Summary

Highly accomplished Vault Teller with 5+ years of experience in banking operations. Proven ability to handle cash and coin transactions accurately and efficiently, maintain vault security and adherence to bank policies. Exceptional communication skills and strong commitment to providing superior customer service. Possess a deep understanding of vault operations, cash handling and management, and risk mitigation strategies.

Education

Associate’s Degree in Business Administration

August 2018

Skills

- Cash Handling and Management

- Vault Operations

- Teller Line Management

- Customer Service and Communication

- Attention to Detail

- Accuracy and Precision

Work Experience

Vault Teller

- Processed and prepared cashintransit shipments, adhering to strict security measures and protocols.

- Developed and implemented procedures to enhance vault security and mitigate risk.

- Provided exceptional customer service, resolving inquiries and complaints effectively.

- Trained and supervised junior staff, ensuring adherence to established standards and procedures.

Vault Teller

- Prepared and processed cash and coin transactions accurately and efficiently, ensuring compliance with bank policies and procedures.

- Verified and reconciled currency, coin, and other negotiable instruments, ensuring completeness and accuracy of cash drawer.

- Maintained and secured the vault, including proper handling of cash, coin, and other assets.

- Operated automated teller machines (ATMs), ensuring smooth functioning and adherence to security protocols.

Accomplishments

- Managed a highvolume vault operation, ensuring accurate and efficient processing of all cash transactions, with 100% daily reconciliation rate.

- Developed and implemented a training program for new vault tellers, significantly improving onboarding time and job performance.

- Successfully resolved a discrepancy in a large cash deposit, preventing potential financial loss and maintaining customer trust.

- Collaborated with law enforcement to provide evidence and assistance in a counterfeit currency investigation.

- Streamlined vault replenishment process by optimizing cash ordering and inventory levels, reducing operational costs and improving efficiency.

Awards

- Vault Teller of the Year Award, consistently exceeding performance metrics and providing exceptional customer service.

- Recognition for implementing a new vault inventory management system, resulting in improved accuracy and reduced operational costs.

- Received a commendation for exceptional attention to detail and accuracy in large cash transactions.

- Recognized for proactive identification and reporting of suspicious activity, contributing to the banks antifraud efforts.

Certificates

- Certified Bank Teller (CBT)

- Certified Cash Handler (CCH)

- Certified Financial Crime Specialist (CFCS)

- National Crime Prevention Council (NCPC) Certified Vault Teller

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Vault Teller

- Highlight your most relevant skills and experience in your resume, such as cash handling, vault operations, and customer service.

- Use action verbs and specific examples to demonstrate your accomplishments and impact in previous roles.

- Quantify your results whenever possible to provide tangible evidence of your contributions.

- Proofread your resume carefully for any errors in grammar or spelling.

- Tailor your resume to each job application, highlighting the skills and experience that are most relevant to the role you are applying for.

Essential Experience Highlights for a Strong Vault Teller Resume

- Prepared and processed cash and coin transactions accurately and efficiently, ensuring compliance with bank policies and procedures.

- Verified and reconciled currency, coin, and other negotiable instruments, ensuring completeness and accuracy of cash drawer.

- Maintained and secured the vault, including proper handling of cash, coin, and other assets.

- Operated automated teller machines (ATMs), ensuring smooth functioning and adherence to security protocols.

- Developed and implemented procedures to enhance vault security and mitigate risk.

- Provided exceptional customer service, resolving inquiries and complaints effectively.

- Trained and supervised junior staff, ensuring adherence to established standards and procedures.

Frequently Asked Questions (FAQ’s) For Vault Teller

What is the primary role of a Vault Teller?

The primary role of a Vault Teller is to handle and manage cash, coin, and other negotiable instruments, ensuring their accuracy, security, and compliance with bank policies.

What are the key responsibilities of a Vault Teller?

Key responsibilities of a Vault Teller include preparing and processing cash and coin transactions, verifying and reconciling currency and negotiable instruments, maintaining the vault and its security, and providing exceptional customer service.

What skills are important for a Vault Teller to possess?

Essential skills for a Vault Teller include cash handling and management, vault operations, teller line management, customer service and communication, attention to detail, and accuracy and precision.

What type of educational background is required for a Vault Teller position?

While educational requirements may vary depending on the employer, many Vault Teller positions require an Associate’s Degree in Business Administration or a related field.

What are the career advancement opportunities for a Vault Teller?

With experience and additional training, Vault Tellers can advance to roles such as Head Teller, Branch Manager, or Cash Operations Manager.

What is the average salary for a Vault Teller?

According to Salary.com, the average salary for a Vault Teller in the United States is around $35,000 per year.

What are the typical working hours for a Vault Teller?

Vault Tellers typically work during regular business hours, which may include evenings and weekends depending on the financial institution.