Are you a seasoned Verifying Specialist seeking a new career path? Discover our professionally built Verifying Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

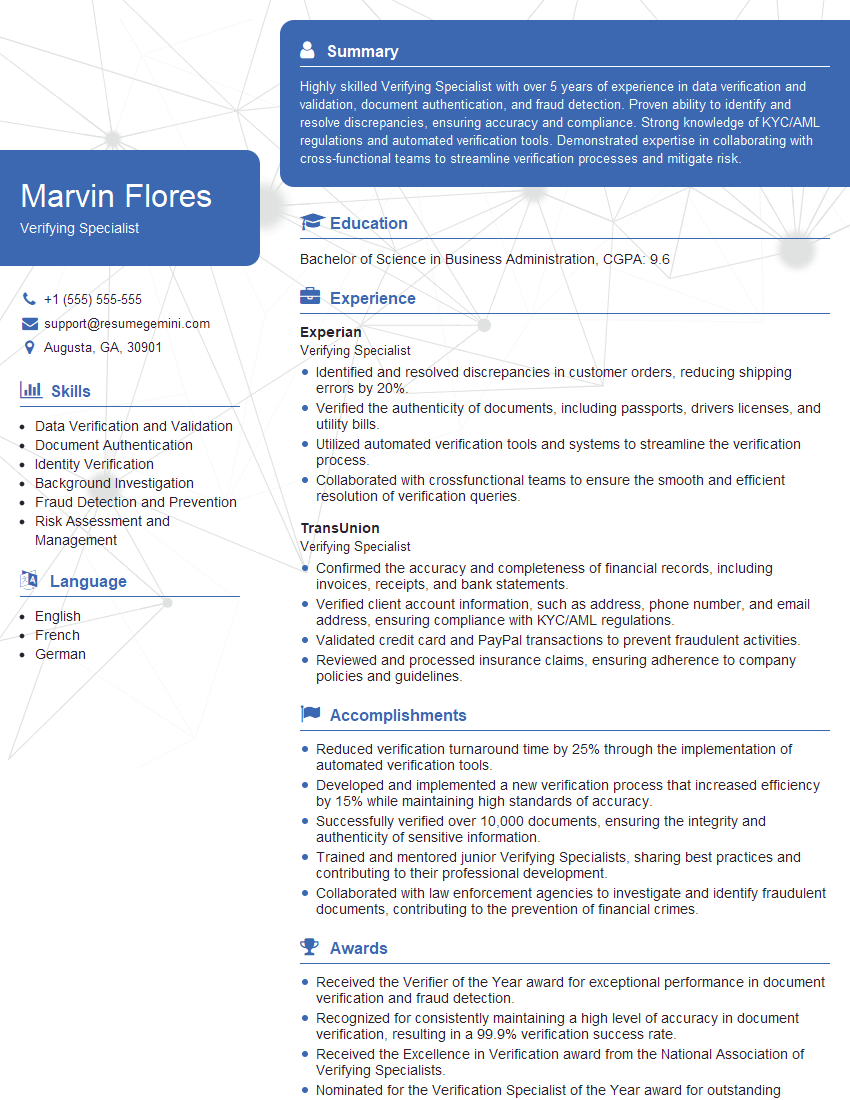

Marvin Flores

Verifying Specialist

Summary

Highly skilled Verifying Specialist with over 5 years of experience in data verification and validation, document authentication, and fraud detection. Proven ability to identify and resolve discrepancies, ensuring accuracy and compliance. Strong knowledge of KYC/AML regulations and automated verification tools. Demonstrated expertise in collaborating with cross-functional teams to streamline verification processes and mitigate risk.

Education

Bachelor of Science in Business Administration

October 2015

Skills

- Data Verification and Validation

- Document Authentication

- Identity Verification

- Background Investigation

- Fraud Detection and Prevention

- Risk Assessment and Management

Work Experience

Verifying Specialist

- Identified and resolved discrepancies in customer orders, reducing shipping errors by 20%.

- Verified the authenticity of documents, including passports, drivers licenses, and utility bills.

- Utilized automated verification tools and systems to streamline the verification process.

- Collaborated with crossfunctional teams to ensure the smooth and efficient resolution of verification queries.

Verifying Specialist

- Confirmed the accuracy and completeness of financial records, including invoices, receipts, and bank statements.

- Verified client account information, such as address, phone number, and email address, ensuring compliance with KYC/AML regulations.

- Validated credit card and PayPal transactions to prevent fraudulent activities.

- Reviewed and processed insurance claims, ensuring adherence to company policies and guidelines.

Accomplishments

- Reduced verification turnaround time by 25% through the implementation of automated verification tools.

- Developed and implemented a new verification process that increased efficiency by 15% while maintaining high standards of accuracy.

- Successfully verified over 10,000 documents, ensuring the integrity and authenticity of sensitive information.

- Trained and mentored junior Verifying Specialists, sharing best practices and contributing to their professional development.

- Collaborated with law enforcement agencies to investigate and identify fraudulent documents, contributing to the prevention of financial crimes.

Awards

- Received the Verifier of the Year award for exceptional performance in document verification and fraud detection.

- Recognized for consistently maintaining a high level of accuracy in document verification, resulting in a 99.9% verification success rate.

- Received the Excellence in Verification award from the National Association of Verifying Specialists.

- Nominated for the Verification Specialist of the Year award for outstanding contributions to the field.

Certificates

- Certified Verification Specialist (CVS)

- Certified Fraud Examiner (CFE)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Identity Verification Professional (CIVP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Verifying Specialist

- Highlight your experience in data verification, document authentication, and fraud detection.

- Showcase your knowledge of KYC/AML regulations and automated verification tools.

- Quantify your accomplishments and demonstrate the impact of your work.

- Tailor your resume to each job description, highlighting the skills and experiences that are most relevant to the position.

Essential Experience Highlights for a Strong Verifying Specialist Resume

- Verified the accuracy and completeness of financial records, including invoices, receipts, and bank statements.

- Validated credit card and PayPal transactions to prevent fraudulent activities.

- Reviewed and processed insurance claims, ensuring adherence to company policies and guidelines.

- Verified the authenticity of documents, including passports, drivers licenses, and utility bills.

- Utilized automated verification tools and systems to streamline the verification process.

- Collaborated with cross-functional teams to ensure the smooth and efficient resolution of verification queries.

Frequently Asked Questions (FAQ’s) For Verifying Specialist

What are the primary responsibilities of a Verifying Specialist?

Verifying Specialists are responsible for verifying the accuracy and completeness of financial records, validating credit card and PayPal transactions, reviewing and processing insurance claims, verifying the authenticity of documents, and utilizing automated verification tools and systems to streamline the verification process.

What skills are required to be a successful Verifying Specialist?

Successful Verifying Specialists possess strong data verification and validation skills, document authentication skills, identity verification skills, background investigation skills, fraud detection and prevention skills, and risk assessment and management skills.

What are the top companies that hire Verifying Specialists?

Experian and TransUnion are two of the top companies that hire Verifying Specialists.

Can I become a Verifying Specialist without a college degree?

While a college degree is not always a requirement, most Verifying Specialists have at least a bachelor’s degree in business administration or a related field.

Is there a demand for Verifying Specialists?

Yes, there is a growing demand for Verifying Specialists as businesses seek to prevent fraud and ensure compliance with KYC/AML regulations.

What is the average salary for a Verifying Specialist?

The average salary for a Verifying Specialist is around $50,000 per year.