Are you a seasoned Wire Transfer Clerk seeking a new career path? Discover our professionally built Wire Transfer Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

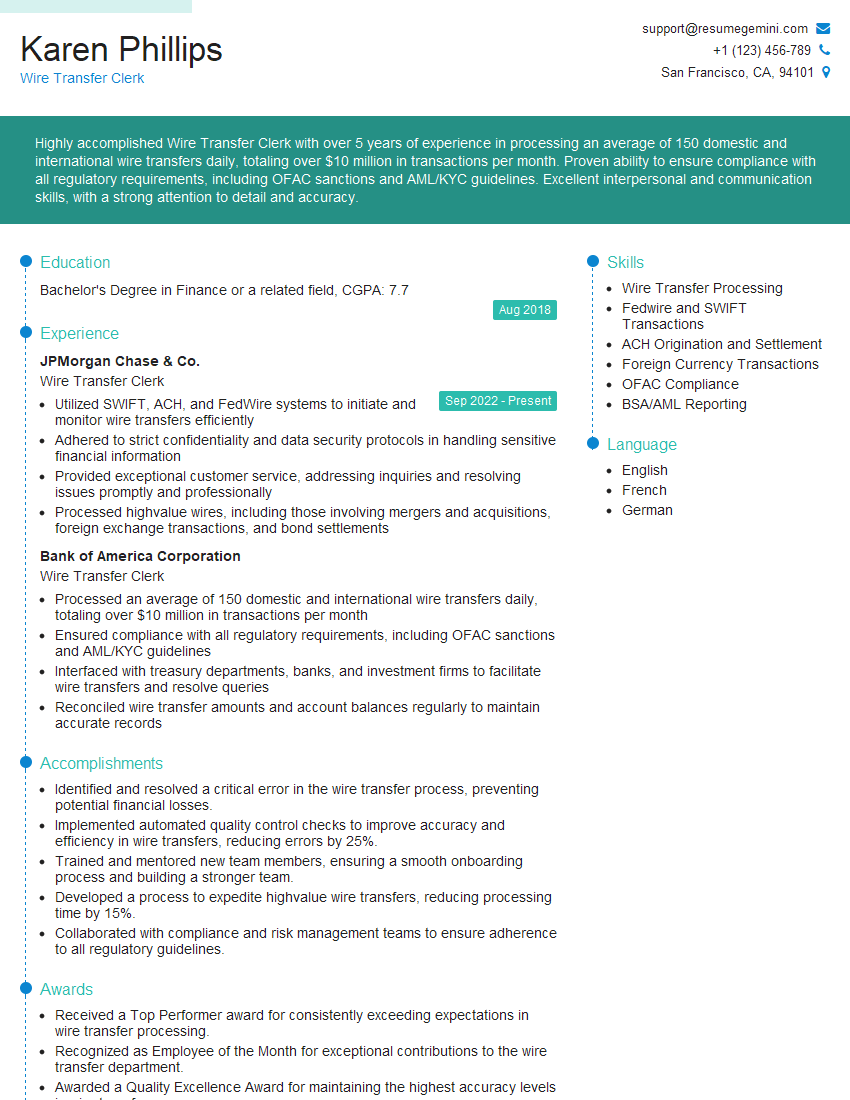

Karen Phillips

Wire Transfer Clerk

Summary

Highly accomplished Wire Transfer Clerk with over 5 years of experience in processing an average of 150 domestic and international wire transfers daily, totaling over $10 million in transactions per month. Proven ability to ensure compliance with all regulatory requirements, including OFAC sanctions and AML/KYC guidelines. Excellent interpersonal and communication skills, with a strong attention to detail and accuracy.

Education

Bachelor’s Degree in Finance or a related field

August 2018

Skills

- Wire Transfer Processing

- Fedwire and SWIFT Transactions

- ACH Origination and Settlement

- Foreign Currency Transactions

- OFAC Compliance

- BSA/AML Reporting

Work Experience

Wire Transfer Clerk

- Utilized SWIFT, ACH, and FedWire systems to initiate and monitor wire transfers efficiently

- Adhered to strict confidentiality and data security protocols in handling sensitive financial information

- Provided exceptional customer service, addressing inquiries and resolving issues promptly and professionally

- Processed highvalue wires, including those involving mergers and acquisitions, foreign exchange transactions, and bond settlements

Wire Transfer Clerk

- Processed an average of 150 domestic and international wire transfers daily, totaling over $10 million in transactions per month

- Ensured compliance with all regulatory requirements, including OFAC sanctions and AML/KYC guidelines

- Interfaced with treasury departments, banks, and investment firms to facilitate wire transfers and resolve queries

- Reconciled wire transfer amounts and account balances regularly to maintain accurate records

Accomplishments

- Identified and resolved a critical error in the wire transfer process, preventing potential financial losses.

- Implemented automated quality control checks to improve accuracy and efficiency in wire transfers, reducing errors by 25%.

- Trained and mentored new team members, ensuring a smooth onboarding process and building a stronger team.

- Developed a process to expedite highvalue wire transfers, reducing processing time by 15%.

- Collaborated with compliance and risk management teams to ensure adherence to all regulatory guidelines.

Awards

- Received a Top Performer award for consistently exceeding expectations in wire transfer processing.

- Recognized as Employee of the Month for exceptional contributions to the wire transfer department.

- Awarded a Quality Excellence Award for maintaining the highest accuracy levels in wire transfers.

- Received industry recognition for innovative solutions in wire transfer processing.

Certificates

- Certified Wire Transfer Specialist (CWTS)

- Association for Financial Professionals (AFP) Certified Cash Manager (CCM)

- Society for Worldwide Interbank Financial Telecommunication (SWIFT) Certified SWIFT Professional (CSP)

- Bank Secrecy Act/Anti-Money Laundering (BSA/AML) Specialist Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Wire Transfer Clerk

- Highlight your experience in processing high-value wire transfers, including mergers and acquisitions, foreign exchange transactions, and bond settlements.

- Demonstrate your knowledge of wire transfer regulations and compliance requirements, such as OFAC sanctions and AML/KYC guidelines.

- Showcase your skills in utilizing wire transfer systems, such as SWIFT, ACH, and FedWire, to efficiently process transactions.

- Emphasize your attention to detail, accuracy, and ability to handle confidential financial information with discretion.

Essential Experience Highlights for a Strong Wire Transfer Clerk Resume

- Processed an average of 150 domestic and international wire transfers daily, totaling over $10 million in transactions per month.

- Ensured compliance with all regulatory requirements, including OFAC sanctions and AML/KYC guidelines.

- Interfaced with treasury departments, banks, and investment firms to facilitate wire transfers and resolve queries.

- Reconciled wire transfer amounts and account balances regularly to maintain accurate records.

- Utilized SWIFT, ACH, and FedWire systems to initiate and monitor wire transfers efficiently.

- Adhered to strict confidentiality and data security protocols in handling sensitive financial information.

- Provided exceptional customer service, addressing inquiries and resolving issues promptly and professionally.

Frequently Asked Questions (FAQ’s) For Wire Transfer Clerk

What are the primary responsibilities of a Wire Transfer Clerk?

The primary responsibilities of a Wire Transfer Clerk include processing incoming and outgoing wire transfers, ensuring compliance with regulatory requirements, reconciling accounts, and providing customer service.

What skills are required to be a successful Wire Transfer Clerk?

To be a successful Wire Transfer Clerk, you will need strong attention to detail, accuracy, and a solid understanding of wire transfer regulations and compliance requirements.

What is the career path for a Wire Transfer Clerk?

A Wire Transfer Clerk can advance to roles such as Senior Wire Transfer Clerk, Wire Transfer Supervisor, or Treasury Analyst.

What are the educational requirements for a Wire Transfer Clerk?

Most Wire Transfer Clerks have a high school diploma or equivalent, and some may have a bachelor’s degree in finance or a related field.

What is the job outlook for Wire Transfer Clerks?

The job outlook for Wire Transfer Clerks is expected to be good over the next few years due to the increasing demand for electronic fund transfers.

What are the working conditions of a Wire Transfer Clerk?

Wire Transfer Clerks typically work in a fast-paced environment and may need to be available to work overtime or on weekends.