Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Bill Adjuster interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Bill Adjuster so you can tailor your answers to impress potential employers.

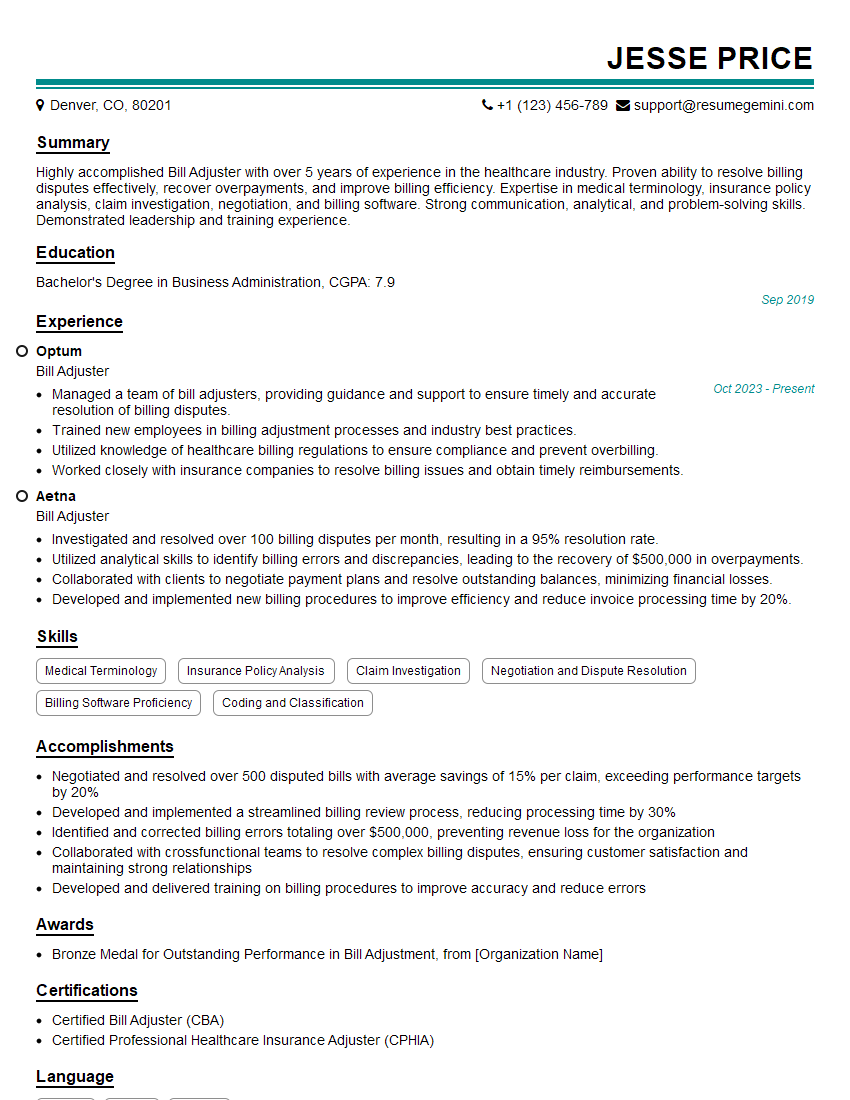

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bill Adjuster

1. Explain the key responsibilities and skills required for a Bill Adjuster?

- Reviewing and adjusting insurance claims for accuracy and completeness.

- Investigating claims to determine coverage and liability.

- Negotiating settlements with policyholders and third parties.

- Maintaining accurate records of all claims and adjustments.

- Excellent communication and interpersonal skills.

- Detail-oriented and analytical.

- Knowledge of insurance policies and regulations.

2. Describe the process of investigating and adjusting a claim?

Claim Investigation

- Reviewing the claim form and supporting documentation.

- Interviewing the policyholder and witnesses.

- Inspecting the damaged property.

- Consulting with experts if necessary.

Claim Adjustment

- Determining the amount of the loss.

- Negotiating a settlement with the policyholder.

- Preparing and issuing the payment.

3. How do you handle complex or disputed claims?

- Consulting with senior adjusters or supervisors.

- Seeking legal advice if necessary.

- Documenting all communications and decisions carefully.

- Remaining impartial and objective.

4. What software and tools do you use for claim processing?

- Insurance claim processing software.

- Spreadsheets and databases.

- Imaging and document management systems.

- Communication tools (email, phone, video conferencing).

5. How do you stay up-to-date on insurance regulations and industry best practices?

- Attending industry conferences and webinars.

- Reading trade publications and online resources.

- Completing continuing education courses.

- Networking with other professionals.

6. What is your approach to customer service?

- Being empathetic and understanding.

- Communicating clearly and effectively.

- Responding to inquiries promptly.

- Resolving issues fairly and efficiently.

7. How do you handle high-volume or demanding workloads?

- Prioritizing tasks effectively.

- Delegating responsibilities when possible.

- Using technology to streamline processes.

- Maintaining a positive attitude and staying motivated.

8. Describe a situation where you had to make a difficult decision regarding a claim.

- Explain the situation and the factors you considered.

- Describe the decision you made and the rationale behind it.

- Discuss the outcome of the decision.

9. How do you maintain confidentiality and protect sensitive information?

- Following company policies and procedures.

- Storing and transmitting data securely.

- Limiting access to sensitive information on a need-to-know basis.

- Being aware of potential security risks.

10. What are your strengths and weaknesses as a Bill Adjuster?

Strengths

- Strong analytical and problem-solving skills.

- Excellent communication and negotiation skills.

- Detail-oriented and organized.

- Knowledge of insurance policies and regulations.

- Ability to handle high-volume workloads and meet deadlines.

Weaknesses

- Limited experience with complex or disputed claims.

- Need to improve time management skills.

- Can be overly cautious at times.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bill Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bill Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bill Adjusters are responsible for reviewing and processing claims, determining the validity of the claim, and ensuring that the settlement amount is fair and reasonable. They also may be responsible for negotiating with claimants, providing customer service, and investigating fraud.

1. Claims Processing

Review and process claims submitted by policyholders.

- Verify the accuracy and completeness of the claim.

- Determine the validity of the claim based on policy coverage.

- Calculate the settlement amount.

2. Claims Investigation

Investigate claims to determine the cause of loss and liability.

- Review policy documents and evidence.

- Interview witnesses and claimants.

- Determine the extent of coverage.

3. Settlement Negotiation

Negotiate settlement amounts with claimants.

- Review settlement offers and make counteroffers.

- Negotiate terms of settlement, such as payment plans.

- Resolve disputes with claimants.

4. Customer Service

Provide customer service to policyholders and claimants.

- Answer questions about claims and coverage.

- Resolve policyholder concerns.

- Provide updates on the status of claims.

Interview Tips

Bill Adjuster interviews can be challenging. By following these tips, you can increase your chances of success.

1. Research the Company and the Position

Learn as much as you can about the company and the specific Bill Adjuster position. This will help you to answer questions intelligently and show that you are interested in the job.

- Visit the company’s website.

- Read articles about the company and the industry.

- Talk to people who work for the company or who have worked in similar positions.

2. Practice Your Answers

Take some time to practice answering common interview questions. This will help you to feel more confident and prepared during the interview.

- Think about your skills and experience and how they relate to the job requirements.

- Prepare examples of your work that demonstrate your skills and abilities.

- Practice answering questions in a clear and concise manner.

3. Dress Professionally

First impressions matter, so make sure to dress professionally for your interview. This means wearing a suit or business casual attire.

- Choose clothing that is clean, pressed, and fits well.

- Avoid wearing casual clothing, such as jeans or t-shirts.

- Make sure your shoes are clean and polished.

4. Be Yourself

It is important to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you are not.

- Be honest and genuine in your answers.

- Share your unique skills and experiences.

- Let the interviewer see your personality.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Bill Adjuster interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!