Are you gearing up for a career in Charge Authorizer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Charge Authorizer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

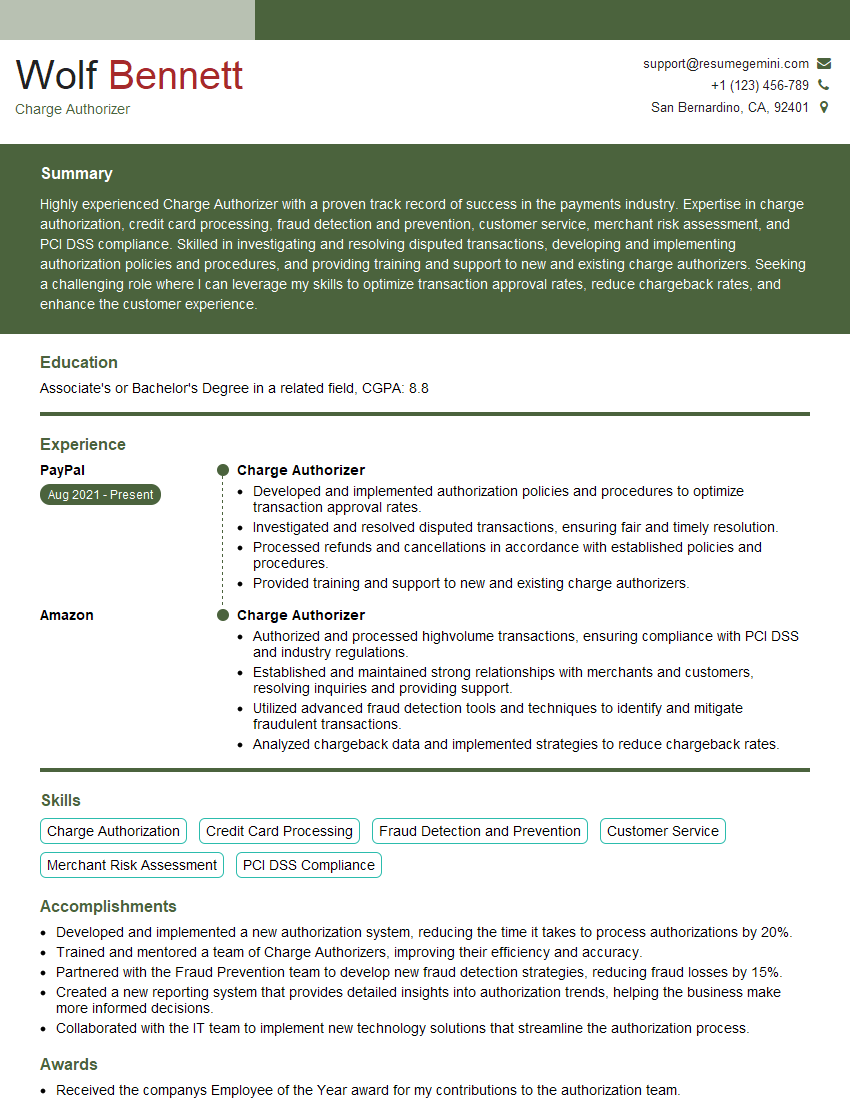

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Charge Authorizer

1. What are the different types of authorizations you have experience with?

As a Charge Authorizer, I have experience with various types of authorizations, including:

- Credit card authorizations

- Debit card authorizations

- Gift card authorizations

- Loyalty card authorizations

- Prepaid card authorizations

2. What are the key factors you consider when evaluating an authorization request?

Fraud prevention

- Checking the cardholder’s address and phone number against the information on file

- Verifying the cardholder’s signature

- Looking for any suspicious activity on the cardholder’s account

Creditworthiness

- Checking the cardholder’s credit score

- Reviewing the cardholder’s payment history

- Determining whether the cardholder has any outstanding debts

Charge amount

- Comparing the charge amount to the cardholder’s credit limit

- Determining whether the charge amount is consistent with the cardholder’s spending patterns

3. What are some of the common reasons why an authorization request may be declined?

There are several reasons why an authorization request may be declined, including:

- Insufficient funds on the cardholder’s account

- Cardholder has exceeded their credit limit

- Card is not active or has been reported lost or stolen

- Cardholder’s signature does not match the signature on file

- Transaction is flagged as suspicious for fraud

4. What are the steps you take when an authorization request is declined?

When an authorization request is declined, I typically take the following steps:

- Review the authorization request to identify the reason for the decline

- Contact the cardholder to verify the information on file and to see if they have any questions

- If the cardholder’s information is correct and there is no suspicious activity on their account, I may attempt to reauthorize the transaction

- If the transaction cannot be reauthorized, I will provide the cardholder with information on how to contact their card issuer to resolve the issue

5. What are some of the best practices for preventing chargebacks?

There are several best practices that can be implemented to help prevent chargebacks, including:

- Providing clear and accurate product descriptions

- Setting realistic expectations for delivery times

- Processing refunds promptly and efficiently

- Maintaining good communication with customers

- Using fraud prevention tools and techniques

6. What are some of the challenges you have faced as a Charge Authorizer?

Some of the challenges I have faced as a Charge Authorizer include:

- Dealing with difficult customers

- Staying up-to-date on the latest fraud prevention techniques

- Balancing the need to prevent fraud with the need to provide a positive customer experience

7. What are some of your strengths as a Charge Authorizer?

Some of my strengths as a Charge Authorizer include:

- Strong attention to detail

- Excellent problem-solving skills

- Ability to work well under pressure

- Commitment to providing excellent customer service

8. What are your career goals?

My career goals are to continue to develop my skills as a Charge Authorizer and to eventually move into a management position. I am also interested in learning more about fraud prevention and risk management.

9. Why are you interested in this position?

I am interested in this position because it is a great opportunity to use my skills and experience to make a difference. I am also excited about the opportunity to work with a team of professionals who are committed to providing excellent customer service.

10. What do you think you can bring to this company?

I believe that I can bring a number of skills and experiences to this company, including:

- Strong attention to detail

- Excellent problem-solving skills

- Ability to work well under pressure

- Commitment to providing excellent customer service

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Charge Authorizer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Charge Authorizer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Charge Authorizers are responsible for ensuring the accuracy and validity of charges made to customer accounts. They play a crucial role in preventing fraud, maintaining customer satisfaction, and ensuring the financial integrity of the organization.

1. Charge Authorization and Verification

Analyze and verify charges to identify potential fraud and errors. Review transaction details, account information, and other relevant data to determine the legitimacy of the transaction.

- Check for suspicious patterns, unusual purchases, or inconsistencies in billing information.

- Contact customers to confirm purchases and resolve any discrepancies.

2. Fraud Prevention and Mitigation

Implement and maintain fraud prevention measures to minimize the risk of unauthorized charges. Monitor transactions for anomalies, investigate suspicious activity, and report potential fraud to the appropriate authorities.

- Use fraud detection tools and techniques to identify fraudulent transactions.

- Collaborate with law enforcement and financial institutions to investigate and prosecute fraud cases.

3. Customer Service and Communication

Respond to customer inquiries and resolve disputes related to charges. Provide clear and concise explanations of charge details and authorization decisions. Maintain a professional and courteous demeanor in all interactions.

- Handle customer complaints and provide prompt resolutions.

- Communicate authorization decisions to customers and provide reasons for any declined transactions.

4. Regulatory Compliance

Ensure compliance with all relevant laws, regulations, and industry standards related to charge authorization. Stay updated on changes in payment processing regulations and implement appropriate measures to maintain compliance.

- Follow PCI DSS (Payment Card Industry Data Security Standard) guidelines to protect sensitive customer information.

- Adhere to industry best practices for fraud prevention and customer dispute resolution.

Interview Tips

To ace the interview and showcase your skills and experience as a Charge Authorizer, consider the following interview tips and preparation hacks:

1. Research the Company and Role

Thoroughly research the company and the specific Charge Authorizer role. Understand the company’s industry, target market, and core values. Familiarize yourself with the job description and key responsibilities to demonstrate your alignment with the position.

- Visit the company’s website and read their mission statement, values, and recent news.

- Read industry articles and reports to stay updated on trends and best practices in charge authorization.

2. Highlight Your Experience and Skills

Emphasize your relevant experience and skills in charge authorization, fraud prevention, and customer service. Use specific examples to demonstrate your ability to analyze transactions, identify fraud, and resolve customer disputes effectively.

- Quantify your results whenever possible, such as reducing fraud rates by a certain percentage or increasing customer satisfaction scores.

- Be prepared to discuss your knowledge of industry regulations and best practices for charge authorization.

3. Demonstrate Problem-Solving and Critical Thinking

Interviewers will be looking for candidates who can think critically and solve problems effectively. Provide examples of situations where you analyzed complex transactions, identified potential fraud, and made appropriate decisions.

- Use the STAR method (Situation, Task, Action, Result) to structure your responses and provide clear examples.

- Be prepared to discuss how you would handle specific fraud scenarios or customer disputes.

4. Prepare Questions for the Interviewer

Preparing thoughtful questions for the interviewer demonstrates your engagement and interest in the role. Ask questions about the company’s fraud prevention strategy, industry trends, or opportunities for professional development.

- Example questions: What are the most common types of fraud that the company experiences?

- How does the company keep up with evolving fraud schemes and technologies?

Next Step:

Now that you’re armed with the knowledge of Charge Authorizer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Charge Authorizer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini