Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Claim Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

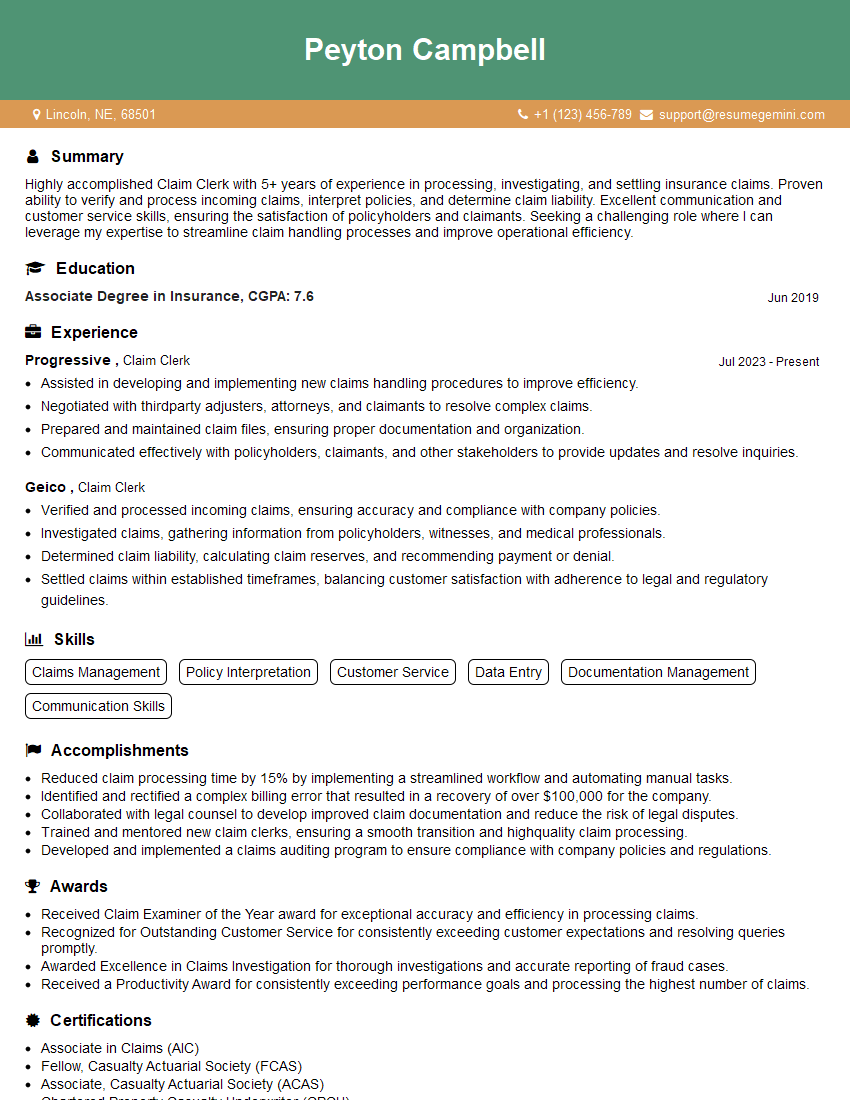

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claim Clerk

1. How would you handle a claim that involves multiple policies?

* Review each policy carefully to determine coverage and exclusions. * Identify any overlaps or gaps in coverage. * Consult with the policyholders to clarify any ambiguities. * Determine the appropriate order of priority for payment. * Document all decisions and communications clearly.

2. What are the key factors you consider when evaluating a claim for potential fraud?

Indicators of Fraud

- Inconsistent or conflicting information

- Unrealistic or exaggerated claims

- Previous history of fraudulent activity

- Delay in reporting the claim

Verification

- Cross-checking information with multiple sources

- Obtaining witness statements

- Reviewing medical records and police reports

- Consulting with experts as needed

3. How do you prioritize claims for processing?

- Urgency: Claims involving life-threatening injuries or severe property damage take priority.

- Policyholder status: Valued customers or high-risk accounts may receive faster processing.

- Coverage type: Some policies (e.g., accident insurance) may have specific time limits for reporting.

- Amount of claim: Larger claims may require more thorough investigation and documentation.

4. What is your process for communicating with policyholders regarding their claims?

- Establish clear communication channels (phone, email, online portal)

- Provide timely updates on the status of the claim

- Use clear and concise language

- Address policyholder concerns promptly and professionally

- Document all interactions for future reference

5. Describe your experience in using claim adjustment software.

* Proficiency in [Claim adjustment software name] * Hands-on experience in data entry, calculations, and documentation * Ability to troubleshoot and resolve system issues * Understanding of software functionality related to claim processing * Knowledge of industry best practices in software utilization

6. How do you stay up-to-date on changes in insurance regulations and claim handling practices?

- Attend industry conferences and workshops

- Read relevant publications and articles

- Participate in continuing education courses

- Monitor regulatory updates and bulletins

- Network with other claim professionals

7. Tell me about a challenging claim that you successfully resolved.

* Describe the complexity of the claim, involving multiple parties or coverage disputes * Explain the steps taken to investigate and gather evidence * Highlight your problem-solving skills and ability to negotiate a fair settlement * Emphasize the positive outcome for the policyholder and the company

8. How do you handle claims that involve emotional or sensitive issues?

- Approach with empathy and understanding

- Maintain confidentiality and respect privacy

- Provide clear and accurate information

- Offer support and guidance throughout the process

- Refer to appropriate resources or professionals if necessary

9. Describe your experience in calculating claim reserves.

* Familiarity with reserving methodologies (e.g., actuarial methods, loss triangle analysis) * Ability to assess claim severity, frequency, and development patterns * Understanding of factors that impact reserve adequacy * Proficiency in using statistical tools and software for reserve calculations

10. What are your strategies for reducing claim costs?

- Early intervention and investigation

- Fraud detection and prevention measures

- Negotiating favorable settlements

- Reviewing claims history for trends and patterns

- Implementing risk management programs

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claim Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claim Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Claim Clerk plays a crucial role in reviewing, verifying, and processing insurance claims. They ensure the accuracy and completeness of claims submission, making them an essential part of the insurance process.

1. Claim Verification and Processing

Claim Clerks scrutinize and verify the validity of insurance claims by cross-referencing them with policyholder information, medical records, and other relevant documents.

- Review claims for accuracy, completeness, and compliance with company policies.

- Contact policyholders and healthcare providers to gather missing or additional information.

- Investigate claims for potential fraud and take appropriate actions.

2. Communication and Follow-up

Claim Clerks serve as a communication bridge between policyholders, healthcare providers, and the insurance company.

- Inform policyholders and healthcare providers about the status of claims.

- Respond to inquiries and provide clear explanations regarding claims processing.

- Maintain open lines of communication to resolve issues and ensure customer satisfaction.

3. Data Entry and Maintenance

Claim Clerks enter and maintain data related to claims into the company’s database.

- Record claim details, such as policy number, type of claim, and amount.

- Update claim status and track progress through the processing stages.

- Maintain accurate records for future reference and auditing purposes.

4. Customer Service

Claim Clerks interact with policyholders and healthcare providers, providing excellent customer service.

- handle customer inquiries related to claims and policy coverage.

- Resolve complaints and address concerns in a professional and courteous manner.

- Build and maintain positive relationships with policyholders and healthcare providers.

Interview Tips

Preparation is key to acing any job interview, and the Claim Clerk interview is no exception. Here are some tips to help you stand out and impress the hiring manager:

1. Research the Company and Position

Take the time to research the insurance company and the specific Claim Clerk role you are applying for. This will give you a good understanding of the company’s values, mission, and the expectations of the position.

- Visit the company’s website and read about their history, products, and services.

- Find out what specific responsibilities and skills are required for the Claim Clerk position.

2. Highlight Your Skills and Experience

In your resume and during the interview, be sure to emphasize the skills and experience that are most relevant to the Claim Clerk position. Examples of relevant skills include:

- Excellent communication and interpersonal skills.

- Strong attention to detail and accuracy.

- Experience in data entry and maintaining records.

- Knowledge of insurance policies and claims processing procedures.

- Customer service experience in a fast-paced environment.

3. Practice Answering Common Interview Questions

There are some common interview questions that you can expect to be asked in a Claim Clerk interview. It’s a good idea to practice answering these questions beforehand so that you can deliver confident and well-thought-out responses.

- Tell me about your experience in claims processing.

- What are your strengths and weaknesses as a Claim Clerk?

- How do you handle difficult customers?

- What do you know about our company and why do you want to work here?

4. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview shows that you are interested in the position and the company. It also gives you an opportunity to learn more about the role and the organization. Here are some questions you can ask:

- Can you describe a typical day for a Claim Clerk in this role?

- What are the biggest challenges facing the claims department currently?

- What opportunities for advancement are there within the company for Claim Clerks?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claim Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!