Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Commercial Credit Reviewer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

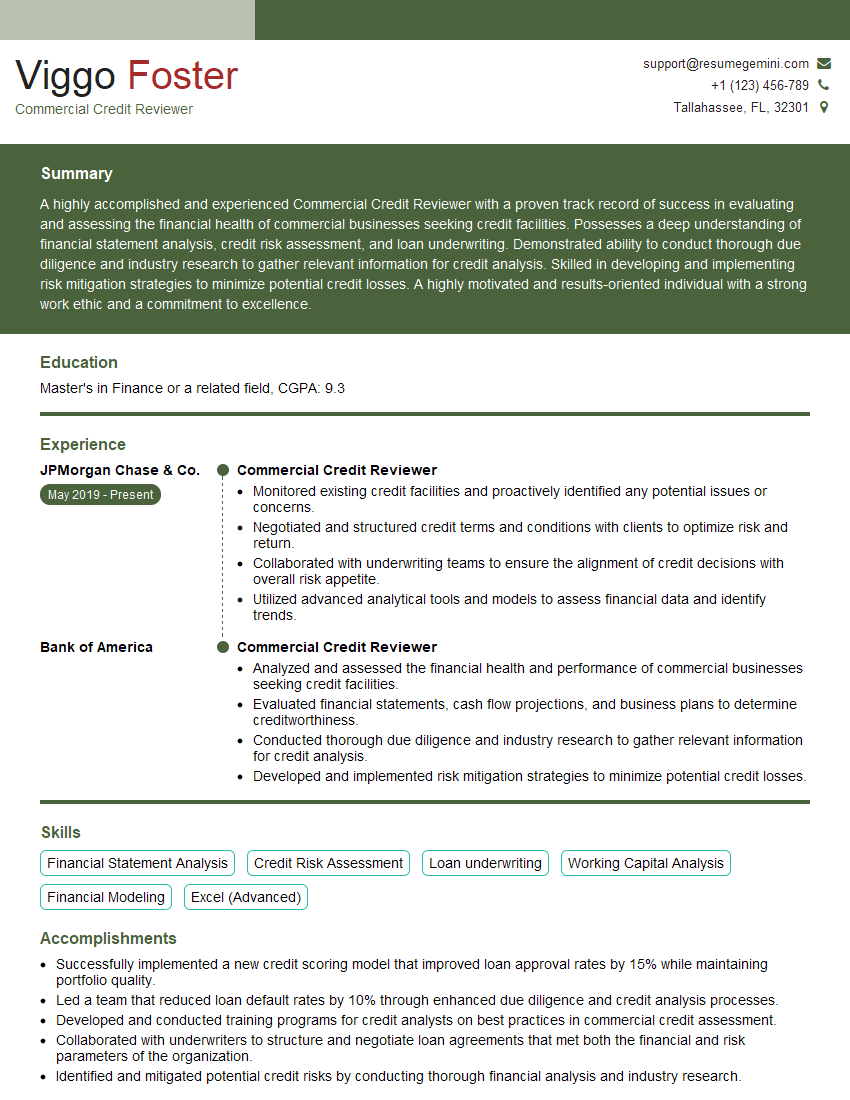

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commercial Credit Reviewer

1. What is the difference between a credit score and a credit report?

- A credit score is a numerical representation of a borrower’s creditworthiness, typically ranging from 300 to 850.

- A credit report, on the other hand, is a detailed account of a borrower’s credit history, including information such as their payment history, outstanding debts, and credit inquiries.

2. What are the key financial ratios used to assess a company’s creditworthiness?

- Current ratio: Measures a company’s ability to meet its short-term obligations, calculated as current assets divided by current liabilities.

- Debt-to-equity ratio: Indicates the proportion of debt a company has relative to its equity, calculated as total debt divided by total equity.

- Times interest earned ratio: Assesses a company’s ability to cover its interest payments, calculated as earnings before interest and taxes (EBIT) divided by interest expense.

: Other important ratios

- Return on assets (ROA)

- Return on equity (ROE)

3. How do you evaluate a company’s cash flow statement?

- Analyze the operating, investing, and financing activities to assess a company’s sources and uses of cash.

- Examine key metrics such as net cash flow from operating activities, capital expenditures, and dividends paid.

- Identify trends and patterns to identify potential areas of concern or growth opportunities.

4. What are some common red flags to look for in a credit application?

- Inconsistent or incomplete information: Missing or conflicting data may indicate potential inaccuracies.

- Unusually high debt-to-income ratio: This suggests the borrower may have difficulty repaying new debt.

- Recent derogatory credit history: Bankruptcies, foreclosures, or late payments raise concerns about creditworthiness.

5. How do you determine the appropriate credit limit for a new customer?

- Analyze the customer’s financial statements and cash flow: Evaluate their ability to repay the loan.

- Consider the customer’s industry and business plan: Assess their growth potential and risk level.

- Review their credit history and references: Verify their track record and credibility.

6. What are the different types of collateral used to secure a loan?

- Real estate: Land, buildings, or property with equity value.

- Inventory: Raw materials, work-in-progress, or finished goods that can be sold to generate cash.

- Equipment: Machinery, tools, or vehicles that can be used to generate revenue.

- Accounts receivable: Unpaid invoices that represent future income.

7. How do you assess the risk associated with a loan application?

- Evaluate the borrower’s financial strength: Review financial ratios, cash flow, and profitability.

- Analyze the loan purpose: Determine the use of the loan and its potential impact on the borrower’s business.

- Assess the collateral: Determine the value, liquidity, and marketability of any collateral offered.

- Consider external factors: Economic conditions, industry trends, and competitive landscape can influence risk.

8. What are some common mistakes to avoid when conducting credit analysis?

- Overreliance on credit scores: While credit scores are important, they only provide a partial view of creditworthiness.

- Ignoring industry-specific factors: Different industries have unique risk profiles that need to be considered.

- Failing to verify information: Always confirm the accuracy of financial statements and other supporting documents.

9. Can you describe the role of credit insurance in commercial lending?

- Protects lenders from financial loss: Credit insurance can cover the lender in case of borrower default.

- Facilitates access to credit: By reducing risk, credit insurance can encourage lenders to provide loans to higher-risk borrowers.

- Supports international trade: Export credit insurance can help businesses secure financing for international transactions.

10. How do you stay updated on changes in the credit industry?

- Attend industry conferences and webinars: Network with professionals and learn about emerging trends.

- Read industry publications and research reports: Stay informed on regulatory changes and best practices.

- Maintain professional certifications: Demonstrate knowledge and proficiency in credit analysis.

11. What are the ethical considerations that a commercial credit reviewer must be aware of?

- Confidentiality: Maintaining the privacy of borrower information is paramount.

- Objectivity: Credit decisions should be made based on objective criteria, free from personal biases.

- Fairness: All borrowers should be treated fairly and equitably, regardless of their circumstances.

- Compliance: Adhering to all applicable laws and regulations.

12. How do you handle difficult conversations with borrowers who are experiencing financial distress?

- Empathy and understanding: Approach the borrower with compassion and try to understand their situation.

- Communication: Clearly explain the borrower’s options and the potential consequences of their actions.

- Negotiation: Explore mutually acceptable solutions, such as payment plans or loan modifications.

- Referral: If necessary, refer the borrower to credit counseling or other resources for assistance.

13. Describe your experience with using financial modeling tools to assess credit risk.

- Proficient in using financial modeling software: Explain the software you have used and how you have applied it in credit analysis.

- Understanding of financial modeling principles: Discuss how you use financial models to forecast cash flows, assess repayment capacity, and evaluate financial risk.

- Examples of successful financial modeling: Provide specific examples of how your financial modeling skills have helped you make sound credit decisions.

14. What are the key regulatory requirements that commercial credit reviewers must be aware of?

- Basel Accords: Global regulations that set capital requirements for banks.

- Credit Risk Management Regulations: Laws and regulations that govern how financial institutions assess and manage credit risk.

- Anti-Money Laundering (AML) Regulations: Measures designed to prevent financial institutions from being used for illegal activities.

- Know Your Customer (KYC) Regulations: Requirements to verify the identity and background of customers.

15. How do you stay updated on emerging trends in the commercial lending industry?

- Industry publications and journals: Read articles and whitepapers from reputable sources.

- Conferences and seminars: Attend industry events to learn about new products, services, and regulations.

- Professional development courses: Take courses to enhance knowledge and skills in relevant areas.

- Networking: Connect with other professionals in the industry to share insights and best practices.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commercial Credit Reviewer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commercial Credit Reviewer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Commercial Credit Reviewers are responsible for evaluating and assessing the creditworthiness of commercial loan applicants. Their primary duties include:

1. Loan Analysis

Reviewing and analyzing financial statements, business plans, and supporting documentation to determine the borrower’s financial strength, cash flow, and repayment capacity.

- Using analytical tools and techniques to assess the borrower’s credit risk and probability of default.

- Identifying potential red flags or areas of concern in the financial data.

2. Industry Knowledge

Staying abreast of industry trends, regulations, and best practices related to commercial lending.

- Understanding the specific risks and challenges associated with different industries.

- Monitoring industry news and events to stay informed about emerging issues.

3. Credit Recommendations

Making credit recommendations to the loan committee or senior management based on the loan analysis findings.

- Recommending loan approval, denial, or modification based on the borrower’s creditworthiness.

- Justifying the recommendations with clear and well-documented analysis.

4. Risk Management

Monitoring and managing the credit portfolio to identify and mitigate potential risks.

- Conducting regular portfolio reviews to assess the performance of existing loans.

- Identifying early warning signs of financial distress or credit deterioration.

5. Communication and Reporting

Communicating with borrowers, loan officers, and other stakeholders to discuss credit decisions and provide updates.

- Preparing and presenting credit reports, risk assessments, and other written materials.

- Participating in meetings and discussions to provide input on credit-related matters.

Interview Tips

To ace the interview for a Commercial Credit Reviewer position, candidates should:

1. Preparation

Thoroughly review the job description and research the company to understand the specific requirements and expectations of the role.

- Practice answering common interview questions related to credit analysis, risk management, and industry knowledge.

- Prepare examples of your analytical skills, problem-solving abilities, and communication effectiveness.

2. Dress Professionally

First impressions matter. Dress professionally and appropriately for the interview setting.

- Choose conservative colors and avoid overly casual or revealing clothing.

- Make sure your attire is clean, pressed, and fits well.

3. Confidence and Communication

Project confidence and enthusiasm during the interview. Speak clearly and articulately, and maintain eye contact.

- Be prepared to discuss your experience and qualifications in detail.

- Highlight your analytical skills, ability to handle complex financial data, and experience in making credit decisions.

4. Be Eager to Learn and Ask Questions

Show your enthusiasm for the role and your desire to learn and grow. Ask thoughtful questions about the company, the industry, and the specific responsibilities of the position.

- This demonstrates your interest in the opportunity and your eagerness to contribute to the team.

- It also allows you to clarify any areas you may be unsure about.

5. Follow Up

After the interview, send a brief thank-you note to the interviewer. Reiterate your interest in the position and highlight any key points you want to emphasize.

- This shows your appreciation for the opportunity and your continued interest in the role.

- It also allows you to reinforce your qualifications and enthusiasm.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Commercial Credit Reviewer interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.