Are you gearing up for an interview for a Consumer Banker position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Consumer Banker and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

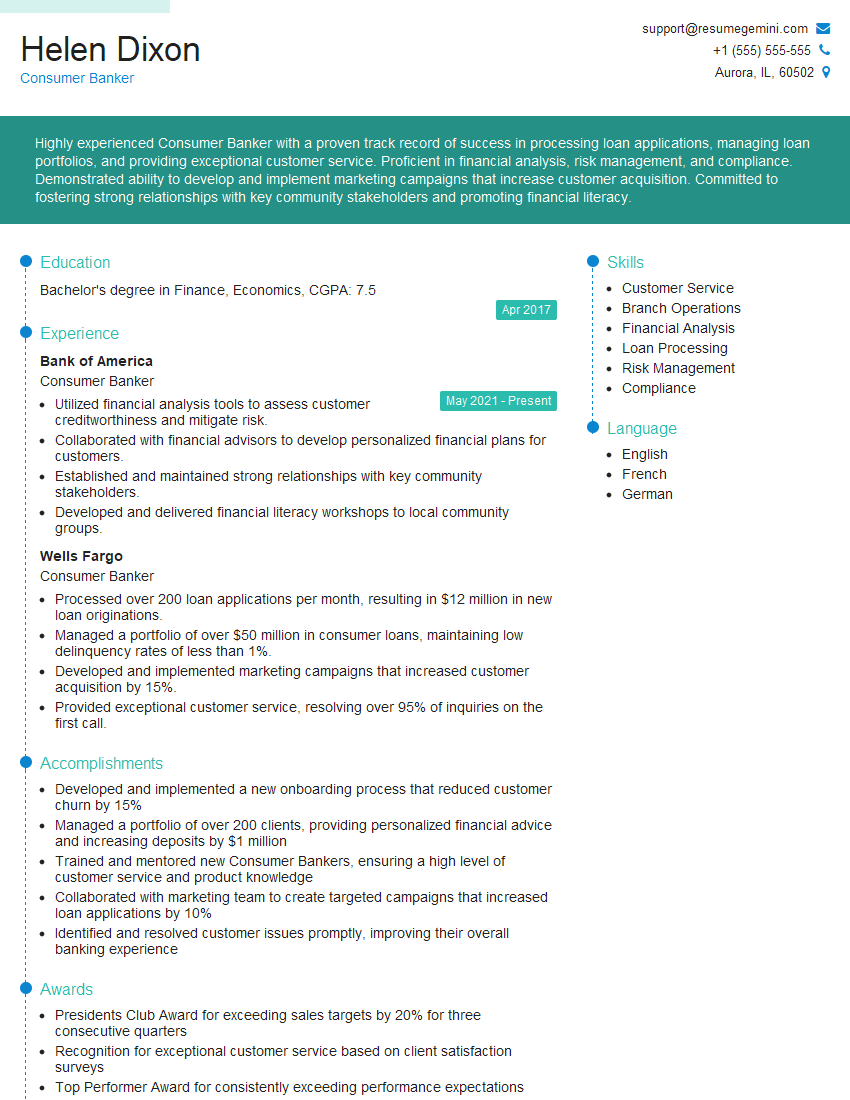

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Consumer Banker

1. Explain the process of underwriting a mortgage loan?

- Assessment of the borrower’s creditworthiness: Evaluate credit history, debt-to-income ratio, and employment stability.

- Verification of income and assets: Review pay stubs, W-2s, and bank statements to confirm income and asset levels.

- Property valuation: Order an appraisal to determine the property’s market value and ensure it meets the lender’s requirements.

- Review of comparable properties: Analyze recent sales data to compare the property’s value to similar homes in the area.

- Risk assessment: Determine the loan-to-value ratio, which is the percentage of the property’s value the borrower is financing.

- Loan approval: Based on the underwriting analysis, the lender will decide whether to approve or decline the loan application.

2. What are the key regulations that impact consumer banking?

Regulatory agencies

- Federal Reserve Board

- Office of the Comptroller of the Currency

- Federal Deposit Insurance Corporation

Key regulations

- Truth in Lending Act (TILA)

- Real Estate Settlement Procedures Act (RESPA)

- Bank Secrecy Act (BSA)

- Fair Credit Reporting Act (FCRA)

3. Describe the different types of consumer loans and their key features.

- Mortgages: Long-term loans secured by real estate, used to purchase or refinance homes.

- Personal loans: Unsecured loans used for various personal expenses, such as debt consolidation, home renovations, or major purchases.

- Auto loans: Loans secured by a vehicle, used to purchase new or used automobiles.

- Credit cards: Revolving loans that allow borrowers to make purchases up to a credit limit.

- Student loans: Loans used to finance higher education expenses, such as tuition, fees, and living expenses.

4. How do you assess a borrower’s risk profile?

- Credit score: Review the borrower’s credit history, including payment patterns and outstanding debts.

- Debt-to-income ratio: Calculate the borrower’s monthly debt payments as a percentage of their income.

- Employment stability: Verify the borrower’s employment history and current income.

- Savings and assets: Assess the borrower’s savings and other liquid assets.

- Property characteristics: For mortgage loans, evaluate the property’s condition, location, and value.

5. What are the common challenges faced by consumer bankers?

- Maintaining regulatory compliance: Ensuring adherence to complex financial regulations.

- Managing risk: Assessing and mitigating credit risk, fraud risk, and operational risk.

- Meeting customer expectations: Providing excellent service, resolving inquiries promptly, and meeting customer needs.

- Staying abreast of industry trends: Staying updated on new products, technologies, and regulations in the banking sector.

- Competing in a dynamic market: Navigating competitive pressures from traditional banks, online lenders, and fintech companies.

6. How do you build and maintain strong customer relationships?

- Personalized communication: Engage with customers on a personal level, understanding their financial goals and tailoring solutions accordingly.

- Proactive outreach: Reach out to customers regularly to check in, provide updates, or offer assistance.

- Excellent service: Provide timely and responsive assistance, resolving issues efficiently and exceeding customer expectations.

- Trustworthy and ethical conduct: Maintain a high level of integrity and transparency in all interactions with customers.

- Building rapport: Establish a rapport with customers by connecting on a human level and showing genuine care for their well-being.

7. Explain the role of technology in consumer banking today.

- Online and mobile banking: Providing convenient access to accounts, transactions, and financial management tools.

- Data analytics: Using data to understand customer behavior, identify trends, and develop targeted products and services.

- Artificial intelligence (AI): Automating tasks, enhancing customer service, and improving risk management capabilities.

- Blockchain: Exploring the potential for secure and transparent financial transactions.

- Robotics and process automation: Streamlining operations, reducing costs, and improving efficiency.

8. How do you stay up-to-date on the latest trends and developments in the consumer banking industry?

- Industry conferences and webinars: Attending industry events to connect with peers, learn about new trends, and exchange best practices.

- Trade publications and online resources: Staying informed through industry-specific magazines, websites, and online platforms.

- Professional development courses: Participating in training programs and workshops to enhance knowledge and skills.

- Networking and collaboration: Engaging with colleagues, mentors, and industry experts to gather insights and stay abreast of industry developments.

- Continuous learning: Setting aside dedicated time for research, reading industry reports, and exploring new technologies.

9. Describe your experience in managing a team of consumer bankers.

Team leadership

- Delegating tasks and responsibilities to optimize team performance.

- Providing clear guidance, training, and support to team members.

- Monitoring team performance and providing constructive feedback.

Team development

- Identifying and developing team members’ strengths and skills.

- Creating a collaborative and supportive team environment.

- Setting team goals and tracking progress.

10. What are your career goals and how do you see this role contributing to your professional development?

- Developing a deep understanding of consumer banking principles and practices.

- Gaining experience in various aspects of consumer banking, such as lending, deposits, and financial planning.

- Improving my communication, interpersonal, and problem-solving skills.

- Building a network of industry professionals and mentors.

- Advancing my career in the consumer banking industry and assuming leadership roles in the future.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Consumer Banker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Consumer Banker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Consumer Banker plays a crucial role in managing financial relationships with individual customers. Their key responsibilities include:

1. Customer Relationship Management

Building and maintaining strong relationships with clients by understanding their financial needs and goals.

- Providing personalized financial advice and guidance.

- Cross-selling and up-selling products and services tailored to customers’ requirements.

2. Account Management

Opening and managing customer accounts, including checking, savings, and loan accounts.

- Processing transactions, resolving account issues, and ensuring compliance with regulations.

- Monitoring account activity to identify potential fraud or unusual patterns.

3. Loan Origination

Assessing loan applications and providing financial counseling to customers.

- Analyzing credit history, income, and expenses.

- Determining loan eligibility and recommending appropriate loan products.

4. Sales and Marketing

Promoting bank products and services to potential customers.

- Actively networking and generating leads.

- Identifying and targeting specific market segments.

Interview Tips

Preparing thoroughly for a Consumer Banker interview is essential to showcase your skills and stand out. Here are some tips:

1. Research the Organization and Role

Thoroughly research the bank you’re applying to, its products and services, and the specific responsibilities of the Consumer Banker role.

- Visit the bank’s website and LinkedIn page.

- Read industry news and articles related to consumer banking.

2. Practice Your Answers to Common Interview Questions

Prepare for standard interview questions, such as “Tell me about yourself” and “Why are you interested in this position?” Develop concise and engaging responses that highlight your relevant skills and experience.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Quantify your accomplishments whenever possible.

- Example: Instead of “I assisted customers with their financial needs,” say, “I increased customer satisfaction ratings by 15% through personalized financial guidance and proactive account management.”

3. Highlight Your Customer Service Skills

Emphasize your ability to build and maintain strong customer relationships. Share examples of how you’ve successfully resolved customer issues and exceeded expectations.

- Example: “In my previous role, I consistently received positive feedback from customers for my empathy, patience, and ability to find solutions that met their individual needs.”

4. Convey Your Sales and Marketing Abilities

Demonstrate your skills in promoting products and services effectively. Discuss your experience in identifying customer needs and developing tailored solutions that drive sales.

- Example: “I successfully increased loan originations by 20% by implementing a targeted marketing campaign that focused on first-time homebuyers.”

5. Ask Insightful Questions

Prepare a list of thoughtful questions to ask the interviewer. This shows your genuine interest in the bank, the position, and the financial industry.

- Example: “I’m particularly interested in your bank’s commitment to sustainable investing. Can you share more about the initiatives you’re currently undertaking in this area?”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Consumer Banker interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.