Feeling lost in a sea of interview questions? Landed that dream interview for Credit Adjuster but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Credit Adjuster interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

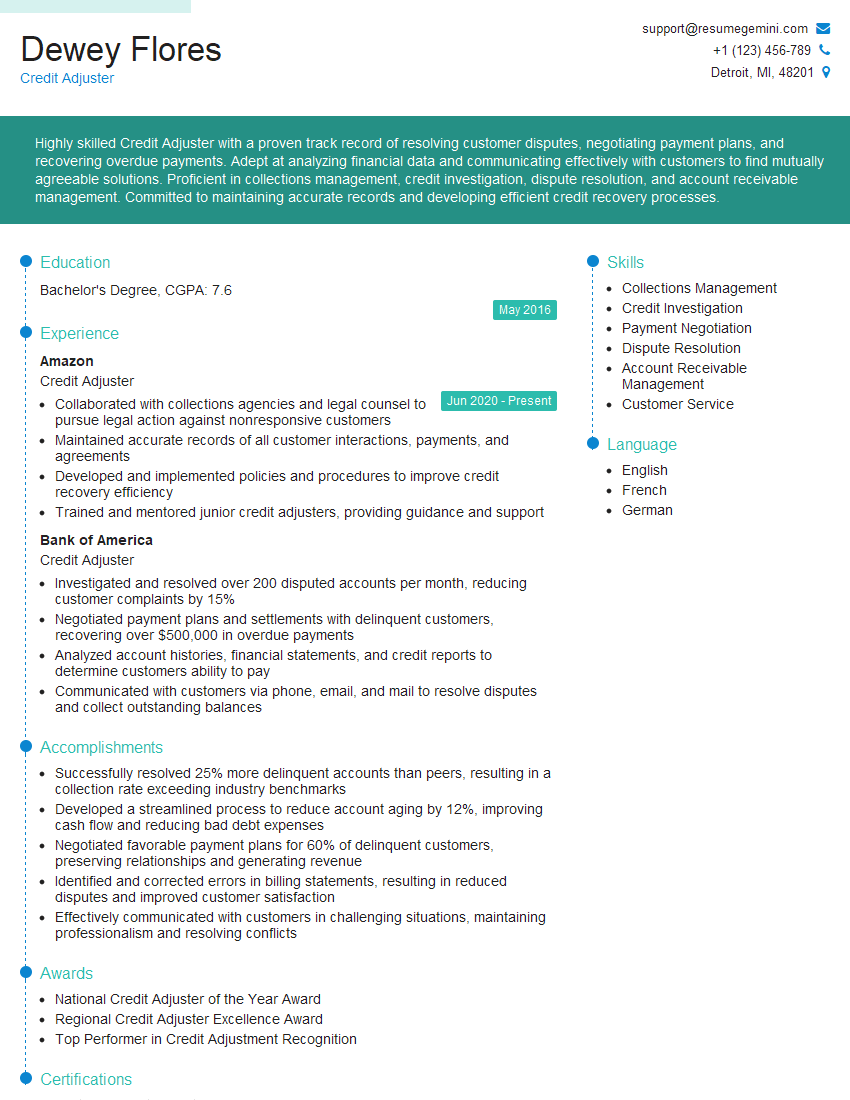

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Adjuster

1. What are the key responsibilities of a Credit Adjuster?

As a Credit Adjuster, my primary responsibilities include:

- Reviewing and analyzing customer accounts to identify and resolve delinquent payments

- Negotiating payment plans and settlements with customers to recover outstanding balances

- Investigating and resolving customer disputes and complaints related to billing and payments

- Maintaining accurate and up-to-date case files and records of all customer interactions

- Reporting on collections performance and providing recommendations for process improvements

2. Describe the steps involved in your collection process.

Initial Contact

- Attempt to contact the customer via phone, email, or mail

- Establish a payment arrangement or discuss payment options

Follow-Up and Negotiation

- Continue to follow up with the customer regularly

- Negotiate a payment plan that works for both parties

Collection Action

- If necessary, escalate the account to legal action

- File a lawsuit or refer the account to a collection agency

3. How do you determine the best collection strategy for an account?

When determining the best collection strategy, I consider several factors, including:

- The customer’s financial situation and ability to pay

- The amount and age of the debt

- The customer’s history of payment behavior

- Any extenuating circumstances that may be impacting the customer’s ability to pay

4. What are some common challenges faced by Credit Adjusters, and how do you overcome them?

Uncooperative Customers

- Remain calm and professional, even when dealing with difficult customers

- Build rapport and try to understand the customer’s perspective

Legal and Ethical Considerations

- Be familiar with all applicable laws and regulations

- Maintain confidentiality and respect customer privacy

Balancing Empathy and Assertiveness

- Show empathy for customers’ situations

- While remaining assertive in pursuing payment

5. How do you stay up-to-date with changes in collection laws and regulations?

- Attend industry conferences and webinars

- Read trade publications and online resources

- Network with other Credit Adjusters and professionals

- Consult with legal counsel when necessary

6. What software or tools do you commonly use in your role as a Credit Adjuster?

- Collection management software

- Customer relationship management (CRM) systems

- Accounting and billing software

- Credit reporting and analysis tools

- Communication and collaboration tools

7. How do you measure your success as a Credit Adjuster?

- Collection rates (percentage of outstanding balances recovered)

- Customer satisfaction scores

- Time to resolution for accounts

- Compliance with laws and regulations

- Contribution to overall company financial performance

8. How do you handle situations where customers are experiencing financial hardship?

- Work with customers to understand their financial situation

- Offer payment plans or other solutions that fit their budget

- Refer customers to financial counseling or other resources

- Maintain empathy and professionalism while enforcing company policies

9. What strategies do you use to prevent customers from becoming delinquent in the future?

- Educate customers about payment options and due dates

- Provide clear and concise invoices and statements

- Offer incentives for early or on-time payments

- Monitor customer accounts and intervene early if payment issues arise

- Collaborate with other departments to identify and address root causes of payment problems

10. How do you prioritize and manage a large caseload?

- Use collection software to track and organize accounts efficiently

- Prioritize accounts based on factors such as balance, age, and customer risk

- Delegate tasks to team members when possible

- Stay organized and maintain a detailed case management system

- Regularly review and adjust priorities as needed

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

To ensure successful performance, Credit Adjusters should be well-versed in the following key responsibilities:

1. Accounts Receivable Management

Efficiently manage accounts receivable by monitoring customer accounts, reviewing invoices, and identifying potential issues.

- Conduct regular reviews of invoices and statements.

- Analyze account activity to identify discrepancies or errors.

2. Credit Analysis

Utilize strong analytical skills to assess creditworthiness, establish credit limits, and monitor customer risk profiles.

- Review financial statements, credit reports, and other relevant data.

- Recommend credit terms and limits based on risk assessment.

3. Collection Activities

Proactively initiate and manage collections activities, including contacting customers, negotiating payment plans, and resolving disputes.

- Communicate with customers via phone, email, or written correspondence.

- Develop and implement collection strategies based on customer needs.

4. Customer Relationship Management

Build and maintain positive relationships with customers by providing excellent service, resolving queries, and negotiating mutually beneficial outcomes.

- Handle customer inquiries and complaints effectively.

- Foster relationships by being responsive and understanding.

Interview Tips

1. Research the Company and Position

Thoroughly research the company’s industry, business model, and culture. Additionally, familiarize yourself with the specific role and its responsibilities.

2. Practice Your Communication Skills

Prepare for questions that assess your communication and interpersonal skills. Practice answering questions clearly, concisely, and with examples.

3. Focus on Transferable Skills

Highlight transferable skills that are relevant to the role, even if you don’t have direct experience as a Credit Adjuster.

- Emphasize your ability to analyze data, resolve conflicts, and manage customer relationships.

4. Be Prepared to Discuss Your Credit Knowledge

Demonstrate your understanding of credit analysis, collections processes, and customer service best practices.

- Provide examples of how you have applied these concepts in previous roles.

5. Ask Thoughtful Questions

Asking insightful questions shows that you’re engaged and interested in the role. Prepare questions that demonstrate your knowledge and enthusiasm.

- Inquire about the company’s credit policies and procedures.

- Ask about opportunities for professional development and advancement.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Credit Adjuster interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!