Are you gearing up for an interview for a Credit Reporter position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Credit Reporter and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

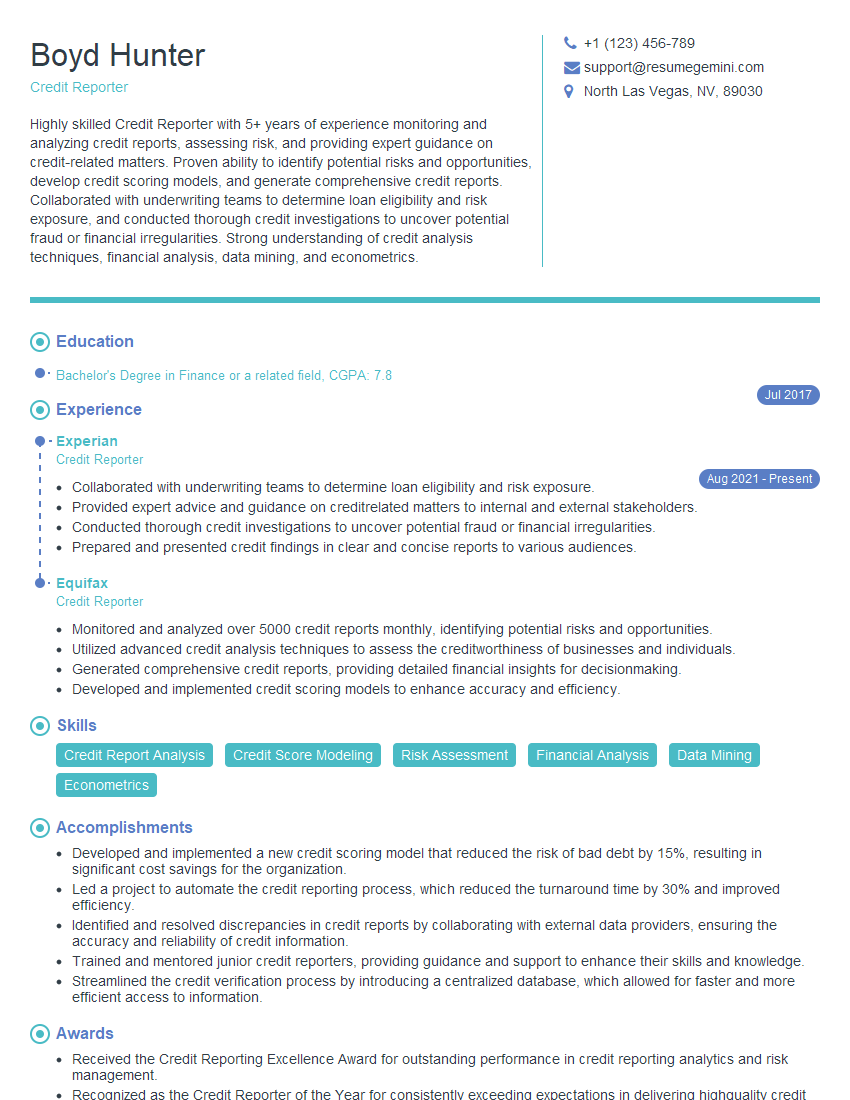

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Reporter

1. What are the key elements you consider when assessing a company’s creditworthiness?

As a Credit Reporter, I meticulously evaluate a company’s creditworthiness based on the following key elements:

- Financial Performance: I analyze financial statements to assess profitability, liquidity, and solvency, as these metrics provide insights into the company’s ability to meet financial obligations.

- Management Team: The experience, qualifications, and track record of the management team play a crucial role in determining a company’s credit risk. I evaluate their ability to manage operations, make sound financial decisions, and navigate challenges.

2. How do you gather and analyze financial data to assess credit risk?

Data Gathering

- Review financial statements, including balance sheets, income statements, and cash flow statements.

- Collect industry-specific data and market information to provide context for the company’s performance.

- Obtain credit reports and other financial data from reputable sources.

Data Analysis

- Use financial ratios and other metrics to evaluate the company’s financial strength and performance.

- Compare financial data to industry benchmarks and historical trends to identify areas of concern or growth potential.

- Identify potential risks and mitigating factors that may impact the company’s creditworthiness.

3. What industry-specific factors do you consider when assessing credit risk?

Industry-specific factors that I consider during credit risk assessment include:

- Industry Risk: I evaluate the overall risk associated with the industry in which the company operates, considering factors such as competition, regulatory changes, and technological advancements.

- Market Position: The company’s market share, competitive advantage, and customer base provide insights into its ability to withstand market fluctuations.

4. How do you stay updated on industry trends and best practices in credit reporting?

- Regular research: I actively monitor industry publications, attend conferences, and engage in professional development to stay abreast of emerging trends and best practices.

- Collaboration: I collaborate with industry professionals, regulatory bodies, and external experts to share knowledge and gain valuable insights.

5. What is your approach to identifying and mitigating credit risks?

- Early Warning Indicators: I identify potential risks by monitoring financial statements, industry news, and market conditions.

- Risk Assessment: I evaluate the severity and likelihood of potential risks and develop mitigation strategies accordingly.

- Risk Mitigation: I recommend measures such as imposing stricter lending conditions, requesting additional collateral, or engaging in hedging strategies to reduce credit exposure.

6. How do you effectively communicate your credit analysis and recommendations to stakeholders?

- Clear and Concise Reporting: I present my analysis and recommendations clearly and concisely in written reports.

- Data Visualization: I use charts, graphs, and other visual aids to simplify complex data and make it more accessible.

- Verbal Presentations: I am confident in presenting my findings verbally in meetings and presentations, addressing questions and clarifying my recommendations.

7. Describe a challenging credit assessment you have encountered and how you resolved it?

In a recent credit assessment, I encountered a company with a complex financial structure and limited financial transparency. I addressed this challenge by:

- In-depth Due Diligence: I conducted additional due diligence through meetings with management, site visits, and discussions with industry experts.

- Collaboration: I consulted with colleagues and external experts to gain diverse perspectives and insights.

- Risk-Adjusted Recommendation: Based on my analysis, I developed a risk-adjusted recommendation that included stricter lending terms and ongoing monitoring.

8. How do you maintain confidentiality and ethical standards in your role as a Credit Reporter?

- Data Security: I adhere to strict data security protocols to protect sensitive financial information.

- Ethical Considerations: I prioritize ethical decision-making and avoid conflicts of interest.

- Transparency: I am transparent with clients and stakeholders regarding potential risks and limitations of my analysis.

9. What is your understanding of credit risk modeling and how do you use it?

- Credit Risk Modeling: I utilize statistical models to assess the probability of default and estimate potential credit losses.

- Model Validation: I validate and calibrate models regularly to ensure accuracy and reliability.

- Model Integration: I integrate credit risk models into decision-making processes to improve lending decisions.

10. How do you stay motivated and up-to-date in the dynamic field of credit reporting?

- Continuous Learning: I actively pursue professional development opportunities to expand my knowledge and skills.

- Curiosity: I maintain a sense of curiosity and seek opportunities to learn about emerging trends and advancements.

- Motivation: The impact of my work on financial decision-making and risk mitigation motivates me to excel in my role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Reporter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Reporter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Credit Reporters serve as gatekeepers of financial integrity, safeguarding the interests of creditors and ensuring responsible lending practices. Their primary responsibilities include meticulously verifying credit information, meticulously analyzing financial data, and astutely reporting on creditworthiness to drive informed decision-making.

1. Credit Verification and Analysis

Thoroughly scrutinize credit applications to ascertain the accuracy and validity of provided information.

- Verify personal identities, employment details, and financial history.

- Meticulously analyze credit reports, scrutinizing payment histories, outstanding balances, and credit inquiries.

2. Financial Assessment

Expertly assess financial statements to determine the creditworthiness of individuals and businesses.

- Analyze balance sheets, income statements, and cash flow statements to evaluate financial stability.

- Identify potential financial risks and develop mitigation strategies.

3. Credit Reporting

Accurately prepare comprehensive credit reports that convey nuanced insights into creditworthiness.

- Compile detailed reports summarizing credit history, financial analysis, and risk assessment.

- Communicate findings and recommendations clearly and effectively to clients and stakeholders.

4. Compliance and Regulatory Adherence

Uphold strict adherence to all applicable laws and regulations governing credit reporting.

- Ensure compliance with the FCRA, Dodd-Frank Act, and other relevant regulations.

- Maintain accurate and up-to-date records to safeguard sensitive financial information.

Interview Tips

To ace the Credit Reporter interview, meticulous preparation is paramount. Here are some invaluable tips to showcase your expertise and leave a lasting impression.

1. Research the Company and Position

Demonstrate your genuine interest and enthusiasm by thoroughly researching the company and the specific job responsibilities. Familiarize yourself with their lending practices, industry reputation, and the company’s commitment to compliance.

2. Highlight Your Experience and Skills

Quantify your accomplishments and articulate your expertise in credit verification, financial analysis, and reporting. Use specific examples to showcase your proficiency in data analysis, risk assessment, and regulatory compliance.

3. Emphasize Your Attention to Detail

Credit Reporters must possess an unwavering eye for detail. Emphasize your meticulous approach to data verification, your ability to uncover discrepancies, and your commitment to delivering accurate and comprehensive reports.

4. Showcase Your Communication and Interpersonal Skills

Effective communication is crucial for Credit Reporters. Highlight your ability to convey complex financial information clearly and concisely to clients, colleagues, and other stakeholders. Showcase your interpersonal skills and ability to build strong working relationships.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Credit Reporter interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.