Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Services Director position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

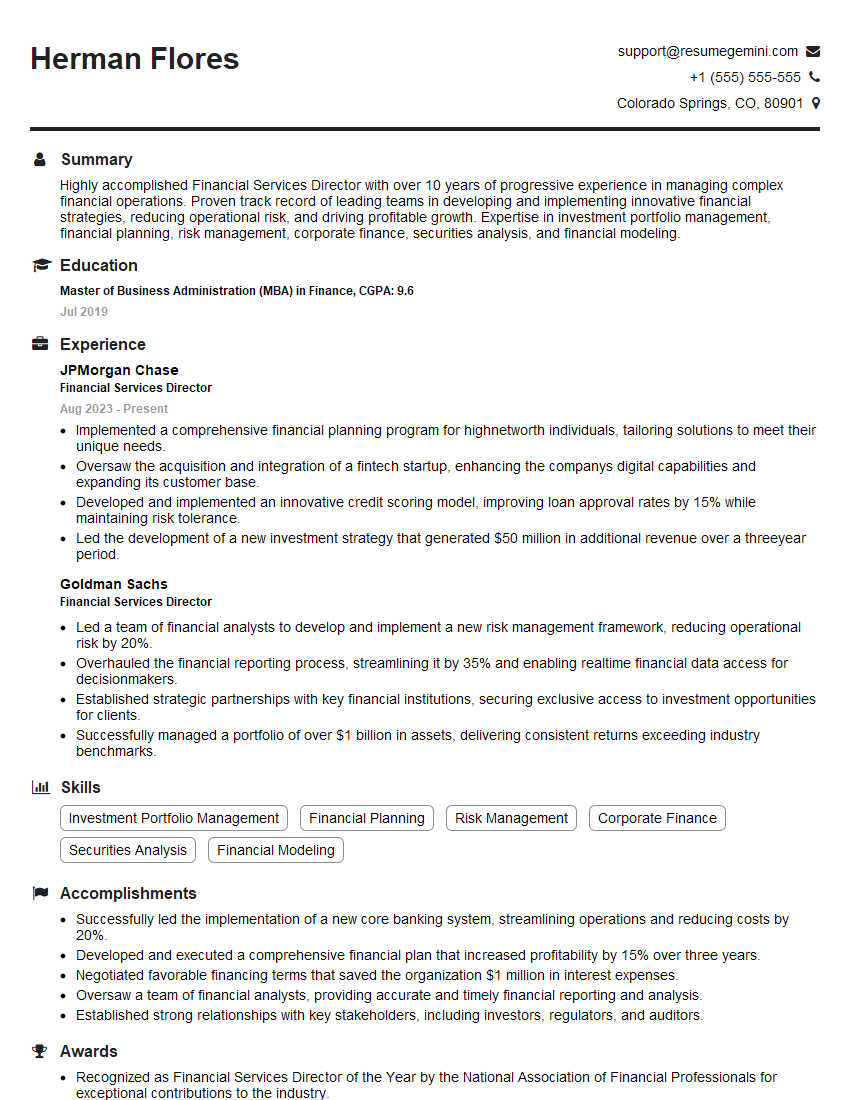

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Services Director

1. Describe the key financial risks that banks face and how you would manage these risks.

The key financial risks that banks face include:

- Credit risk: This is the risk that a borrower will not be able to repay a loan.

- Market risk: This is the risk that the value of a bank’s investments will decline.

- Operational risk: This is the risk that a bank will suffer a loss due to an operational error, such as a computer glitch or a fraud.

To manage these risks, banks can use a variety of tools, including:

- Risk assessment: This involves identifying and assessing the risks that a bank faces.

- Risk mitigation: This involves taking steps to reduce the impact of risks.

- Risk monitoring: This involves tracking risks and taking corrective action as needed.

2. What are the current trends in the financial services industry and how are you preparing for these changes?

Digital Transformation

- The financial services industry is undergoing a significant digital transformation.

- Banks are increasingly offering online and mobile banking services.

- Fintech companies are also emerging as a major force in the industry.

Regulatory Changes

- The financial services industry is also facing a number of regulatory changes.

- These changes are designed to improve the safety and soundness of the financial system.

- Banks need to be prepared to comply with these changes.

Preparing for the Future

- To prepare for these changes, banks need to invest in technology.

- They also need to develop new products and services.

- And they need to be prepared to partner with fintech companies.

3. How do you stay up-to-date on the latest developments in the financial services industry?

I stay up-to-date on the latest developments in the financial services industry by reading industry publications, attending conferences, and networking with other professionals.

- Industry publications: I read a variety of industry publications, including The Wall Street Journal, Financial Times, and American Banker.

- Conferences: I attend industry conferences to hear from experts and learn about new trends.

- Networking: I network with other professionals in the financial services industry to stay informed about the latest developments.

4. What are your strengths and weaknesses as a Financial Services Director?

Strengths

- Strong understanding of the financial services industry

- Proven track record of success in managing financial risks

- Excellent communication and interpersonal skills

Weaknesses

- Not as experienced in digital transformation as I would like to be

- Can be a bit too detail-oriented at times

I am confident that my strengths outweigh my weaknesses and that I would be a valuable asset to your team.

5. What is your management style?

My management style is collaborative and empowering.

- Collaborative: I believe in working with my team to achieve our goals.

- Empowering: I give my team the authority to make decisions and take ownership of their work.

I am also a results-oriented manager. I set clear goals for my team and hold them accountable for achieving those goals.

6. What are your career goals?

My career goal is to become a Chief Financial Officer (CFO) of a major financial institution.

- I believe that my skills and experience make me well-qualified for this role.

- I am confident that I can lead a finance team to achieve success.

7. Why are you interested in this position?

I am interested in this position because I believe that my skills and experience would be a valuable asset to your team.

- I have a strong understanding of the financial services industry.

- I have a proven track record of success in managing financial risks.

- I am a collaborative and empowering manager.

I am also excited about the opportunity to work with a team of talented professionals.

8. What are your salary expectations?

My salary expectations are commensurate with my experience and qualifications.

- According to Glassdoor, the average salary for a Financial Services Director in this area is between $150,000 and $250,000.

- I am confident that my skills and experience are worth the top of this range.

I am willing to negotiate my salary based on the overall compensation package.

9. Are you available for immediate employment?

Yes, I am available for immediate employment.

- I have given my current employer two weeks’ notice.

- I am eager to start working with your team as soon as possible.

10. Do you have any questions for me?

- What are the biggest challenges facing the financial services industry today?

- What are your expectations for this position in the first 90 days?

- What is the company culture like?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Services Director.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Services Director‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Financial Services Director holds a pivotal role in driving the financial strategy and operations of the company. Key responsibilities encompass:

1. Financial Planning and Forecasting

Overseeing the development and execution of comprehensive financial plans aligning with the organization’s strategic objectives. Ensuring accurate financial forecasting and analysis to guide decision-making.

2. Risk Management and Compliance

Establishing and maintaining a robust risk management framework to identify, assess, and mitigate financial and operational risks. Ensuring adherence to regulatory requirements and industry best practices.

3. Financial Reporting and Analysis

Leading the preparation and timely delivery of financial statements in compliance with accounting standards. Providing insightful financial analysis and interpretation to support informed decision-making.

4. Capital Allocation and Investment

Developing and implementing strategies for optimal capital allocation and investment decisions. Overseeing the evaluation and execution of financial instruments, acquisitions, and mergers.

5. Team Leadership and Development

Guiding and developing a team of finance professionals, providing mentorship, and ensuring their professional growth. Fostering a collaborative and results-oriented work environment.

Interview Tips

To ace the Financial Services Director interview, meticulous preparation is essential. Here are some invaluable tips:

1. Research the Company and Industry

Thoroughly research the company’s financial performance, strategic initiatives, and market landscape. Demonstrate your understanding of the industry’s trends and regulatory environment.

2. Quantify Your Accomplishments

When presenting your qualifications, provide specific, quantifiable examples that showcase your contributions to previous roles. Use metrics to demonstrate the impact of your work on financial performance or risk mitigation.

3. Articulate Your Vision

Prepare a concise and impactful statement outlining your vision for the company’s financial future. Explain how your expertise and experience can contribute to achieving strategic objectives.

4. Leverage Behavioral Interviewing Techniques

Behavioral interviewing involves sharing real-life examples of your skills and experiences. Use the STAR method (Situation, Task, Action, Result) to effectively articulate how you handled challenging situations and delivered positive outcomes.

5. Ask Thoughtful Questions

Asking insightful questions during the interview demonstrates your engagement and interest in the role. Prepare questions that delve into the company’s financial strategy, risk management practices, and opportunities for professional growth.

Next Step:

Now that you’re armed with the knowledge of Financial Services Director interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Financial Services Director positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini