Are you gearing up for an interview for a Mortgage Loan Processor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Mortgage Loan Processor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

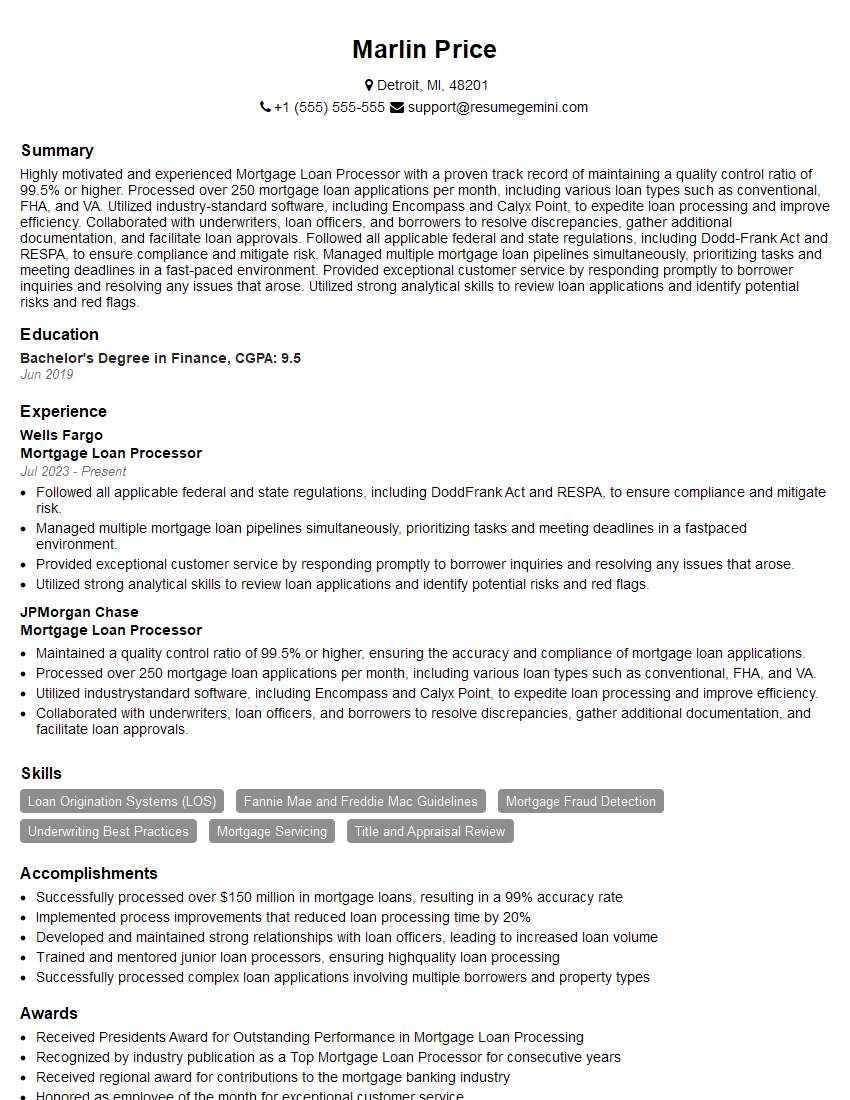

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Loan Processor

1. Explain the mortgage loan processing workflow.

The mortgage loan processing workflow typically involves the following steps:

- Loan application

- Loan underwriting

- Loan closing

2. What are the key documents required for mortgage loan processing?

Loan application

- W-2s

- Pay stubs

- Bank statements

- Tax returns

Loan underwriting

- Credit report

- Income verification

- Asset verification

Loan closing

- Closing disclosure

- Mortgage note

- Deed of trust

3. What are the common challenges you face in mortgage loan processing?

- Incomplete or inaccurate loan applications

- Delays in obtaining required documentation

- Underwriting issues

- Compliance issues

4. How do you ensure the accuracy and completeness of loan applications?

- Carefully review all loan applications

- Contact borrowers to clarify any incomplete or inaccurate information

- Request additional documentation as needed

5. How do you track the status of loan applications and communicate with borrowers and other parties involved in the loan process?

- Use a loan processing software system

- Send regular updates to borrowers and other parties

6. What are the different types of mortgage loans that you have processed?

- Conventional loans

- FHA loans

- VA loans

- Jumbo loans

7. What are the key factors that you consider when evaluating a mortgage loan application?

- Borrower’s credit score

- Borrower’s debt-to-income ratio

- Borrower’s employment history

- Property value

8. What are the different types of underwriting conditions that you may encounter?

- Clear to close

- Conditions that must be met prior to closing

- Denials

9. What are the most common reasons for loan denials?

- Insufficient income

- Poor credit history

- Unfavorable property value

- Incomplete or inaccurate loan applications

10. What are the key compliance regulations that you must be aware of in mortgage loan processing?

- The Truth in Lending Act (TILA)

- The Real Estate Settlement Procedures Act (RESPA)

- The Equal Credit Opportunity Act (ECOA)

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Loan Processor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Loan Processor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mortgage loan processors play a vital role in ensuring that clients can secure and maintain their mortgages. Their key responsibilities encompass:

1. Application Processing

Serving clients by receiving and reviewing loan applications, ensuring they are complete, accurate, and compliant.

2. Data Verification

Verifying income, employment, assets, and other borrower information to assess financial stability and eligibility.

3. Loan Origination

Packaging and submitting loan applications to lenders for review and approval, preparing loan documents for signing.

4. Processing Disbursements

Coordinating with closing agents to ensure timely funding and disbursement of loan proceeds.

5. Customer Service

Providing clear and efficient customer service throughout the loan process, resolving queries and concerns.

6. Quality Control

Adhering to quality control standards, ensuring accuracy and completeness of loan documentation.

7. Regulatory Compliance

Maintaining knowledge of industry regulations and adhering to compliance requirements to mitigate risks.

Interview Tips

To excel in a mortgage loan processor interview, candidates should prepare thoroughly by considering the following tips:

1. Research the Company and Role

– Study the company’s website and social media to understand its culture and values.

– Thoroughly review the job description to grasp the specific responsibilities and qualifications.

2. Highlight Relevant Skills and Experience

– Emphasize your experience in processing mortgage loans or similar financial transactions.

– Quantify your accomplishments using specific metrics to demonstrate your impact.

3. Prepare Questions

– Asking insightful questions demonstrates your interest and engagement.

– Prepare questions about the company’s lending policies, technology used, and opportunities for growth.

4. Practice Common Interview Questions

– Practice answering typical interview questions, such as “Tell me about yourself” and “Why are you interested in this role?”.

– Prepare examples of your work to support your answers.

5. Dress Professionally and Arrive on Time

– First impressions matter. Choose business attire that conveys professionalism.

– Plan to arrive on time or slightly early to show respect for the interviewers’ time.

Example Outline:

When answering interview questions, consider using the following outline:

- Situation: Briefly describe a relevant situation or challenge.

- Task: Explain the specific task you were responsible for completing.

- Action: Outline the actions you took to address the situation.

- Result: Quantify or describe the positive outcome of your efforts.

6. Follow Up

– Send a thank-you note to the interviewers within 24 hours, expressing your appreciation and reiterating your interest.

– Follow up a few days later if you have not heard back to inquire about the status of your application.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mortgage Loan Processor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.