Are you gearing up for a career in Insurance and Accounts Receiveable Coordinator? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Insurance and Accounts Receiveable Coordinator and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

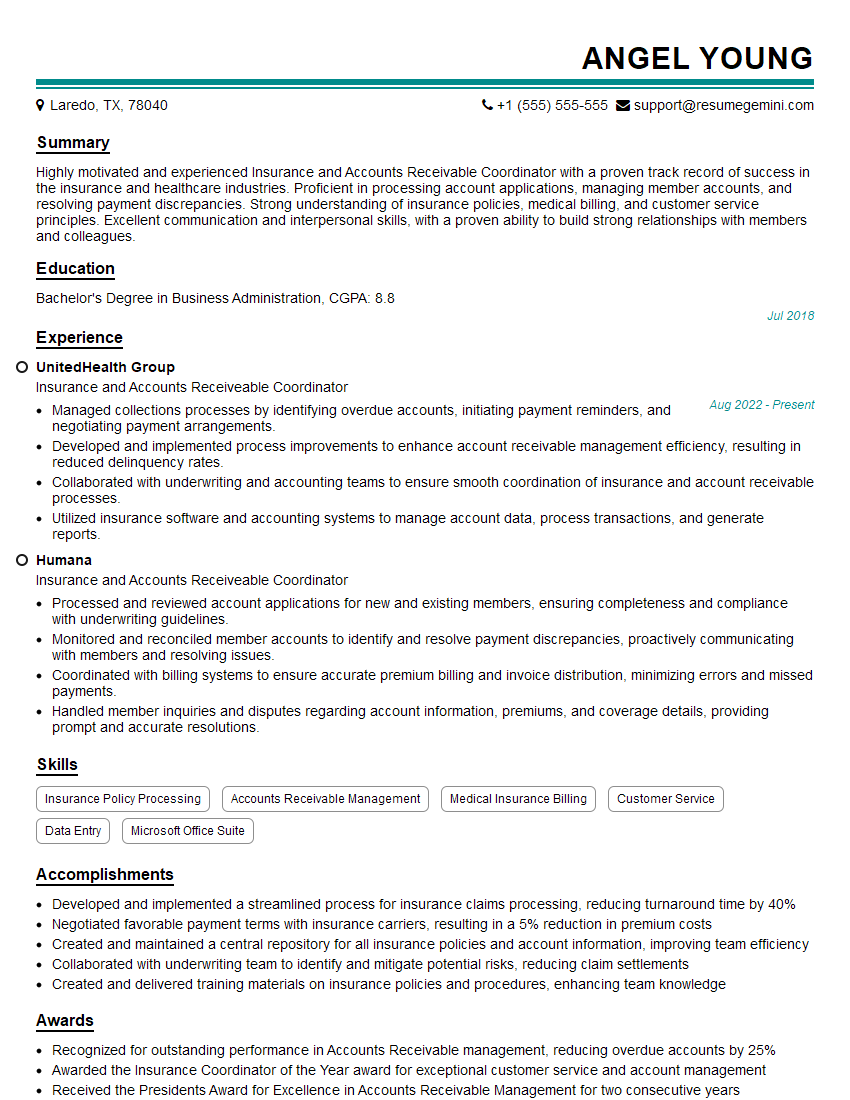

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance and Accounts Receiveable Coordinator

1. How do you ensure that patient insurance is verified before services are rendered?

- Request and review insurance cards upon patient arrival.

- Verify coverage through electronic eligibility verification systems.

- Contact insurance companies directly to confirm patient benefits and limitations.

2. What steps do you take to handle denied insurance claims?

Researching the Reason for Denial

- Review the claim denial notice to determine the specific reason for rejection.

- Check if the information on the claim matches the patient’s records and insurance policy.

- Consult with the provider to verify the accuracy of the diagnosis, procedures, and billing codes.

Appealing the Denial

- Write a clear and concise appeal letter outlining the reason for the denial and supporting documentation.

- Provide additional information, such as medical records, to support the claim.

- Follow up with the insurance company to track the status of the appeal.

3. How do you prioritize and manage a large volume of accounts receivable?

- Establish clear aging categories to identify overdue accounts.

- Use technology or software to automate account monitoring and tracking.

- Develop follow-up strategies for different types of debtors.

- Prioritize accounts based on factors such as balance, risk of default, and potential impact on cash flow.

4. What methods do you use to collect outstanding patient balances?

- Send out automated payment reminders via phone, email, or text message.

- Offer flexible payment plans and discounts for early payment.

- Collaborate with collection agencies as a last resort.

5. How do you stay up-to-date on changes in insurance regulations and billing codes?

- Attend industry webinars, conferences, and training sessions.

- Subscribe to industry publications and newsletters.

- Consult with insurance companies and billing experts for guidance.

6. What is your understanding of the HIPAA privacy and security regulations?

- Protecting patient health information (PHI) from unauthorized access, use, or disclosure.

- Providing patients with clear and concise information about their privacy rights.

- Ensuring that all employees are properly trained on HIPAA compliance.

7. How do you balance the need for accurate billing with the timely submission of claims?

- Establish clear billing guidelines and procedures.

- Use technology to automate claim submission and reduce errors.

- Prioritize claims based on urgency and potential impact on cash flow.

8. What strategies do you use to improve insurance reimbursement rates?

- Negotiating contracts with insurance companies.

- Submitting clean and accurate claims.

- Appealing denied claims and providing supporting documentation.

9. How do you handle patient inquiries and complaints related to insurance and billing?

- Listen attentively and empathize with the patient’s concerns.

- Thoroughly review the patient’s account and insurance policy.

- Provide clear explanations and options for resolving the issue.

10. What is your experience with using medical billing and accounting software?

- Proficient in using relevant software programs, such as [specific software names].

- Understanding of medical billing workflows and data management.

- Ability to troubleshoot and resolve software issues.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance and Accounts Receiveable Coordinator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance and Accounts Receiveable Coordinator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Insurance and Accounts Receivable Coordinator plays a vital role in ensuring the smooth functioning of insurance and accounts receivable operations. Their responsibilities encompass a wide range of tasks related to insurance verification, billing, and accounts receivable management.

1. Insurance Verification and Processing

Verify insurance eligibility and benefits for patients.

- Contact insurance companies to obtain authorization for procedures.

- Review insurance policies and determine coverage.

2. Billing and Collections

Prepare and send patient invoices.

- Follow up on unpaid invoices and resolve billing issues.

- Process patient payments and deposits.

3. Accounts Receivable Management

Maintain accurate accounts receivable records.

- Monitor and analyze accounts receivable aging reports.

- Identify and resolve discrepancies in patient accounts.

4. Customer Service

Provide excellent customer service to patients and insurance companies.

- Answer inquiries and resolve concerns promptly.

- Maintain positive relationships with customers.

Interview Tips

To ace the interview for the Insurance and Accounts Receivable Coordinator position, it is crucial to prepare both professionally and technically. Here are some tips to help you succeed:

1. Research the Company and the Role

Familiarize yourself with the company’s mission, values, and services. Understand the specific requirements of the Insurance and Accounts Receivable Coordinator role.

- Visit the company website and social media accounts.

- Read reviews and articles about the company.

2. Practice Your Answers

Prepare answers to common interview questions related to your skills, experience, and qualifications. Practice delivering your answers clearly and succinctly.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Quantify your accomplishments whenever possible.

3. Showcase Your Technical Expertise

Demonstrate your proficiency in insurance verification, billing, and accounts receivable management. Highlight any certifications or specialized training you have received.

- Provide specific examples of how you have handled complex insurance cases.

- Discuss your understanding of medical billing codes and regulations.

4. Emphasize Your Customer Service Skills

Emphasize your ability to provide excellent customer service to both patients and insurance companies. Share examples of how you have resolved conflicts and built strong relationships.

- Describe your experience in handling challenging patient interactions.

- Explain how you maintain positive relationships with insurance representatives.

5. Prepare Questions for the Interviewer

Ask thoughtful questions about the role, the company, and the industry. This shows your interest and engagement.

- Inquire about the company’s growth plans.

- Ask about the company’s commitment to customer satisfaction.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance and Accounts Receiveable Coordinator interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!