Are you gearing up for an interview for a Loan Assistant position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Loan Assistant and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

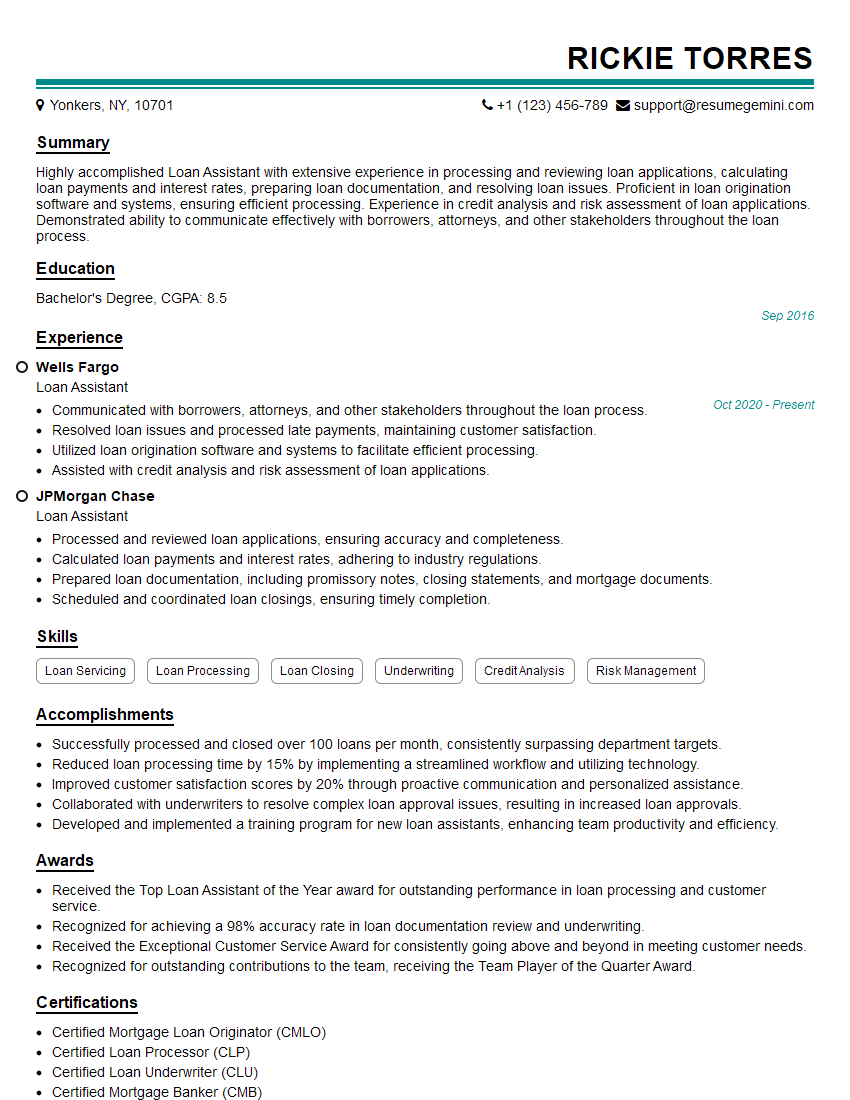

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Assistant

1. Explain the different types of loan products that you are familiar with?

- Installment Loans: These loans are repaid in fixed monthly payments over a specific term.

- Revolving Loans: These loans allow borrowers to draw funds as needed and repay them over time, usually with a minimum payment each month.

- Mortgages: These loans are used to purchase real estate and are secured by the property.

- Lines of Credit: These loans provide borrowers with access to a pre-approved amount of funds that can be drawn upon as needed.

- Business Loans: These loans are designed to help businesses finance growth, expansion, or other business-related needs.

2. What is the loan application process and what are the key documents required?

- Customer submits a loan application.

- Loan officer reviews the application and requests additional documentation if necessary.

- Loan officer analyzes the documentation and assesses the customer’s creditworthiness.

- Loan officer issues a loan commitment or denial.

- Loan application

- Proof of income (pay stubs, tax returns)

- Proof of assets (bank statements, investment accounts)

- Credit report

Loan Application Process

Key Documents Required

3. How do you determine the interest rate and loan terms for a borrower?

The interest rate and loan terms are determined based on a number of factors, including:

- Credit score

- Debt-to-income ratio

- Loan amount

- Loan term

- Type of loan

4. What are some of the common reasons why loan applications are declined?

- Poor credit history

- High debt-to-income ratio

- Insufficient income

- Unverifiable information on the loan application

- Incomplete documentation

5. What is your experience with using loan origination software and what are its benefits?

I have experience using several different loan origination software programs, including [list of software]. These programs help to streamline the loan application process by automating tasks such as data entry, credit checks, and document generation. They also provide real-time updates on the status of loan applications, which helps to improve communication with borrowers and reduce processing times.

6. How do you handle irate or difficult customers?

- Remain calm and professional.

- Listen to the customer’s concerns.

- Empathize with the customer’s situation.

- Offer solutions to resolve the issue.

- Follow up with the customer to ensure satisfaction.

7. What are your strengths and weaknesses as a Loan Assistant?

Strengths

- Excellent communication and interpersonal skills

- Strong attention to detail and accuracy

- Proficient in loan origination software

- Ability to work independently and as part of a team

- Customer-focused and committed to providing excellent service

Weaknesses

- Limited experience with certain types of loans (e.g., commercial loans)

- Working under pressure (but is improving)

8. What are your salary expectations?

My salary expectations are in the range of [salary range]. I believe that this is a fair salary for my experience and qualifications, and it is in line with the industry average.

9. Why are you interested in working as a Loan Assistant at our company?

I am interested in working as a Loan Assistant at your company because I am impressed by your company’s reputation for providing excellent customer service and your commitment to helping customers achieve their financial goals. I believe that my skills and experience would be a valuable asset to your team, and I am eager to contribute to the success of your company.

10. Do you have any questions for me?

I do have a few questions. First, could you tell me more about the company’s training program for new Loan Assistants? Second, what are the opportunities for advancement within the company? Finally, what is the company’s culture like? I am particularly interested in the company’s commitment to diversity and inclusion.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Assistants play a crucial role in the loan processing and underwriting process. They perform various administrative and analytical tasks to support loan officers and ensure smooth loan transactions.

1. Loan Processing

Loan Assistants are responsible for collecting and verifying loan applications, reviewing financial documents, and preparing loan packages for approval.

- Gather and organize borrower information, including income, assets, and debts.

- Review and analyze financial statements, tax returns, and credit reports to assess borrower creditworthiness.

2. Loan Underwriting

Loan Assistants assist loan officers in underwriting loans by performing due diligence and evaluating loan risk.

- Analyze loan applications to determine adherence to lending guidelines and policies.

- Identify and mitigate potential risks associated with loan approvals.

3. Customer Service

Loan Assistants serve as the primary point of contact for borrowers throughout the loan process, providing information and support.

- Answer borrower inquiries, address concerns, and provide updates on loan status.

- Explain loan terms and conditions clearly and ensure borrowers understand their obligations.

4. Administrative Support

Loan Assistants perform administrative tasks to maintain loan files and support the loan processing team.

- Maintain loan files, track loan progress, and ensure compliance with regulations.

- Generate correspondence, prepare reports, and handle administrative duties related to loan processing.

Interview Tips

Preparing for a Loan Assistant interview requires a combination of technical knowledge and interpersonal skills. Here are some tips to help you ace your interview:

1. Research the Industry and Company

Familiarize yourself with the mortgage industry, loan products, and the specific company you are applying to. This knowledge will demonstrate your interest and understanding of the role.

- Read articles and industry publications to stay updated on current trends.

- Visit the company’s website to learn about their mission, values, and loan portfolio.

2. Highlight Your Technical Skills

Emphasize your proficiency in loan processing software, financial analysis tools, and customer relationship management systems.

- Quantify your accomplishments by providing specific examples of loans you have processed or analyzed.

- Mention any certifications or training you have completed to enhance your technical skills.

3. Demonstrate Customer Focus

Loan Assistants must have excellent communication and interpersonal skills. Showcase your ability to build rapport with borrowers and provide exceptional customer service.

- Share examples of how you have effectively handled challenging borrower interactions.

- Explain your approach to providing clear and concise loan information to borrowers.

4. Prepare for Behavioral Questions

Interviewers often ask behavioral questions to assess your fit for the role. Prepare answers that align with the company’s values and highlight your problem-solving abilities.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Focus on demonstrating your skills in areas such as teamwork, attention to detail, and adaptability.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Loan Assistant interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.