Feeling lost in a sea of interview questions? Landed that dream interview for Loan Representative but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Loan Representative interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

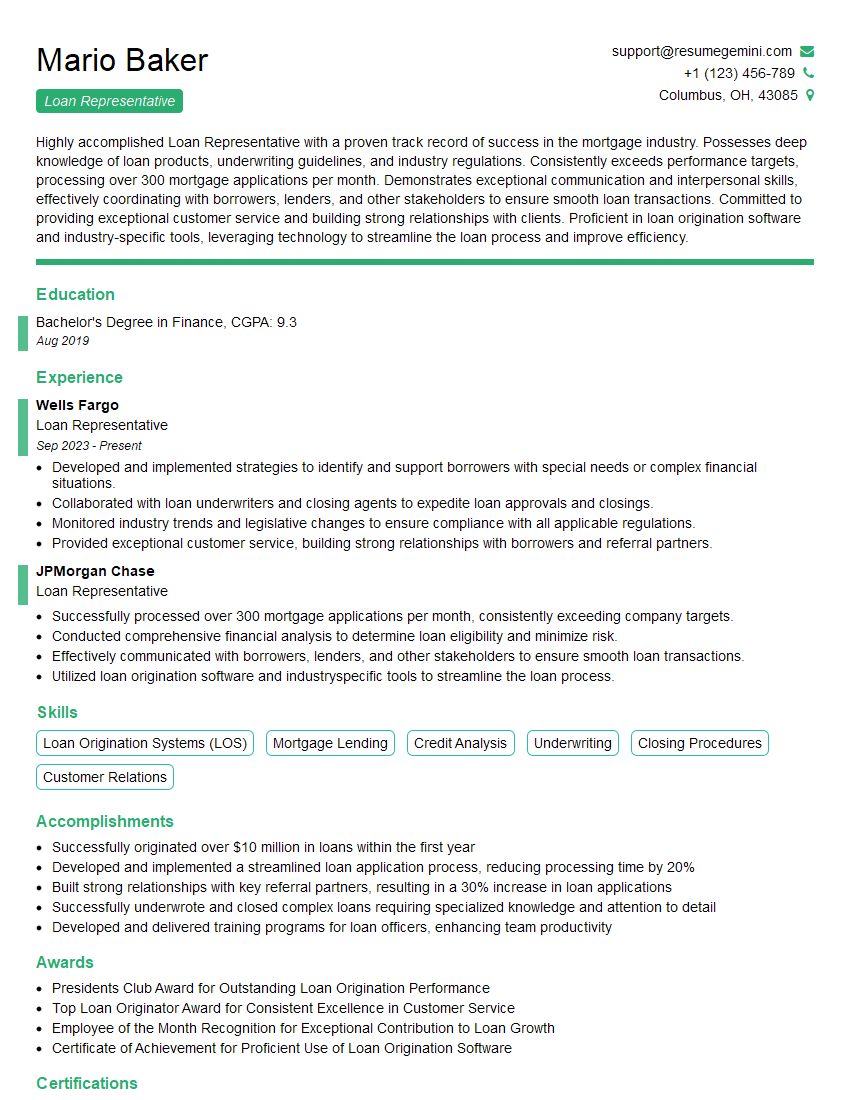

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Representative

1. What are the key responsibilities of a Loan Representative?

As a Loan Representative, my primary responsibilities include:

- Assessing loan applications and determining creditworthiness of potential borrowers

- Processing and underwriting loan applications, ensuring compliance with regulations and policies

2. Describe the different types of loans you have experience with.

Mortgage Loans

- Conventional loans

- FHA loans

- VA loans

Consumer Loans

- Personal loans

- Auto loans

- Credit cards

Business Loans

- Small business loans

- Commercial real estate loans

- Equipment financing

3. What are the key factors you consider when evaluating a loan application?

- Borrower’s credit history

- Debt-to-income ratio

- Loan-to-value ratio

- Collateral

- Employment and income history

4. How do you handle difficult customers or borrowers?

- Remain calm and professional

- Listen to their concerns and try to understand their perspective

- Provide clear and concise explanations

- Offer solutions or alternatives when possible

5. What are the ethical and legal considerations you must adhere to as a Loan Representative?

- Maintaining confidentiality

- Avoiding conflicts of interest

- Complying with regulations such as the Truth-in-Lending Act and Fair Credit Reporting Act

- Treating all customers fairly and equitably

6. Describe your experience with using loan origination software and other financial technologies.

I am proficient in using various loan origination software, including [mention specific software]. I am also familiar with financial technologies such as automated underwriting systems and electronic signatures.

7. How do you stay up-to-date on changes in the lending industry?

- Attending industry conferences and webinars

- Reading trade publications and news articles

- Participating in continuing education programs

- Network with other professionals in the lending industry

8. What is your understanding of the Dodd-Frank Wall Street Reform and Consumer Protection Act?

- Imposes new regulations on financial institutions to prevent future financial crises

- Creates the Consumer Financial Protection Bureau (CFPB) to protect consumers

- Prohibits unfair and deceptive lending practices

9. How do you prioritize and manage your workload effectively?

- Use a task management system to track my tasks and deadlines

- Prioritize tasks based on urgency and importance

- Delegate tasks to others when necessary

- Take regular breaks to avoid burnout

10. Why are you interested in working as a Loan Representative for our company?

I am excited about the opportunity to join your team because of [mention specific reasons, such as the company’s reputation, the growth potential, or the opportunity to work with a team of experienced professionals].

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Representatives play a crucial role in the financial industry, helping individuals and businesses secure funding for their needs.

1. Loan Origination

Loan Representatives are responsible for initiating and processing loan applications efficiently and accurately.

- Gather and verify loan application information

- Assess applicant’s financial profile and creditworthiness

2. Customer Service

Exceptional customer service skills are essential for Loan Representatives to build and maintain positive relationships with clients.

- Provide clear and concise information about loan products

- Address customer inquiries and resolve any concerns

3. Loan Processing

Loan Representatives ensure the timely and accurate processing of loan applications.

- Prepare loan documentation, including contracts and disclosures

- Coordinate with underwriters to obtain loan approvals

4. Risk Management

Loan Representatives play a role in managing financial risks associated with lending.

- Monitor loan performance and identify potential problems

- Collaborate with risk management teams to develop and implement risk mitigation strategies

Interview Tips

Preparing thoroughly for an interview can significantly increase your chances of success. Here are some valuable tips to help you ace your Loan Representative interview:

1. Research the Company and Industry

Show genuine interest and knowledge of the financial institution and the industry it operates in. Demonstrate your understanding of their loan products and services.

- Visit the company’s website

- Read industry news and articles

2. Practice Your Responses

Anticipate common interview questions and prepare thoughtful responses. Use the STAR method (Situation, Task, Action, Result) to effectively communicate your experiences.

- Example Outline:

- Situation: Describe a time you successfully navigated a complex loan application process

- Task: Explain the steps you took to gather information and assess the applicant’s financial situation

- Action: Highlight your analytical and decision-making skills in evaluating the application

- Result: Emphasize the positive outcome and how your efforts contributed to the company’s success

3. Highlight Your Skills and Experience

Emphasize your relevant skills and experience that align with the job requirements. Quantify your accomplishments and provide specific examples to demonstrate your abilities.

- For example, instead of saying “I handled numerous loan applications,” say “I processed over 100 loan applications with a 95% approval rate.”

4. Show Enthusiasm and Confidence

Convey your genuine interest in the role and the company. Maintain a positive and confident demeanor throughout the interview. Your enthusiasm and passion will make a lasting impression.

- For example, you could say, “I am eager to contribute my skills and experience to your team and help drive the success of your financial institution.”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Loan Representative interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.