Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Mortgage Loan Closer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

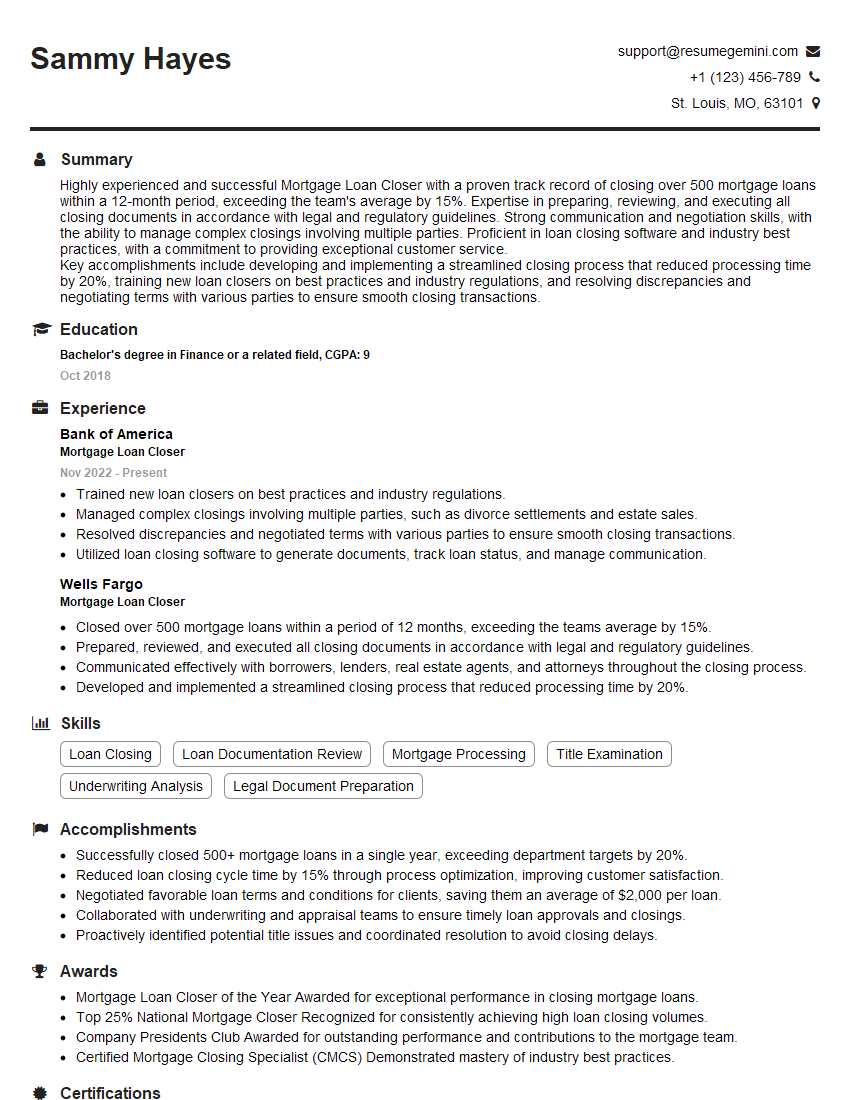

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Loan Closer

1. Explain the process of preparing a closing disclosure for a mortgage loan.

- Review the loan application and supporting documentation.

- Calculate the loan amount, loan term, and interest rate.

- Itemize the closing costs, including loan origination fees, title insurance, and attorney fees.

- Prepare a closing statement that includes all of the above information.

- Send the closing statement to the borrower for their review and approval.

2. What are some common errors that can occur during the closing process?

Errors related to the loan amount and terms:

- Calculating the wrong loan amount or interest rate.

- Including incorrect loan terms, such as the loan term or repayment schedule.

Errors related to closing costs:

- Omitting closing costs or including incorrect amounts.

- Failing to disclose certain closing costs, such as prepaid interest or homeowners insurance.

Other errors:

- Not obtaining the borrower’s signature on the closing documents.

- Failing to record the mortgage with the county recorder.

3. What steps can be taken to avoid errors during the closing process?

- Thoroughly review the loan application and supporting documentation.

- Use a closing software program to help calculate the loan amount and closing costs.

- Have the closing statement reviewed by an attorney before sending it to the borrower.

- Attend the closing meeting with the borrower to answer questions and ensure that they understand the closing documents.

4. What are the differences between a conventional loan and a government-backed loan?

Conventional Loans

- Not backed by a government agency

- Typically require a higher credit score and down payment

- Often have lower interest rates than government-backed loans

Government-Backed Loans

- Backed by a government agency, such as the FHA or VA

- Available to borrowers with lower credit scores and down payments

- Typically have higher interest rates than conventional loans

5. What are some of the challenges that mortgage loan closers face?

- Dealing with complex loan documents

- Meeting deadlines

- Resolving errors and discrepancies

- Managing multiple clients at once

- Staying up-to-date on changing regulations

6. What are the qualities of a successful mortgage loan closer?

- Excellent communication skills

- Strong attention to detail

- Ability to manage multiple tasks and meet deadlines

- Knowledge of mortgage loan products and regulations

- Ability to work independently and as part of a team

7. How do you stay up-to-date on changing regulations in the mortgage industry?

- Reading industry publications and attending webinars

- Taking continuing education courses

- Networking with other mortgage professionals

- Consulting with an attorney who specializes in mortgage law

8. What is your experience with using closing software programs?

- Name the closing software programs that you have used.

- Describe your experience with using these programs to calculate loan amounts, closing costs, and prepare closing statements.

- Discuss the benefits and challenges of using closing software programs.

9. How do you handle errors and discrepancies that arise during the closing process?

- Identify the error or discrepancy.

- Communicate the error or discrepancy to the appropriate parties.

- Work with the appropriate parties to resolve the error or discrepancy.

- Document the resolution of the error or discrepancy.

10. What is your favorite part of being a mortgage loan closer?

Explain why you enjoy working as a mortgage loan closer. Describe the aspects of the job that you find most rewarding. Mention the impact that you have on the lives of your clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Loan Closer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Loan Closer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Mortgage Loan Closer, you play a crucial role in ensuring a smooth and efficient mortgage lending process. Your primary responsibilities include:

1. Document Preparation and Review

Prepare and review all necessary loan documentation, including mortgage notes, closing statements, and other legal documents.

- Verify the accuracy and completeness of all information provided by borrowers.

- Ensure that all required signatures and notarizations are obtained.

2. Title Clearance

Confirm that the property title is clear and free of any liens or encumbrances.

- Review title reports and legal descriptions.

- Coordinate with title companies and attorneys to resolve any title issues.

3. Disbursement and Settlement

Handle the disbursement of loan proceeds to the borrower and other parties involved.

- Prepare and process checks for closing costs, prepaid expenses, and other fees.

- Ensure timely and accurate settlement of loan funds.

4. Regulatory Compliance

Adhere to all applicable federal and state laws and regulations governing mortgage lending.

- Maintain a thorough understanding of RESPA, TILA, and other relevant regulations.

- Complete required disclosures and ensure compliance with fair lending practices.

Interview Tips

To ace your interview for a Mortgage Loan Closer position, consider the following tips:

1. Research the Company and Industry

Demonstrate your knowledge of the company’s history, products, and market position. Familiarize yourself with current trends and regulations in the mortgage lending industry.

- Visit the company’s website and LinkedIn page.

- Read industry news and articles.

2. Practice Your Technical Skills

Be prepared to discuss your experience and proficiency in loan documentation, title clearance, and disbursement processes. Showcase your attention to detail and ability to handle complex transactions.

- Review sample loan documents and closing statements.

- Prepare a portfolio of your previous work.

3. Highlight Your Customer Service and Communication Skills

Mortgage Loan Closers often interact with borrowers, real estate agents, and other professionals. Emphasize your ability to build rapport, communicate effectively, and resolve issues in a timely and professional manner.

- Share examples of how you handled challenging situations or exceeded customer expectations.

- Be prepared to discuss your experience working in a fast-paced environment.

4. Demonstrate Your Regulatory Knowledge

Interviewers will assess your understanding of the legal and ethical aspects of mortgage lending. Highlight your familiarity with RESPA, TILA, and other relevant regulations. Explain how you ensure compliance in your daily work.

- Prepare a brief presentation on a recent regulatory update.

- Discuss your experience with compliance audits or training programs.

Next Step:

Now that you’re armed with the knowledge of Mortgage Loan Closer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Mortgage Loan Closer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini